Technology is evidently evolving in parallel with the end user, and use cases are increasing with the emergence of new avenues of payments. Payments form the core of any financial institution and it’s becoming imperative for central banks to provide avenues that offer new world functionalities for relevance. Central Bank Digital Currency (CBDC) is one such avenue that aims to help central banks facilitate financial services widely. The RBI foresees e-Rupee/Indian CBDC – that is, the digital form of the fiat currency issued and regulated by it – as the next-generation payment mode that is seamless, ubiquitous and anonymous, delivering customers value and a satisfying experience.

e-Rupee can act as a viable alternative to paper currency, the issuance and circulation of which entail a long process with the government incurring heavy costs. For example, for every INR 100 note, the cost estimate is around 15%–17% of the entire expense in a four-year lifecycle, including printing, distribution and returning due to soilage.3 As cash circulation increases, it puts pressure on distribution and storage channels, along with the environment, owing to its carbon footprint. A larger amount of cash in circulation means pressure on regulators and governance in terms of printing, distribution and storage, thus posing several risks such as counterfeits, spoilage and security risks. Counterfeits are a huge risk with the RBI reporting an increase in fake 2,000 and 500 currency notes in fiscal year 2021–22.4 A major risk with carrying cash is the risk of loss or theft. e-Rupee gives central banks better control over usage and distribution. This is one of the primary motivations for the RBI to launch CBDC.

Launching the e-Rupee in India would also mean taking a step towards a digital economy, given the rise in the adoption of mobile and internet-based payments, besides improving the cumbersome cross-border transaction process. One of the top priorities of the G20 has been to enhance cross-border payments and it has been implied that CBDC can be an appropriate tool. Cross-border transactions have always involved time-consuming processes laden with strict compliance checks owing to their dependency on the correspondent bank’s availability and time zones. Financial institutions which have reserves in the RBI can transact in CBDC and make it easier to reduce counterparty risks. CBDC is also expected to accelerate the process by automating the method of transaction and settlement. Some other potential areas where CBDC can be leveraged to ease the process of transactions include government securities and international forex trade.

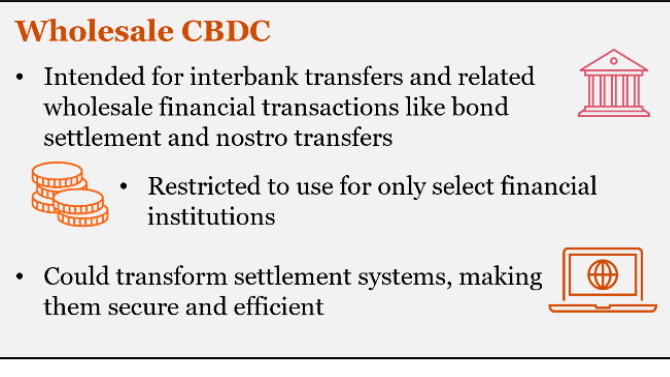

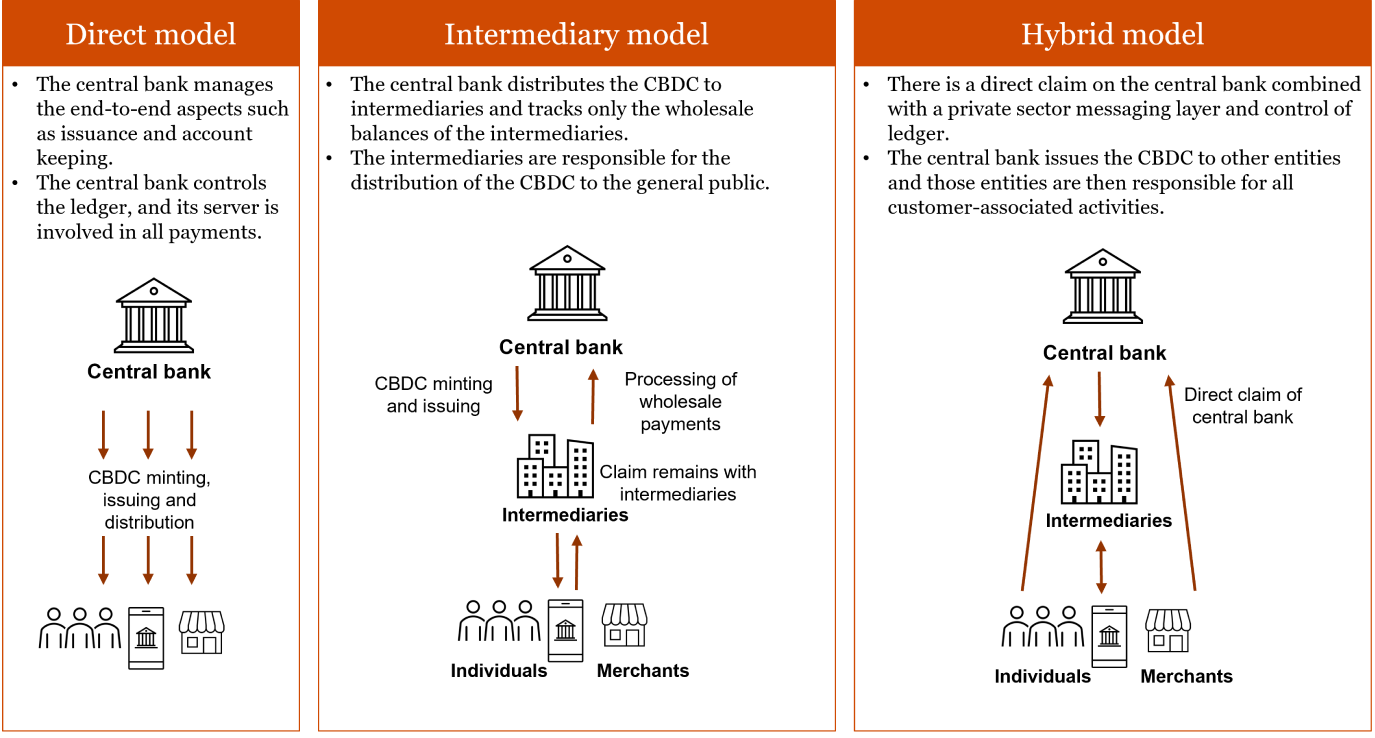

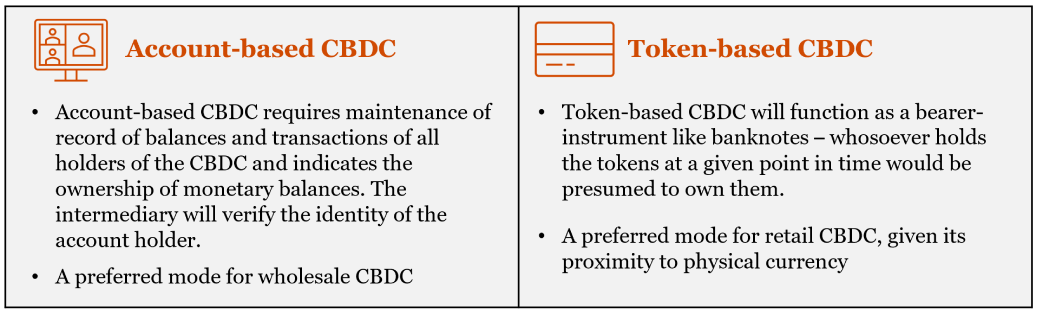

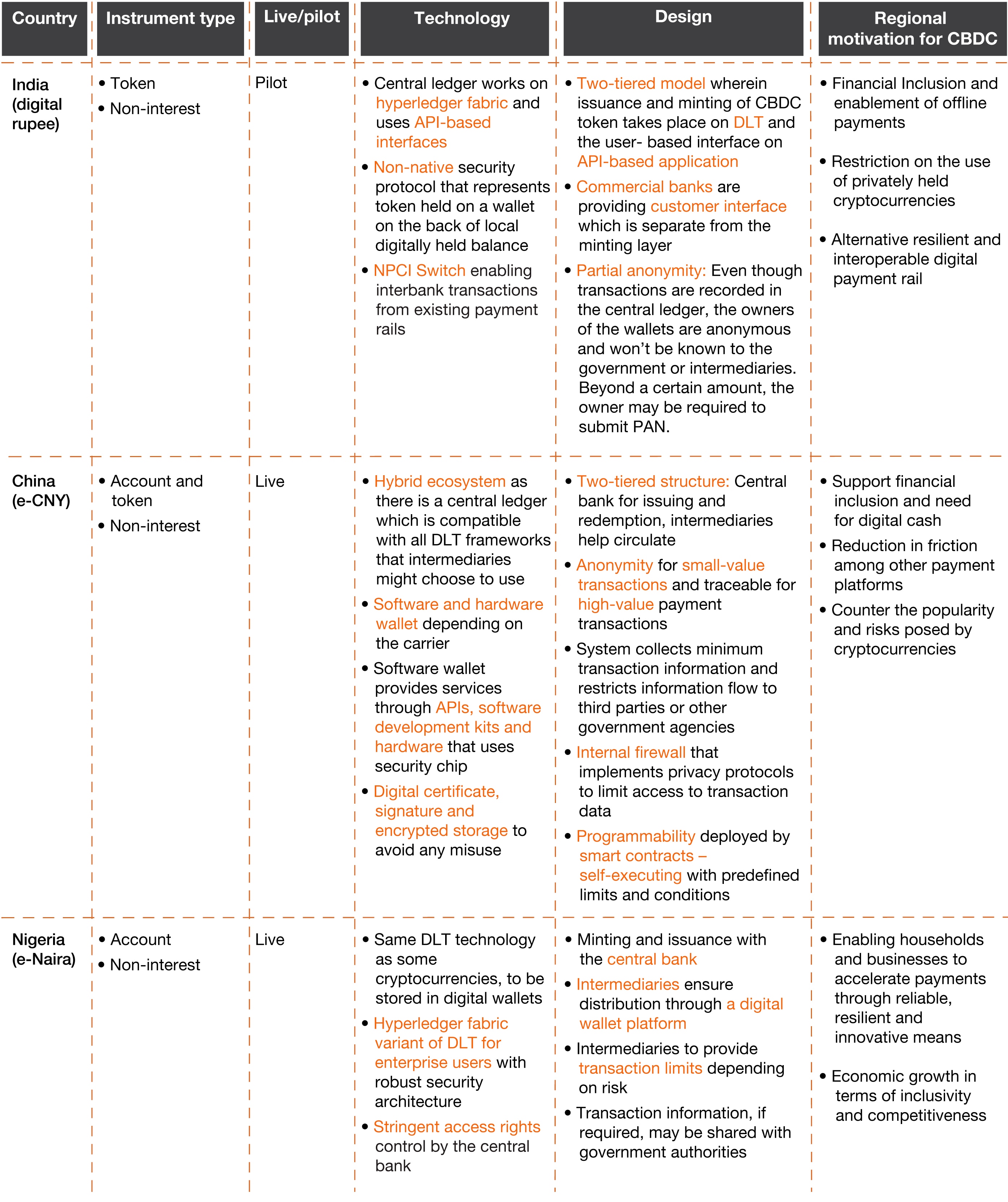

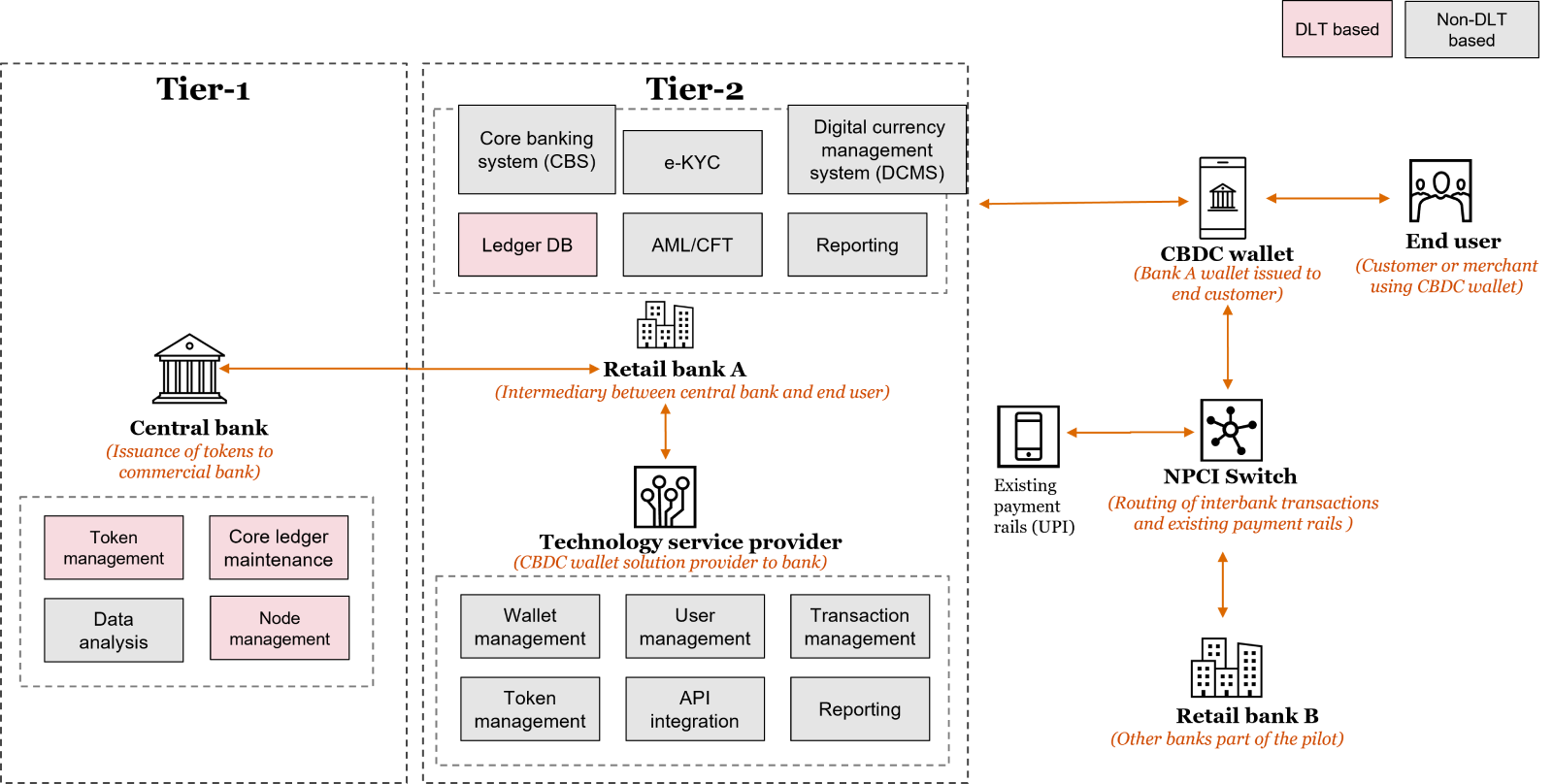

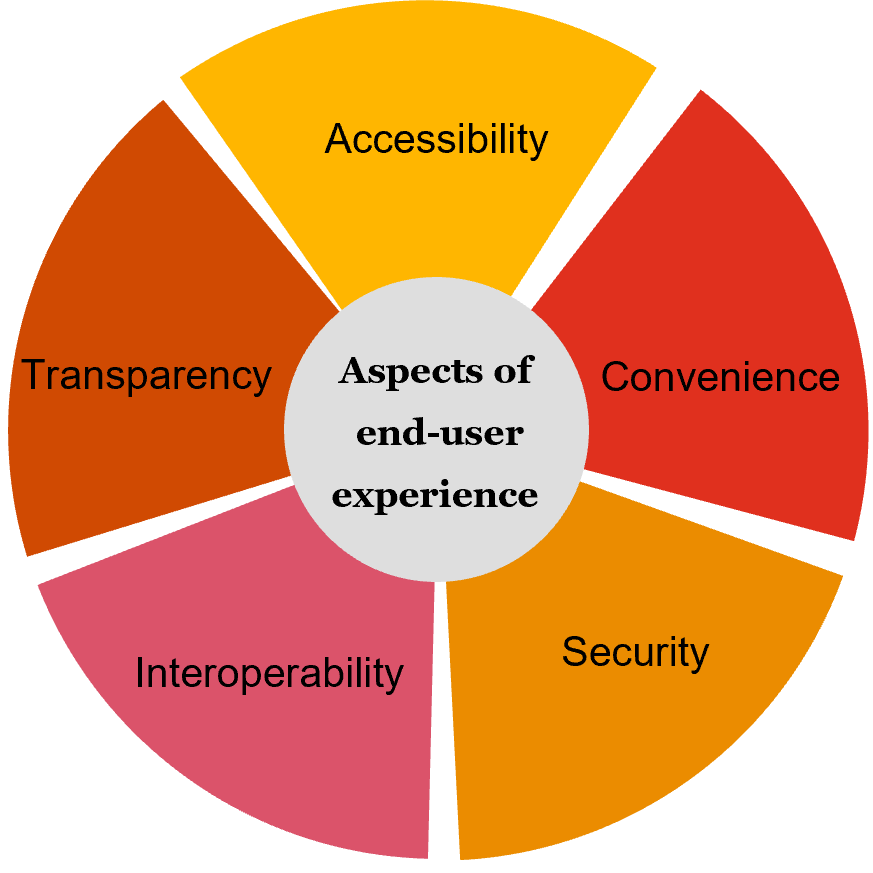

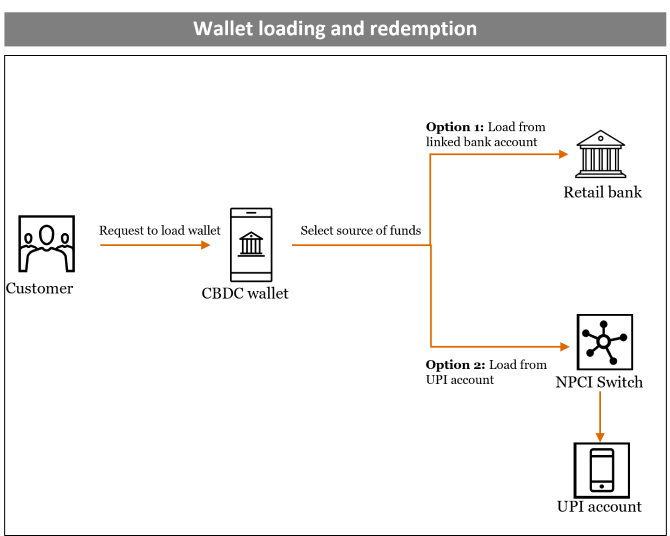

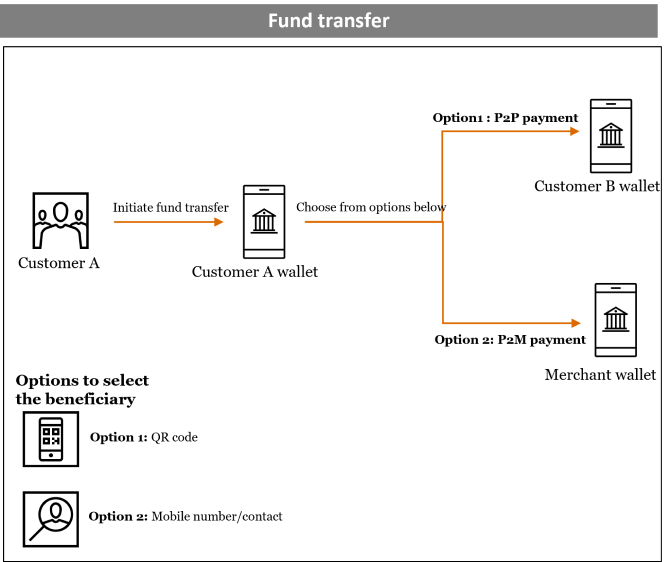

The design of CBDC depends on the functions it is expected to perform, as the RBI has underlined in its concept note.5 The implications of CBDC for payment systems, monetary policy, and the structure and stability of the financial system will be determined by the design. A primary consideration is that the design features of CBDC should be least disruptive. Accordingly, the key aspects include:

Types of CBDC or e-Rupee issued: Retail and wholesale6