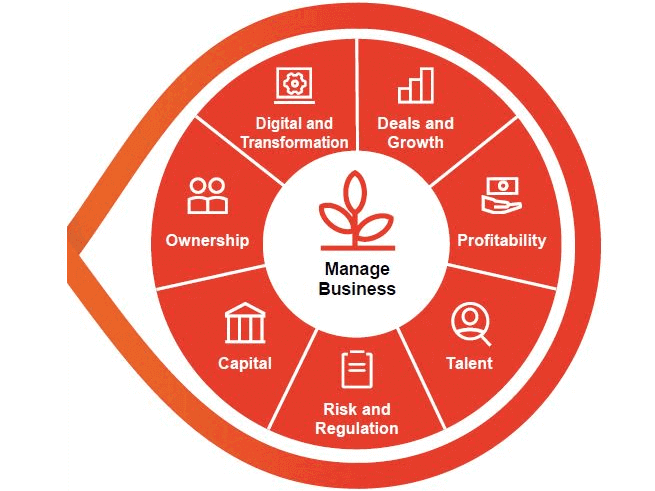

Family businesses play a crucial role in global economies due to their long-term vision, values, and legacy, which offer a competitive edge through sustainable practices and agile decision-making. However, rapid market changes and disruptions pose challenges to this advantage. We support family businesses by investing in innovative solutions to enhance their strengths, focusing on succession planning and next-generation perspectives for effective transitions.

Discover: www.pwc.com/familybusiness