{{item.title}}

{{item.text}}

{{item.text}}

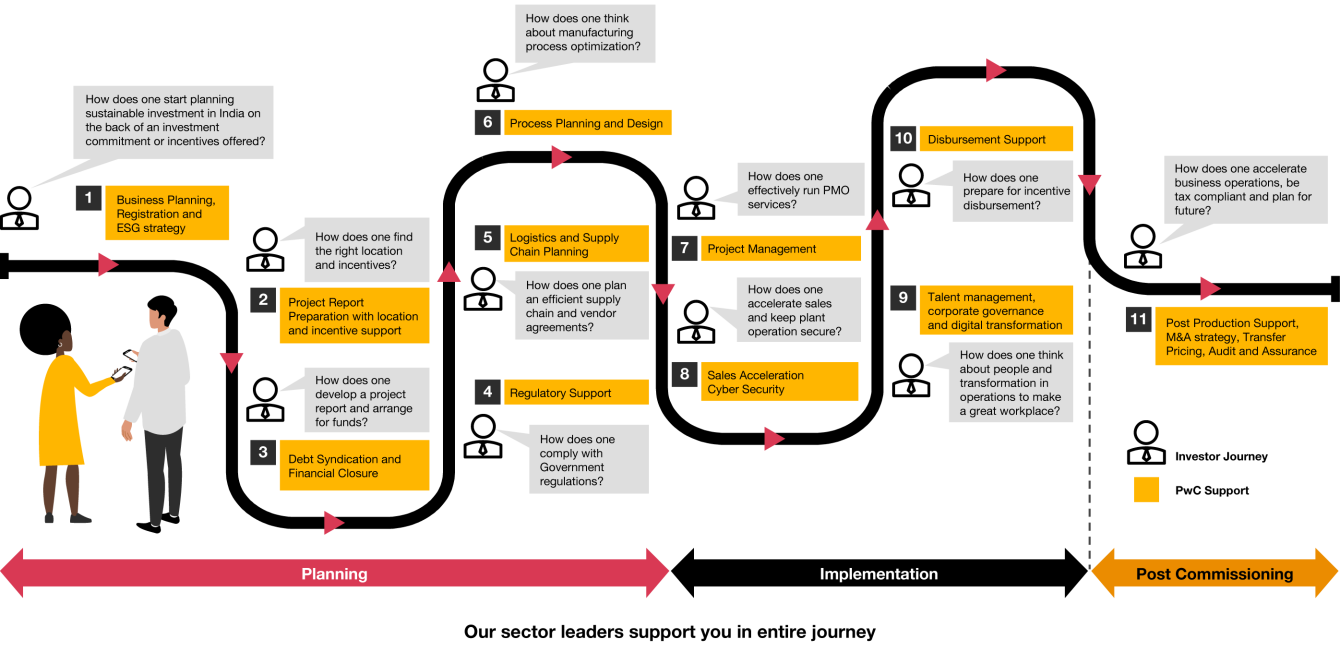

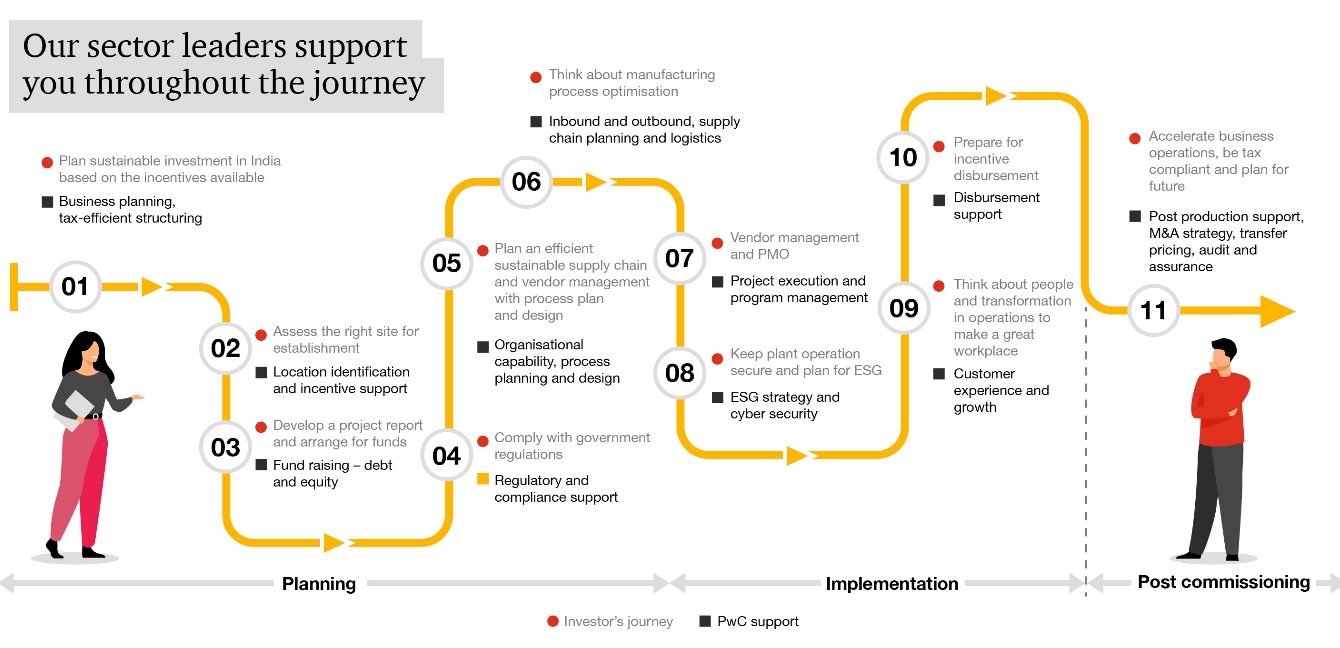

The journey of investment ranges from ideation and justification of investment decisions to commencement of business till eternal sustainability. During this period, numerous activities are involved and with ever evolving modern technologies and changing consumer behaviours, the business needs to recalibrate their elements of focus and action items continuously. This, coupled with the statutory regulations to be complied with, leads to an environment of significant challenges for the business fraternity.

India offers a distinctive competitive advantage to investors. Moreover, its target of becoming a USD 5 trillion economy by FY 2026, with a contribution of USD 3 trillion and over USD 1 trillion from the services and manufacturing sector respectively requires accelerated investments with special focus to be laid up on Foreign Direct Investments (FDI) by supporting their entry into India. However, it can be challenging to navigate the Indian market due to the various nuances and considerations related to location, incentives, labour regulations, and financial and non-financial regulations, including the recent transition from special economic zones (SEZ) to Development of Enterprise and Service Hubs (DESH), amendments in the Manufacturing and Other Operations in Warehouse Regulations (MOOWR) scheme to name a few. In this context, how can an organization tailor its expansion plans to the regulatory environment and select the most suitable location, optimally integrate its backward and forward supply chains, think about sustainable development, and avail the most optimal tax regime?

Supporting in the programme management of entire greenfield/brownfield investments.

The investment journey starts with ideation and justification of investment decisions be it Green field or Brown field, followed by commencement of operations and, finally, delivery of outcomes. PwC has launched Industrial Development and Investment Promotion (IDIP), an integrated service offering which brings together its sectoral capabilities which includes right from concept (business establishment) till commissioning (regulatory support). This is a comprehensive solution that aims to benefit both Government as well as private clients who are into various spaces such as Manufacturing, Services, Logistics, Tourism and Government organizations. We travel with you as a partner on your successful business journey from concept to commissioning.

For private clients, PwC’s IDIP will provide end-to-end solutions from concept to commissioning within a short span of ~36 months. Further, our offering can be customized based on the client’s requirements which could be location advisory, incentives, regulatory, Customer-led transformation, leadership transformation, audit and assurance and so on.

For Government clients, PwC will develop an investor-friendly ecosystem for enhancing employment, ease of doing business and trade facilitation.

PwC’s Industrial Development and Investment Promotion (IDIP) is a one-stop solution that can be leveraged for new investments and developments in the industrial ecosystem. In alignment with PwC’s The New Equation strategy, this practice brings together a community of solvers to develop trust and sustainable solutions for our clients.

For our clients, the biggest challenge is navigating constraints that arise when consultants and competencies are at different stages of the project lifecycle.

This paved the way for our IDIP practice which combines multiple xLoS capabilities of the firm into a holistic solution for our clients’ business proposals – from concept to commissioning. The platform formalises analytics-driven collaboration of the firm’s value propositions for successful project delivery. It saves significant time and money.

In a nutshell, IDIP supports business needs from concept to commissioning through an integrated team with diverse capabilities across business functions to maximise business opportunities with existing/new clients.

The challenges can be resolved with what we, PwC are now launching, called the Industrial Development and Investment Promotion (IDIP) initiative. Right from business commencement, the firm supports in all key aspects that occupy the minds of the promoters and top management of companies, as follows

{{item.text}}

{{item.text}}