Our commitment to family businesses

The pivotal role of family businesses in economies worldwide is underpinned by their unique long-term vision, values and legacy. These attributes are evident in their: deeply-embedded value systems, sustainable family business practices, agile decision-making and proud track record of innovation and legacy-building.

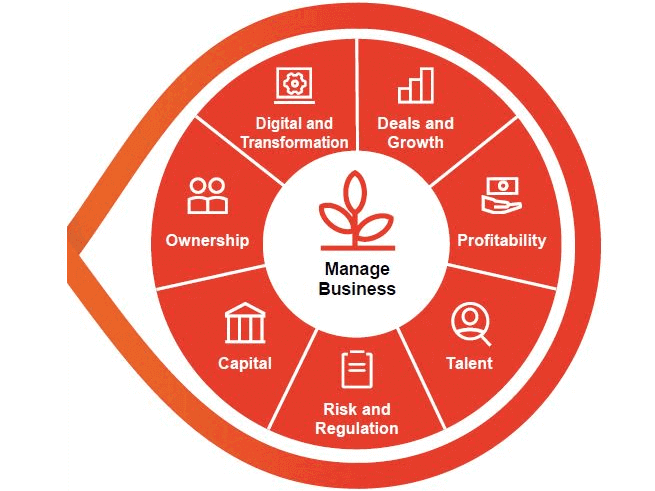

This distinctive set of characteristics gives family businesses a competitive advantage. However, this competitive advantage is threatened by today’s fast-paced change and radical disruption in the market. For family ownership and succession planning, new perspectives of the next generation need to be recognised and addressed to ensure effective transitions are in place. That’s why PwC’s business advisors are constantly developing and investing in innovative solutions to help maintain and further leverage your family business advantage.

Discover: www.pwc.com/familybusiness