{{item.title}}

COVID-19: Path to Recovery

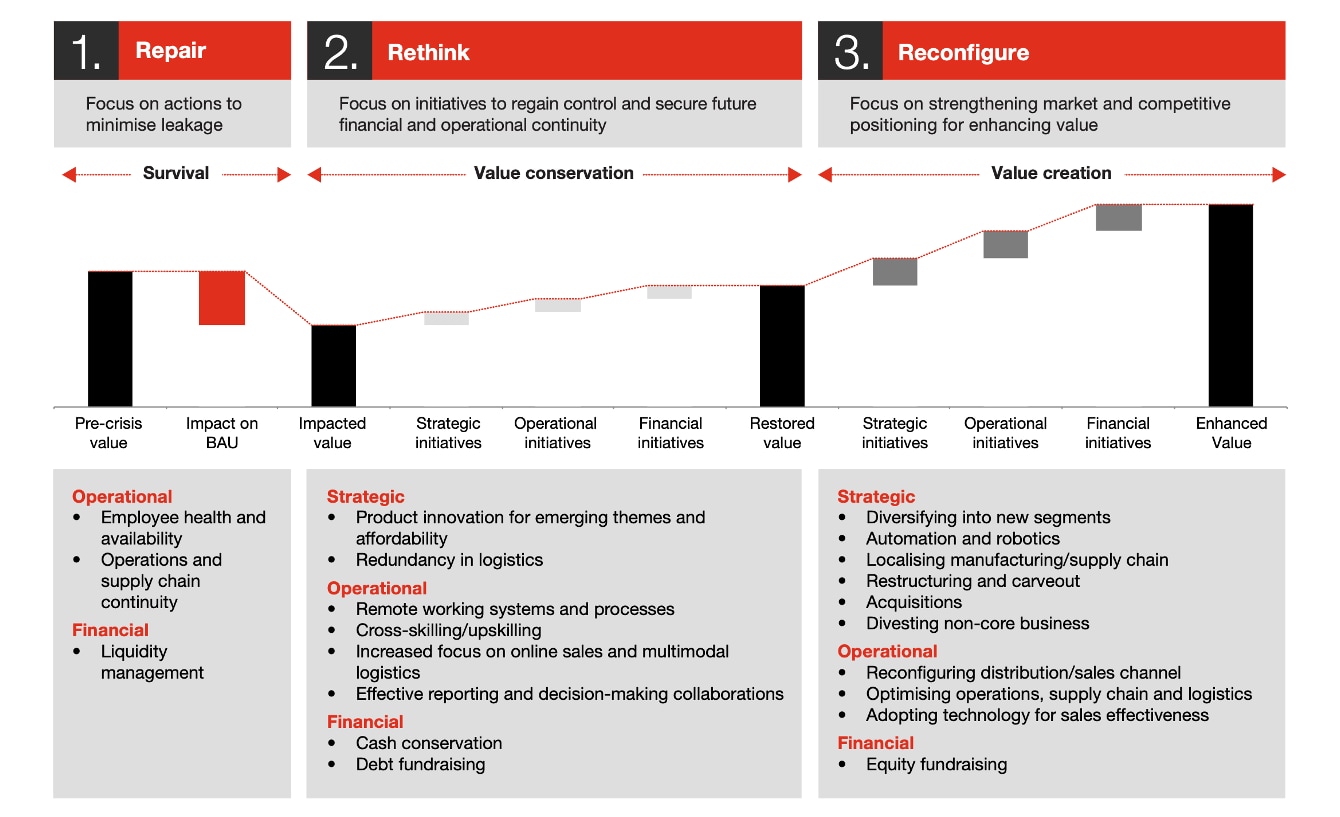

COVID-19 has had a relentless impact on the global and Indian economy. Pitted against an unknown adversary, business leaders have altered their priorities and are adapting their business models to the evolving situation – from lockdown to unlock to several localized lockdowns. The severity of the crisis has led companies to focus on the immediate problems, namely the here and now. Our ‘Value conservation to value creation’ survey explores corporate India’s journey through this crisis and path to recovery.

225 CXOs from across a wide range of sectors and company sizes responded to the survey between 17 June and 10 July 2020. We have drawn insights into the steps that companies have taken for survival and value conservation to the steps that will be taken for value creation subsequently.

Decoding the impact of Covid-19 on India Inc and understanding the new emerging paradigm

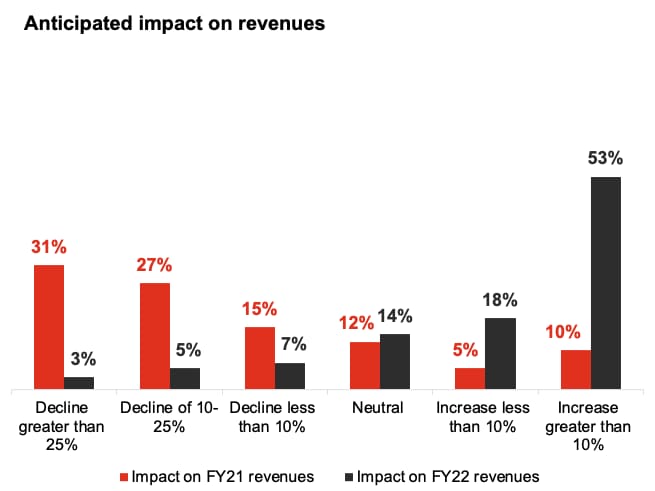

73% of respondents expecting lower revenues in FY21

Recovery expected to be swift, with 82% looking at returning to pre-COVID revenue run rates by June 2021

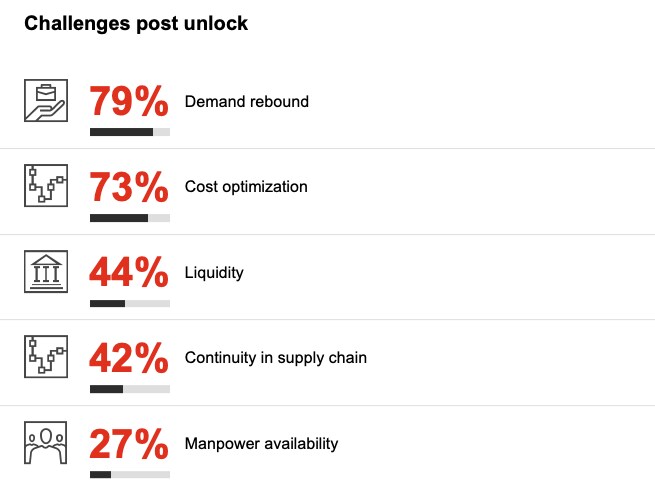

As the nation unlocks businesses are focused on recapturing demand and optimising costs

Greater competition and higher costs are expected to be major challenges in the near term

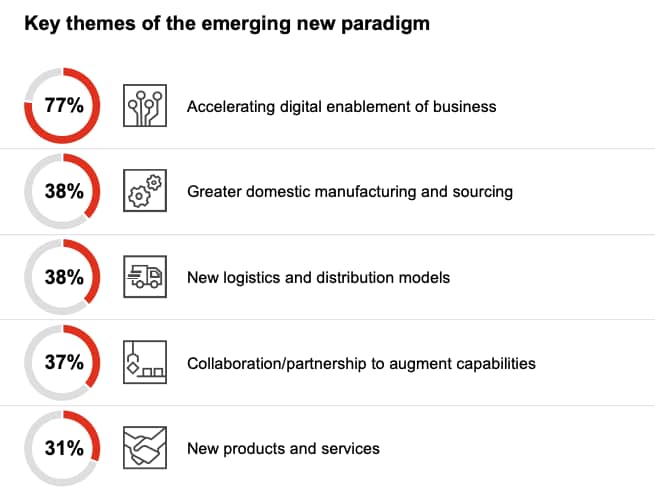

Accelerating digital enablement has emerged as a clear necessity across all sectors to overcome these challenges.

The respondents considered localisation, new logistics and distribution models, new products and services and collaborations and partnerships as other key themes

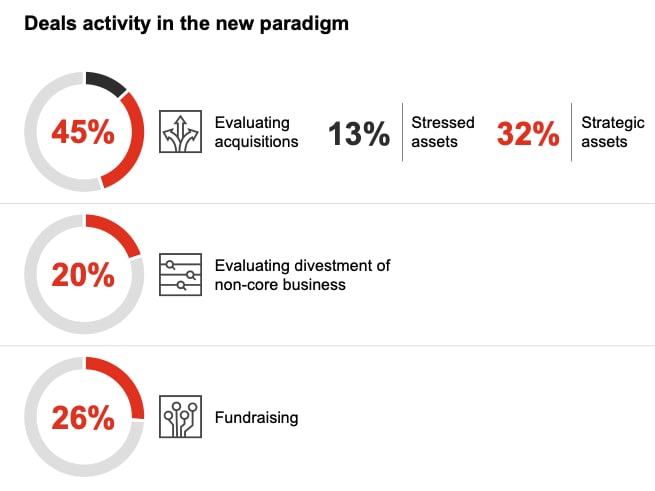

45% of organisations view the current situation as a good consolidation opportunity

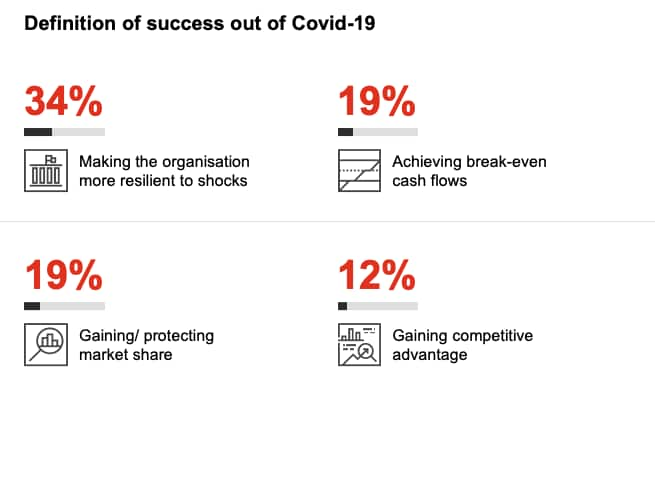

34% of the respondents have stated that a successful response to this crisis would be to build organisational resilience to future shocks.

Scroll down for further analysis

Scroll down for further analysis

Lorem ipsum