Click here to download the column

It has been over six years since SFBs were set up to provide banking services to the under-served sections of society and meet the credit needs of small borrowers through high-technology and low-cost operations. Today, SFBs stand at a crossroads. The strategies they adopt will be critical in determining if they can fulfil their overarching objective of promoting inclusive growth.

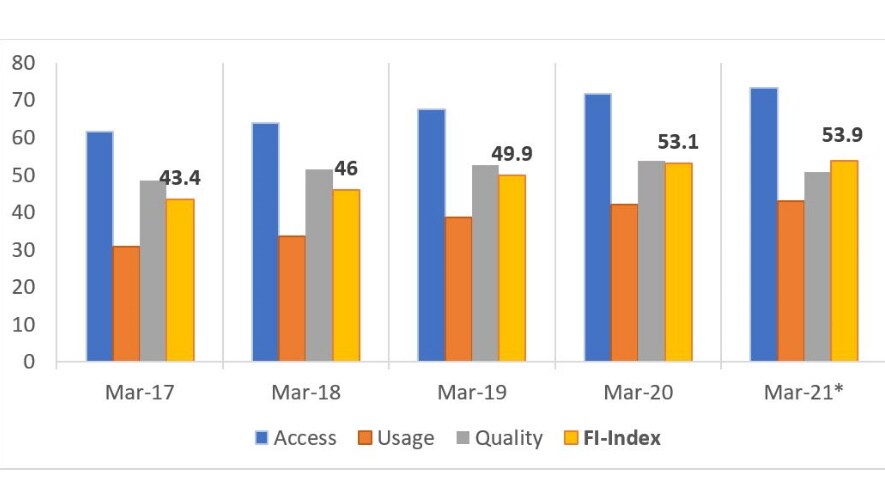

In August 2022, the Reserve Bank of India (RBI) released the Financial Inclusion Index (FI Index) for FY22. The value of the index was 56.4[1] as against 53.9 for FY21. The FI Index – which ranges from 0 (denoting financial exclusion) to 100 (indicating total financial inclusion) – is meant to gauge the extent to which people in a country as asymmetrical as India have access to banking and financial services and products based on three parameters – usage, ease of access and quality of such facilities. While it is heartening to note the improvement in the FI Index, its value also indicates that there are still several miles to go before we can expect inclusive growth that impacts all segments of society.

Given this scenario, SFBs, which were set up to meet the financial needs of the marginalised sections of the society and perform basic banking activities for small business units, including the unorganised sector, are poised to play a critical role in driving financial inclusion in the near term. Data from the micro, small and medium enterprises (MSMEs) registrations portal, which had 1.07 crore registered MSMEs[2] as on 8 September 2022, underscores the importance of SFBs. These MSMEs provide employment to about 8 crore people and interestingly, 95% of these enterprises fall under the micro category.

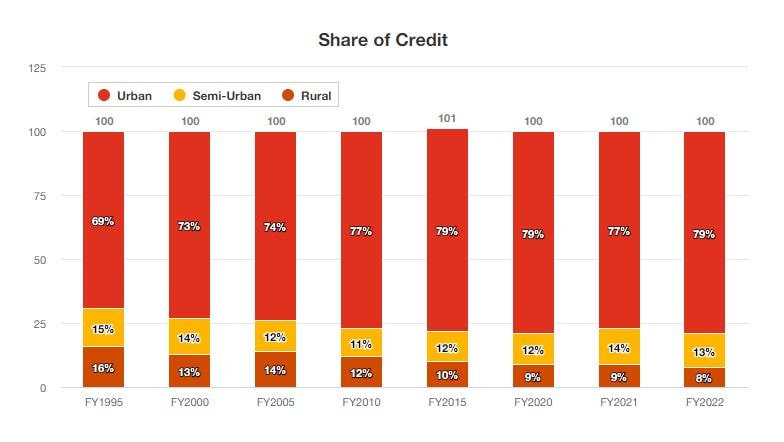

For India’s MSME sector, the debt requirement is estimated at INR 69 lakh crore[3]. About half of the funding needs of the segment are currently being met through informal sources, and the rural segment’s share in overall bank credit remains low at around 8–10%, as indicated in the figure below:

Source: RBI Publications Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks

Evolution of SFBs

SFBs encompass a wide range of entities, including those that have evolved from small cooperative banks and those with a strong technology association. In addition, microfinance institutions (MFIs) and small non-banking financial companies (NBFCs) have also transitioned into SFBs. Currently, 12 SFBs are operational in India, of which two were recently awarded the SFB licence. Four of these SFBs are listed.[4] The origin of the SFBs, it has been observed, often had a profound bearing on their performance.

Demonetisation and the COVID-19 pandemic are two significant events that occurred in the short lifespan of the SFBs. The impact of these events on different SFBs has been varied; SFBs that developed from MFIs witnessed the greatest impact. These SFBs initially catered to the more vulnerable customer segments which constituted a higher proportion of their books. Moreover, they had a steeper learning curve, as they shifted gears from the microfinance segment to diversify into other products and connect with other customer segments. However, even within this group, players with an urban customer base were impacted more than those with a rural base. During the first wave of COVID-19, the impact was more pronounced in urban areas while in the second wave, the impact in rural and urban areas depended on the states where the customer base was concentrated. The portfolios of SFBs with an MFI background still have high regional concentration; hence, their performance is varied based on the urban/rural mix and states.

By contrast, the SFBs which had transitioned from an erstwhile NBFC model seem to have weathered the disruptions much better due to a different customer mix.

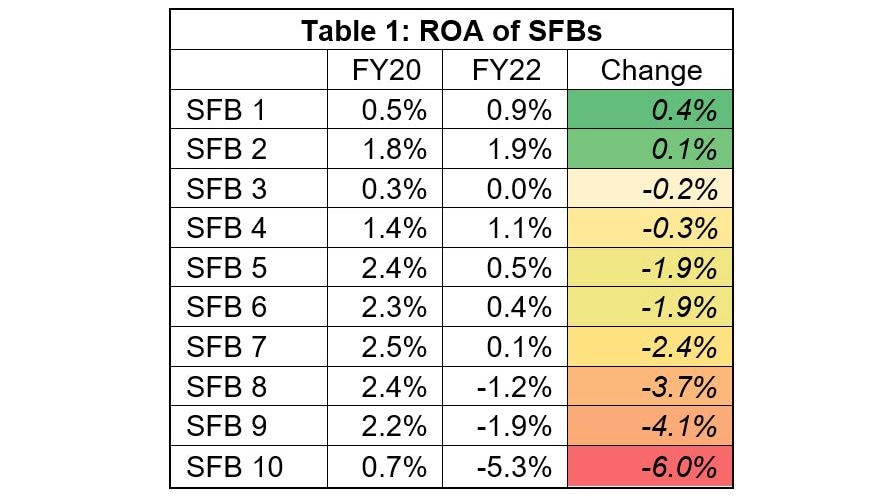

The following table below shows the variation in return on assets (RoA) of SFBs. It highlights the varying impact of COVID-19 on their performance, the variation being largely driven by their exposure to more vulnerable segments.

Source: Company filings, PwC Research and Insights Hub analysis

Strong growth in loans and advances, and in deposits

Aggregate loans and advances for banking sector participants – FY22

Banking sector data as on 31 March 2022 indicates that SFBs’ loans and advances comprise 1.2% of the banking sector’s total loans and advances. This is partly because of the segments in which they operate and also because of the relatively shorter tenure of their operations. However, SFBs have a relatively stronger position in the specific segments that they focus on, with around 6% market share in small-ticket lending.[5]

Source: RBI Publications Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks

Aggregate performance metrics for SFBs – FY22

On account of the low base effect, SFBs have registered strong growth in loans and advances, and in deposits. They also have high net interest margins which are reflective of the inherent risk profile of the advances portfolio. The operating expenses/average assets amounting to 5.34% for FY22 is on account of the high touch–based model and the fact that the operating leverage benefits are yet to kick in. The provisions and contingencies/total average assets for SFBs were 2.61% for FY22. That is a laudable performance given the segment that they operate in, which has a significant number of customers with limited/no credit history.

Aggregates also tend to mask the performance of some of the lagging players. In the above aggregation, two SFBs account for 49% of the total SFB loans and advances, and 50% of the deposits. While the aggregate RoAs at 0.53% are depressed, and eight of the ten SFBs[6] registered an RoA less than 1% in FY22, within the SFB universe there are entities which have optimised their operating model and delivery, resulting in high RoAs.

| Parameters (in %) | FY22 |

|---|---|

| Growth in loans and advances (3-year CAGR) | 24.48% |

| Growth in loans and advances (Y-o-Y [FY22/FY21]) | 24.01% |

| Growth in deposits (3-year CAGR) | 37.30% |

| Growth in deposits (Y-o-Y [FY22/FY21]) | 31.67% |

| RoAs (FY22) | 0.53% |

| Net interest margin (NIM) (FY22) | 6.88% |

| Cost of deposits (FY22) | 5.90% |

| Cost of borrowings (FY22) | 7.17% |

| Operating expenses to total average assets (FY22) | 5.34% |

| Provisions and contingencies to total average assets (FY22) | 2.61% |

Wide performance arc

Within the ambit of the regulatory framework for SFBs, their performance varies depending on the risk appetite and execution capability of the players. Of the four listed SFBs, two have RoAs which are better than the aggregate RoAs of public sector and private sector banks. Of these, SFB1 (a non-MFI origin SFB) follows a more conservative lending strategy, lending to safer segments and through secured products. This results in relatively lower NIMs, but it also has a salutary impact on the bottom line in terms of relatively lower provisions and contingencies. This, coupled with operating leverage benefits, results in its superior RoA performance. SFB2 (MFI-origin SFB) is able to realise a higher yield on advances due to a different lending portfolio mix. While this does result in relatively higher provisions and contingencies relative to SFB1, these are still lower relative to the other listed SFBs, resulting in a differentiated RoA performance.

The ability to lend to safer segments requires a certain balance sheet size to start with and a certain cost of funds, which drives the customer segment an SFB can competitively play in. The MFI-origin SFBs (SFB2–4) had neither of these advantages at the outset and have had to graduate to these levels through current account savings account (CASA) build and after achieving a certain scale. MFI-origin SFBs also have a high operating expenses (opex) model and given the investment in scale build, the operating leverage will take time to kick in.

Performance of the four listed SFBs

Our take

The data available on SFBs –an integral part of the Indian financial landscape – indicates that it is the right time for these banks to consider shifting gears in order to move to the next level. There is also a need for SFBs to recalibrate strategy and for regulators to reshape policies. A closer scrutiny of the SFB landscape points to four key imperatives that could shape the future growth trajectory for this unique set of players.

- Leverage data to build trust

- Leverage technology for greater process efficiency

- Explore and evaluate underserved segments

- Strategise to provide a differentiated customer experience

Leverage data to build trust

Many MFI-origin SFBs have developed the skills necessary to establish the creditworthiness of borrowers without a credit history. This is done through various means:

- assessment of the borrower’s occupation

- prevalent remuneration

- assessment of cash flows

- deriving income from expenditure pattern.

A large part of the population performs cash transactions and thus remains invisible to lenders due to the absence of a digital footprint. To provide credit underwriting for this segment, innovative technology companies are leveraging the explosive pace of mobile proliferation and rich data generated by mobile users. This data, which includes frequently dialed numbers, call duration, time of call, top-up of prepaid phones, and top-up amounts and frequency, has helped to create risk forecasting models that are significantly more accurate compared to conventional methods. The data exchanged among telcos, banks and tech companies is anonymised, and a credit score is applied to the data only after a customer’s consent.

Partnerships between telcos and SFBs, enhanced by a powerful artificial intelligence (AI) platform, could help the entire finance ecosystem working towards greater financial inclusion to seamlessly assess and disburse credit to a large portion of the unbanked population.

There is, however, an inherent issue that needs to be addressed. In a recent development, the RBI has implemented the recommendations of its working group on digital lending.[7] These recommendations comprise restrictions on usage of mobile phone resources such as files and media, contact lists, call logs, and telephone functions. Considering this, the Data Empowerment and Protection Architecture (DEPA) – which serves as a mechanism for individuals and businesses to provide consent for access to their data – could play a vital role in ensuring a smooth flow of information among various stakeholders.

Leverage technology for greater process efficiency

SFBs, being fairly new, have a relatively cleaner slate and could use technology along with data analytics as a force multiplier to drive innovation and provide a superior customer experience. Given the increased digitisation of the banking experience, technology has emerged as an enabler. Customer acquisition and retention could be governed by adhering to a seamless process that factors in stakeholder requirements to ensure that the customer relationship management is glitch free. It will therefore be essential that the front end is designed to provide an intuitive experience for both customers as well as the SFB staff, while the processes remain rule based and are designed to reduce human intervention. This will be essential for SFBs to reduce their operating expenses, which stood at 5.34% of their assets in FY22 (refer to Table 2).

Some SFBs have made significant progress in deploying technology for acquiring and onboarding customers for individual loans. In this case, financial analysis, linkage to the credit bureau and customer acquisition are done through a tablet, which makes the process very efficient. Similarly, for payment collections, the field staff collects payments once a month and is able to update the payment status from the field itself. This results in reduced reconciliation effort and paperwork. The proliferation of application programming interfaces (APIs) and low-/no-code technology allows for the agile development of new digital products.

Further, some SFBs have collaborated with FinTechs to bridge the technology gap and widen the overall catchment area. These collaborations address specific customer segments and user needs (e.g. blue- and grey-collar workers, digital insurance, financial products such as lines of credit, credit cards, EMI cards, and buy now pay later offerings) and help SFBs to be on par with their competitors who may have developed these offerings in-house.

Explore and evaluate underserved segments

SFBs, set up with the express objective of fostering financial inclusion, have made considerable progress on this front in their short period of operations. However, there is still a long way to go.

The FI Index comprises three elements – access, usage and quality, with weightages of 35%, 45% and 20%, respectively. As indicated by RBI, access refers to the availability of physical and digital infrastructure, while usage tracks the extent of active usage of financial infrastructure by way of savings, investment, insurance, availing of credit and remittance facilities. Finally, the quality aspect of the FI-Index is measured by the extent of financial literacy, consumer protection and equality in the distribution of financial infrastructure.[8]

The subcomponents of the FI-Index point towards the need for improving the usage and quality-related aspects. This would require an increased emphasis on improving financial literacy and incentivising clients towards the increased usage of these services. Regulatory support, in terms of compulsory transfer of payments to MSME employees, can also help to drive the inclusion agenda. It would also be beneficial to focus on women and children, as they have historically lagged behind in this inclusive growth agenda.

SFBs can further build on their success by focusing on the following groups:

- all blue-collar workers, including gig workers

- daily-wage earners.

However, the ability to gauge the cash flows of these groups would be critical. SFBs could create self-help groups of people engaged in a similar trade – for example, three-wheeler operators. The key here would be to address the financial education aspect and ingrain greater financial discipline among such borrowers, in order to ensure a satisfactory credit history.

Moreover, this segment is often tempted to save through chit funds (the assets under management of these funds is about INR 1.5 lakh crore)[9] and also has some savings in PM Jan Dhan Yojana and post office accounts. In order to target this segment, it is necessary to first introduce them to fixed deposit (FD) and recurring deposit (RD) type of offerings, as they will not be comfortable with CASA accounts initially.

SFBs need to discover underserved niches in the segments that they are targeting. For example, the conventional salary accounts of listed and unlisted companies are a saturated segment. SFBs can thus look at the salary accounts of proprietorships and partnership firms.

Further, SFBs need to increase their fee-based income by distributing third-party products, such as mutual funds and insurance and financial advisory services. Moreover, it would be beneficial for them to opt for a lifecycle approach and improve customer stickiness by providing products such as low-cost medical and term insurance. This will go a long way in furthering the financial inclusion agenda.

Finally, SFBs need to invest in building an ecosystem for MSMEs. They can have empanelled business coaches who can provide guidance and direction to MSME promoters in addressing the growth, profitability and risk vectors. The MSME ecosystem can also have a cadre of technical experts who can deal with specific operational issues faced by MSMEs, as well as introduce a mechanism for facilitating conversations among businesses. This will enable the constituents to gain new skills, explore new business opportunities and align themselves with technological developments.

Strategise to provide a differentiated customer experience

It may be necessary for SFBs to consciously adopt a strategy that enables them to offer differentiated customer experiences. This is illustrated by certain overseas banks[10] which have two distinct types of customer outlets with highly specialised services and customised products – red and blue banks. Red banks cater to the poor segment, while blue banks cater to the aspirational middle class. These banks are able to align the unique skill sets of their respective teams to serve the needs of two very different classes of customers.

This strategy will be useful for many SFBs as they embark on building a liability portfolio and garnering deposits. While SFBs have the credit underwriting experience, the success of their deposit-raising efforts would depend on the customer experiences and trust they are able to build.

Moreover, such a strategy would be central to solving a basic mathematical problem – namely how to raise deposits at an interest rate of 5–6% from a customer who is used to a high interest rate environment as s/he has been provided loans at rates exceeding 20%. The answer to this lies in achieving these two goals by targeting two different sets of customers, and hence the need for a differentiated customer experience for these distinct groups.

To diversify their liabilities, SFBs can collaborate with peer-to-peer (P2P) lending FinTechs, which can enable them to reach new customer segments – from both the borrowing and lending perspectives. Once a level of trust and familiarity has been developed, SFBs can start cross-selling a bouquet of products.

The need for nuanced regulatory evolution

There is a need for a differential approach to regulatory oversight as far as SFBs are concerned. This approach would include parameterised risk-based supervision, where the supervision intensity would be dictated by a set of criteria being met or breached. This would result in appropriate compliance expectations and, hence, optimisation of the associated costs.

There is also the need to adopt a layered approach for regulating SFBs, along the lines of that prescribed for urban co-operative banks (UCBs). Regulation of UCBs is based on the recommendation of the expert committee on UCBs appointed in February 2021. A similar approach could include the tiering of SFBs, depending on the stage of maturity, asset book and net worth. This approach would provide a graded reduction in the capital adequacy ratio (CAR) and ease restrictions in terms of loan proportions of up to a particular size in the loan book. Our analysis shows that a 1% reduction in the CAR can provide for approximately 5% additional growth in total assets (equivalent to around INR 10,000 crore on the asset base of FY22).

The graded change in these metrics could be provided on the basis of a track record of satisfactory performance on key parameters. Some of these relaxations would be needed as a natural corollary to the overall growth story in India. For example, as the scale of the MSME customers of SFBs increases, fuelling the India growth story, their funding requirements will also increase commensurately. This would necessitate a periodic look at the threshold loan size below which SFBs are required to maintain a specified proportion of their loans.

Looking ahead

While SFBs have made a fair amount of progress in the financial inclusion agenda, fostering true financial inclusion would require them to offer differentially and affordably priced products that appropriately factor in the risks. To do so, SFBs would need to develop better risk-profiling frameworks. Deploying a trifecta of data analytics, automation and a customer-centric approach which helps build a sizeable liability portfolio would prove useful in offering appropriately priced products to their customer base – based on the risk profile.

It is then that the financial inclusion agenda of SFBs would be truly complete. Within the SFB universe itself, there are entities which need to catch up with their better performing peers. Establishing a solid position in their chosen area, as well as innovating to penetrate new accounts, could help SFBs serve customers at the bottom of the pyramid – a market size with huge potential. This will also prepare them for the eventual transition to a universal bank.

Contact us

Joydeep K Roy

Partner, India Financial Services Advisory Leader, PwC India

Tel: +91 83 3486 0711