Download the report

The food industry is navigating dual pressures: intensifying supply chain constraints and rapidly evolving consumer demands for healthier, tech-integrated choices. Our voice of the consumer survey 2025 indicates that consumers are prioritising nutrition, affordability and sustainability – embracing local produce, digital grocery platforms and wellness technologies.

Evolving consumer preferences, behaviours and purchasing power will redefine where value is generated and where it diminishes in the decade ahead.

Demographic shifts are giving rise to niche customer segments, unlocking potential for innovative stock-keeping units (SKUs) and new channel propositions tailored to emerging needs.

More than half of the consumers surveyed believe that government and public health bodies should take the lead in promoting healthier food choices and the recent Goods and Services Tax (GST) reforms appear to align with these expectations.

of consumers in our survey were concerned about the cost of food

of consumers surveyed were extremely or very concerned about food safety

of consumers now use at least one healthcare app or wearable technology

of consumers cited 'health benefits' among the top 3 reasons they would switch brands

At PwC, we are human-led and tech-powered to help businesses build and deliver trust to their stakeholders. Our holistic range of cyber security, data protection and privacy services based on Microsoft Cloud help companies adopt leading technology with confidence.

Key findings

Cost of living crunch is reshaping consumer behaviour

Consumers globally agreed that cost of living would have the greatest impact on their country over the next year. 32% of consumers said they were ‘financially coping’, while 7% mentioned that they were financially insecure and struggling to pay bills. The cost of-living crunch has prompted consumers to adopt money-saving behaviours such as shopping at different stores, switching to products with discounts or using coupons and promotions.

Current financial situation

Q: Which of the following best describes your current financial situation?

Steps to offset the effects of increased food costs

Q: You’ve noted that you’re concerned about the cost of food. What actions, if any, are you taking to reduce or offset the effects of food cost?

Taste, price and growing nutritional awareness are driving food choices

Taste, price and nutritional value are the primary factors when purchasing products. Health benefits, such as added vitamins, minerals and higher nutritional value, have emerged as the leading factor influencing consumers to switch food brands. This signals a growing demand for functional foods that support wellness goals. Taste and value for money are other key reasons consumers switch brands, reinforcing the importance for companies to deliver both sensory satisfaction and affordability.

Most important factors when choosing which food items to buy

Q: When you’re choosing which food items to buy, which factors are most important to you?

Factors which would encourage you to switch to a different food brand

Q: Which of the following factors, if any, would encourage you to switch from a food brand you usually buy to a different brand?

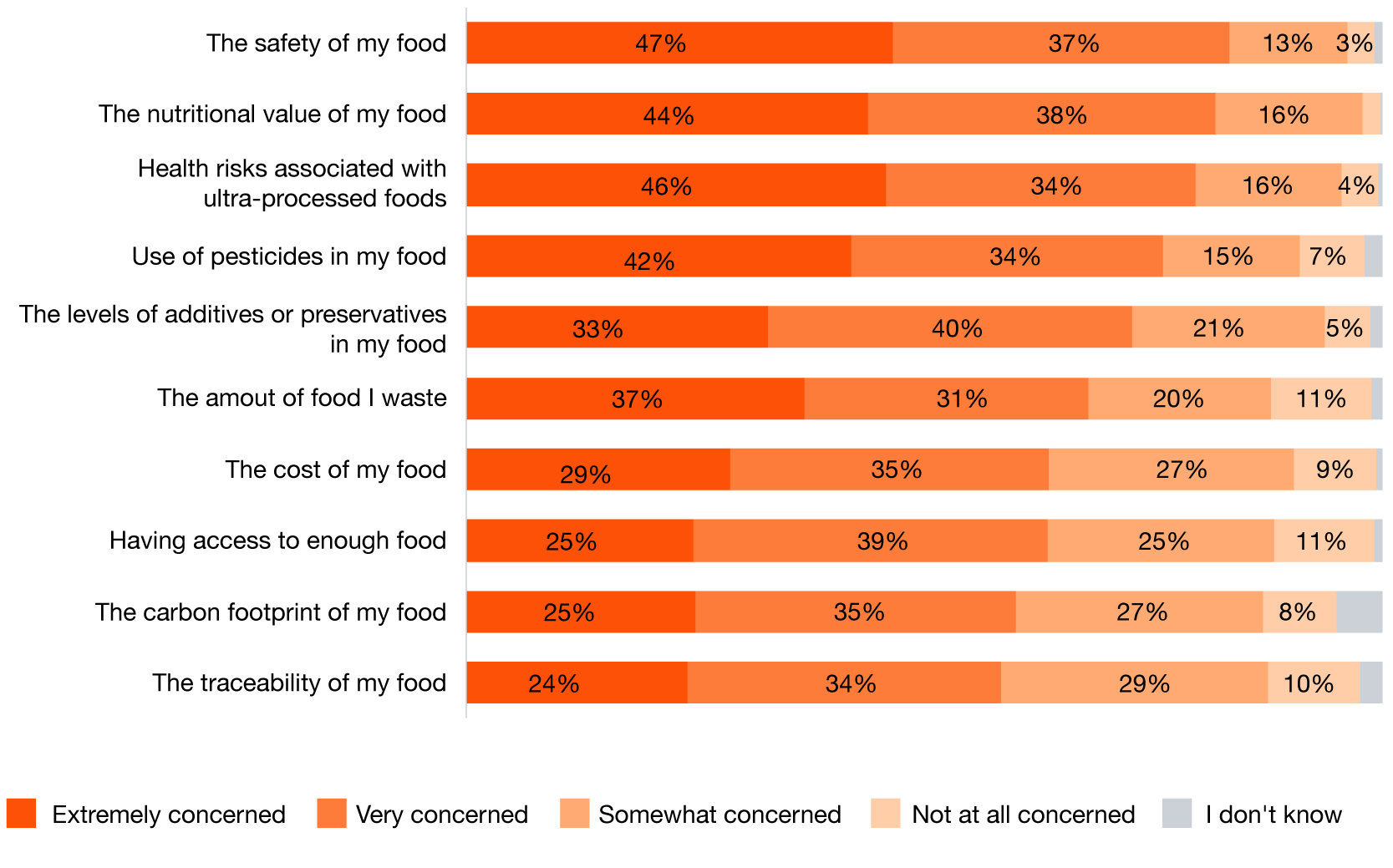

Food safety concerns outweigh cost constraints

Consumer expectations around greater food safety underscore the need for companies in the food industry to explore synergies with those in the health and wellness industry. In our research, concerns around food safety, nutritional value, food processing and pesticide use outweighed cost considerations. Consumers say that companies should increase nutrition in their core product offerings, offer specific health-related products, and focus on marketing more nutritious choices to contribute to consumer health and wellness.

Concerns around food

Q: How concerned, if at all, are you about the following?

Convenience is a growing area for value creation

The Indian retail landscape is witnessing a convergence of traditional and digital shopping channels. Consumers are availing of both in-store experiences and on-demand delivery platforms to optimise convenience and value.

Digital health technologies are becoming central to personal wellness routines, with over 80% of consumers using at least one healthcare app or wearable and they are comfortable with multiple GenAI use cases.

Shopping for groceries in the last year

Q: Where have you shopped for grocery items in the last year?

Comfort with GenAI performing activities

Q: Which of the following activities would you be comfortable allowing GenAI to perform?

Climate change is top of mind, but purchase impact is low

Although a majority of consumers are worried about climate change, climate and sustainability initiatives rank low when it comes to choosing food or switching to a new brand.

Pesticide-free products, supporting environmental initiatives and environment friendly packaging were listed as the most important sustainability practices for food purchases.

As per our survey results, 53% of Indian respondents (compared to 44% globally) prefer locally produced food even if it is more expensive.

Actions taken to reduce impact of food on climate change

Q: Have you taken any of the following actions to reduce your impact on climate change with the food that you buy and eat?

Most important sustainability practices when buying food products

Q: When you buy food products, which of the following sustainable practices are most important to you?

Recommendations

Brands must recalibrate their value propositions to better serve a consumer base that is increasingly cost-sensitive. Strategic pricing, value-driven product portfolios, and targeted promotions will be critical in maintaining relevance and driving volume. Moreover, with climate concerns top of mind for consumers, brands should actively promote their climate and sustainability efforts, especially through social media.

The fact that traditional brand equity drivers such as reputation and word-of-mouth rank lower, brands should clearly communicate health credentials and ensure pricing strategies reflect perceived value. They can also invest in nutrient-rich innovation which in turn opens up possibilities for collaboration with cross-industry players to capture emerging value in this segment.

As concerns around food safety, nutritional integrity, and the presence of ultra-processed ingredients and pesticides intensify, brands must respond with a commitment to transparency through clean labelling, credible certifications, and clear communication of product benefits.

There is a palpable shift towards proactive, tech-enabled health management. For brands in the health, wellness, and nutrition space, the opportunity lies in integrating with digital ecosystems and offering personalised solutions.

Adopting a domain-based approach: Our research sends a clear message. Consumer preferences are evolving rapidly and companies must reinvent to meet growing demands for health and safety, transparency, convenience and affordability. A domain-based approach built on collaboration with ecosystem partners and innovative delivery formats is imperative.

Hover on each tile to view more

Recalibrate Value for the Cost-Conscious Consumer

Brands must recalibrate their value propositions to better serve a consumer base that is increasingly cost-sensitive. Strategic pricing, value-driven product portfolios, and targeted promotions will be critical in maintaining relevance and driving volume. Moreover, with climate concerns top of mind for consumers, brands should actively promote their climate and sustainability efforts, especially through social media.

Elevate Perceived Value with Health Credentials

The fact that traditional brand equity drivers such as reputation and word-of-mouth rank lower, brands should clearly communicate health credentials and ensure pricing strategies reflect perceived value. They can also invest in nutrient-rich innovation which in turn opens up possibilities for collaboration with cross-industry players to capture emerging value in this segment.

Build Trust Through Transparency and Clean Labeling

As concerns around food safety, nutritional integrity, and the presence of ultra-processed ingredients and pesticides intensify, brands must respond with a commitment to transparency through clean labelling, credible certifications, and clear communication of product benefits.

Personalised Wellness in a Digital World

There is a palpable shift towards proactive, tech-enabled health management. For brands in the health, wellness, and nutrition space, the opportunity lies in integrating with digital ecosystems and offering personalised solutions.

Integrate Sustainability into the Value Equation

While taste, price, nutritional value and trust in the brand remain the dominant factors influencing food choices, sustainability is emerging as a secondary but increasingly influential consideration. Brands have an opportunity to shape consumer preferences by integrating sustainability narratives into product marketing.

Reinvent for the Future: A Domain-Based, Collaborative Approach

Our research sends a clear message. Consumer preferences are evolving rapidly and companies must reinvent to meet growing demands for health and safety, transparency, convenience and affordability. A domain-based approach built on collaboration with ecosystem partners and innovative delivery formats is imperative.

Download Full Report

Retail and Consumer

Value in motion

Contact us

Ravi Kapoor

Partner and Retail and Consumer Goods Leader, PwC India