The changing landscape of India’s credit industry

August 2021

The credit industry in India

India is one of the fastest-growing economies in the world but there exists a significant gap in accessing formal credit, especially when compared to other developed nations. Banks and financial institutions (FIs) are working on filling this gap by introducing new payments products and instruments that would make it easier to access formal credit. Traditionally, formal credit was restricted to financial products such as home, auto and personal loans. However, banks and FIs have recently shifted their focus towards instruments like credit cards, buy now, pay later (BNPL) and credit EMIs. New FinTech players have disrupted the market by introducing new and innovative products and offerings to consumers.

Credit cards, BNPL and credit EMIs have witnessed large-scale issuance and growth in usage. Traditional banks and new start-ups are focusing on acquiring new customers by allowing access to credit for the unbanked/underserved segment.

India’s credit card industry

India has traditionally been a debit card market. However, the growth in credit card issuance in the last decade has changed this narrative and credit cards are being used prominently. This growth is further accelerated by the various products and services being offered by FIs, and such products are being increasingly used by customers, especially the millennial population.

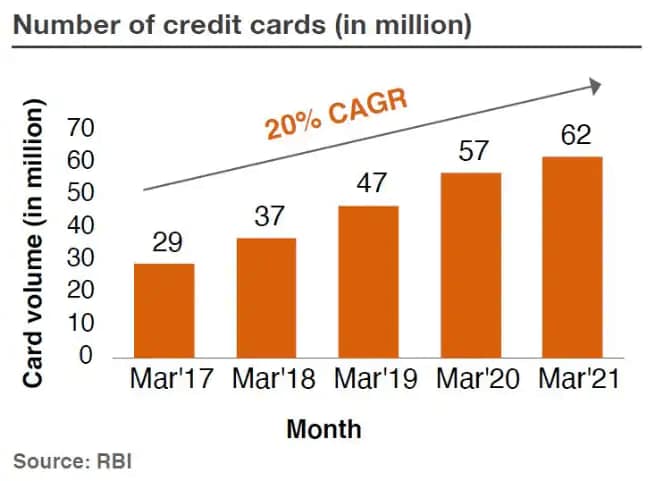

Credit card issuance has grown significantly in India at a compound annual growth rate (CAGR) of 20% in the last four years. The number of credit cardholders increased from 29 million in March 2017 to 62 million1 in March 2021. It has further grown by 26% and 23% respectively in 2019 and 2020. However, the COVID-19 pandemic affected the growth rate of India’s credit card industry and it grew by only 7% in 2020–21. The growth rate is expected to improve marginally in FY21–22 but will remain slow due to the restrictions on card issuance by some large banks and payments networks.

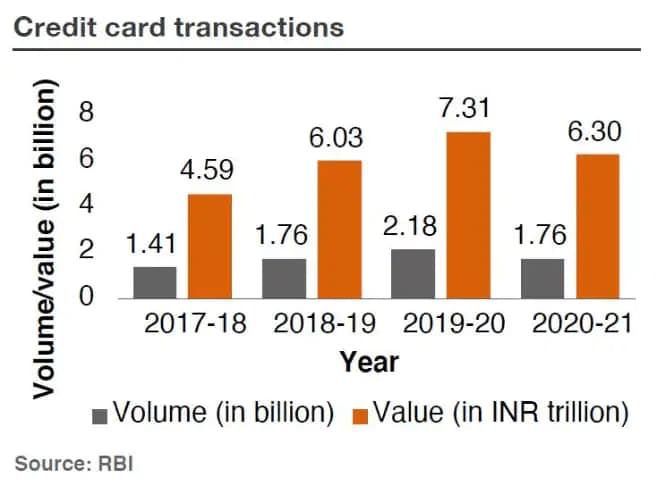

Similarly, credit card transactions were growing at a CAGR of 16% till 2019–20 but went back to the 2018–19 levels in FY20–21, as depicted in the figure above. The growth rate was low during the first half of 2020–21 though it gained momentum during the second half.

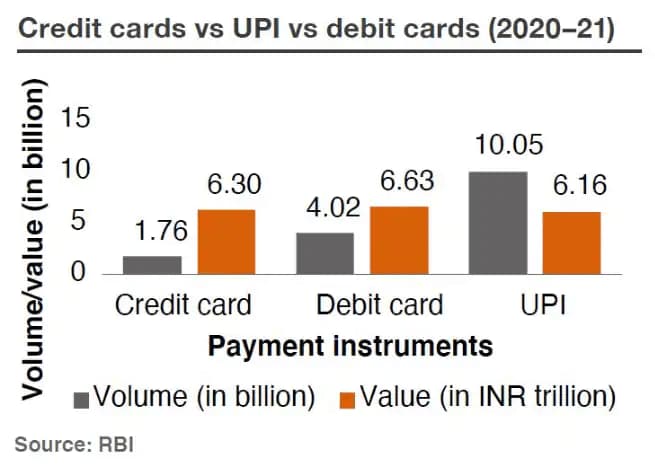

Unified Payments Interface (UPI) has become one of the most popular payments systems in India. The volume of UPI transactions was much higher compared to debit or credit cards in 2020–21. However, the value of transactions recorded was similar for all the three modes of payments during the same period.

A total of 31 card issuers in India have issued approximately 62 million cards till now. Out of the 31 issuers, the top six have a market share of around 81% while the rest account for the remaining 19%, as per RBI data released in March 2021.2

Typical revenue models for card issuers

The typical revenue model for credit card issuers revolves consists of the following:

Interest income – revolver interest, cash advance interest, etc.

Fees and charges – joining/annual fee, over-limit fee, late payment fee, etc.

Interchange fee incomeInterchange fee income

EMIs/loans – transaction conversion, EMIs/loansbalance conversion, loans above and within limits, etc.

Income from interest accounts for the highest of the total revenue earned by card issuers. Approximately 40–50% of the card revenue comes from interest income which is paid by approximately 15–20% of the revolving customers. The issuer charges interest ranging between 18–42% from customers depending on the product that they are using.3

Interchange income is earned from the fee charged by the issuer to process every credit card transaction. Interchange income is paid by the acquirer to the issuer from the MDR earned by the acquirer by charging the merchant for every transaction. Typically, the issuer charges around 1.2–2% as interchange fee for different card and customer segments. This contributes to around 20–25% of the overall revenue earned by the card issuer.

The remaining revenue is earned by the issuer through various fees and charges like joining/ annual fee, over-limit fee, late payment fee, cash advance fee, cheque/NACH bounce fee, EMI conversion fee and foreclosure. The issuer also earns revenue from interest levied on various transactions, balance conversion, loan above allocated/within limits, etc.

Key trends in the credit card space

Some of the key trends in the credit card space are analysed below:

- FinTech disruption: A number of FinTechs, new-age banks and original equipment manufacturers (OEMs) have entered the credit card issuance space. These players are entering into co-branded partnerships with banks and providing customers with the best in-class services.

- Better mobile apps: Customers today expect better mobile applications with best-in-class user-experience(UX)/user-interface (UI), features and do-it-yourself (DIY) services. A number of issuers have already started working on this front.

- New risk models: Card issuers are exploring various new credit risk models apart from the traditional credit rating model. These models can cater to customers with and without a credit score.

- Contactless payments: Customers are preferring mobile-based contactless, QR and token payments.

BNPL

BNPL has become a prominent mode of payment in the last few years. As per a latest report by a FinTech firm, BNPL has already captured 3% of the market share in the online e-commerce payments segment and the number could go up to 9% by 2024.4 BNPL is becoming a popular mode of short-term financing amongst millennials.

Key features of BNPL

- The average transaction limit ranges between INR 1,500–25,000 based on the use case.

- Some players are offering credit limit of up to INR 0.1 million with some nominal interest.

- The repayment cycle ranges between 15–45 days.

- BNPL is the only low-cost/free source of short- term credit for new-to-credit customers and does not require a previous credit score unlike traditional credit cards.

- BNPL is fast and convenient compared to card payments. Hence, customers are using it for use cases like paying for train/air fares.

- BNPL can penetrate the untouched segments like customers with no- or low-bureau scores. It is also becoming popular amongst the millennial population as they don’t get access to credit cards easily. They mostly use BNPL for purchase of electronics, travelling, etc.

Typical revenue models for BNPL issuers

Although there is no published data on typical BNPL revenue models, the following models have been identified as per industry sources:

- merchant fee

- late payment fee.

Merchant fee ranges between 2–5% of the total value of payment. Merchants pay this fee to the BNPL player for every transaction.

Late payment fee is charged in case customers do not repay before the due date. Unlike credit card issuers, BNPL players charge a very nominal late fee between 1–1.5%.

FinTechs are also responsible for bearing the financing cost – ranging between 18–24% – on behalf of the financer. The BNPL model is based on multiple rounds (six–ten) of rotation of funds within a short term till the players start to earn profits.

Apart from the normal convenience-based BNPL, there are other typical models for interest-based BNPL as well where larger amounts of credit are provided to customers who can use it in the form of interest-based EMI. A few BNPL players operating in this space are offering credit limit of more than INR 25,000.

Credit EMIs

Credit EMIs or consumer durable loans is another category of formal credit growing at a good pace due to the rising urban population, increase in consumption income, low-interest credit and disruption by FinTechs.

As per a recent report published by a news portal, the consumer durable loans segment is expected to grow at a CAGR of 21% to become worth INR 205 billion in 2026–27 from INR 84 billion in 2020–21.5

Key features of credit EMIs

- Most players provide easy approvals along with minimum documentation requirements. KYC processes can be completed using mobile numbers.

- Low processing fees and affordable interest rates.

- No-cost EMIs offered in some cases.

- No security or down payment required by most of the players.

- Provides a tenure ranging from 3–60 months.

- Provides loans in the range of INR 5,000–15 lakh.

Typical revenue models for credit EMI issuers

The typical revenue models for credit EMIs consist of:

- credit/loan processing fee

- interest charged on credit.

Credit EMI lenders charge around 12–22% for consumer durable credit which varies from player to player. The typical loan processing fee ranges between 1–3%.

Some issuers also offer no-cost EMIs for repayment of consumer durable loans. For most of the cases in such a setup, the retailer bears the interest though it is shared with the lender in some cases.

Disruption by FinTechs

FinTechs are disrupting the banking space by changing the whole ecosystem of how banks traditionally work and bringing in a digital change across all segments. In the last few years, the credit space has seen some of the most popular offerings globally by neobanks. New players are entering the credit space in India and have started providing credit cards and digital lending via BNPL, EMI and other services. These FinTech start-ups are also partnering with traditional banks to launch new products and services in the untapped market.

India has been culturally conservative towards credit and it is always seen as a debt trap instrument. But new-age start-ups are very focused on changing this mentality by creating awareness about how credit cards and BNPL can be used for daily expenditure.

Many new FinTechs have entered the Indian credit card space by offering credit cards to individuals and corporates. All FinTechs in this space are trying to attract customers through their digital offerings and have seen significant growth in new credit card customers.

FinTechs are also focusing on bringing out co-branded cards with features and rewards dedicated to a segment. Co-branding has enabled banks to acquire customers fast and at a lower cost. There are co-branded credit cards in the market which are specifically designed for market players. Banks are also exploring partnerships with FinTech players to acquire new customers to their platforms. Banks are actively participating to provide open APIs to the FinTechs to leverage their ecosystem and on-board new credit card customers. Over the last few years, FinTechs have scaled up aggressively.

FinTechs in the BNPL segment have emerged as one of the fastest growing start-ups in digital payments. Most of these FinTechs are providing a faster and better checkout experience during online payments on different platforms. Millennials and Gen Z are the target audience for these FinTechs as they provide real-time credit approval.

Mobile apps provide a variety of features to consumers and take user experience to a different level. The overall mobile app market has grown at a very high pace and FinTech apps dominate this space. New-age credit card apps have placed the digital banking experience in the customer’s hands, allowing them to perform all actions ranging from getting a new card to statements to disputes, etc.

Best-in-class features offered by FinTechs

- Digital and faster onboarding: Digital acquisition of credit card customers is taking place faster with no physical documentation. KYC is being done with methods like DigiLocker, Central KYC (CKYC) and video KYC.

- Virtual cards: These apps provide instant virtual cards to customers post completion of onboarding. Customers can use their cards on e-commerce portals instantly. New virtual cards are also provided in case of lost/stolen cards or reissue scenarios.

- UI/UX: FinTechs are providing a simple, best-in- class UX to customers during each phase of the user journey – onboarding, payment, services, etc. – on the website and mobile app.

- Transactions: These apps support different types of transactions such as QR payments, tap and pay, and tokenisation.

- Statements: Some apps are working towards providing interactive statements which are easy to understand and allow customers to perform actions like bill repayment, EMI booking, spend analysis and raising a dispute.

- Dispute resolution: Dispute resolution is a key feature which FinTechs are working on to provide a way to raise and track a dispute. Traditionally, dispute resolution takes place through call centres or physical branches only.

- In-app support: This includes the latest support features such as chatbots, video tutorials, FAQs and tracking of any previous support issues to quickly resolve issues.

- Rewards: FinTechs are providing a wide range of rewards and loyalty programmes to customers, mainly focusing on new emerging areas like subscriptions, food delivery, e-pharmacy and EdTech.

- Business support: FinTechs are providing customised support to businesses with features like spend tracking, adding/removing an employee from a corporate card and assigning or changing limits.

Credit card FinTech #1

- Partnership with a leading bank

- Digital onboarding – offers card to customers without a credit score

- Split bill functionality

- Spend analyser with passbook

- Various rewards

Credit card FinTech #2

- Partnership with two banks

- Digital onboarding within five minutes through a mobile app

- Metal card

- Mobile application with all control aspects like contactless on/off and limit management

- Loyalty programme, spend analyser, etc.

BNPL FinTech #1

- Works on both online and offline retail

- Offers EMIs on BNPL option with higher limits

- No-cost EMI options for customers

- BNPL options on PoS terminals

- Ventured into the international market with partnerships

BNPL FinTech #2

- Offers to shop online for big-ticket purchases and pay back later through easy instalments

- The platform has over six million registered users

- Registered a 50% growth in the average ticket size of EdTech transactions, 30% in personal loans and 15% in e-commerce during 2020 compared to the previous year

Credit card FinTech #1

- Partnership with a leading US bank

- Digital onboarding

- Titanium credit card

- Mobile app application with QR and token payment features

- Face authentication

- Family feature to manage all the cards under a single app for family

Credit card FinTech #2

- Neo/digital bank

- Digital credit card, transfers and payments

- Digital onboarding

- In-app customer support

- Expense management

- QR- and token-based payment

BNPL FinTech #1

- A BNPL company

- It operates in 17 countries and has 15 million US customers

- In 2020, customers used this to buy products worth USD 53 billion

- Its BNPL service offers two interest-free payment plans

BNPL FinTech #2

- Offers to convert the transaction into four interest-free equal repayments

- An average of approximately 23,000 new customers were added to the platform per day between July–December 2020

- Active merchants continued to grow in H1 FY21 with over 74,000 retailers at present

BNPL FinTech #3

- Offers low-interest rates on consumer loans at POS outlets

- Makes money through the interest that customers pay on the loan and the percentage fee of the product’s sales price paid by merchants in exchange for managing the payments

- Over one million customers and more than 3,000 merchants across the US

Way forward

Traditionally, the formal credit sector was dominated by banks in India. However, in the last couple of years, the entry of FinTechs has led to disruption and brought in a lot of new initiatives, product offerings and innovation in this sector. These developments are bringing in new untapped customer segments, new and innovative product offerings and various new credit channels/ modes such as online payment, offline payments, etc., to the credit industry. These changes are providing major benefits to the credit card, BNPL and credit EMI sectors.

The credit card market in India is still under- penetrated. It was only 3%6 of the total population above 15+ years in year 2017–18 as per World Bank. This will currently be around 5–6%, which is still very under-penetrated compared to other countries like the United states (66%), United Kingdom (65%) and Brazil (30%).7 Though growth is a bit stagnant at the moment due to the pandemic, it will eventually pick up pace.

However, it is not only credit cards but also BNPL, credit EMIs and other payment modes have also been impacted by the current situation.

- Co-branding with FinTechs for credit cards:

- Foray into the BNPL space

- Taking a cue from global players

- Omnichannel ecosystem for credit EMIs

Co-branding with FinTechs for credit cards:

Banks should focus on bringing these FinTechs on board with co-branded partnerships in the credit card space. The focus should be on introducing more propositions in the high-spend categories. This will help banks to not only provide better offerings to their existing customer base and acquire new customers but also earn higher interchange.

Foray into the BNPL space

Traditional banks are already offering BNPL. Given the growth of BNPL in India, especially among the millennial population, other banks will also venture into this space. A lot of banks are already working in this space, and they can partner with FinTechs in order to leverage their experience and brand value along with the technology, product offerings and merchant reach of FinTechs.

Taking a cue from global players

Some global players are providing best-in-class credit solutions with the latest mobile application features such as digital onboarding, enhanced UX/UI, single click payment, QR, token-based payments, dispute resolution, in-app support and spend analysis. Traditional players need to take a cue from these players to enhance their offerings.

Omnichannel ecosystem for credit EMIs

The credit EMI market has traditionally been dominated by offline retail. However, due to the current situation, online buying is seeing greater traction among customers. Players in this sector need to focus more on building the omnichannel ecosystem to cater to both the offline and online market.

Conclusion

The credit industry has seen tremendous growth, technological disruption and structural changes in the last decade. While the current crisis has impacted credit card adoption, BNPL and credit EMIs have changed the landscape of this industry in the last few years.

BNPL can be a threat to the credit card industry in the future. Keeping in mind the low penetration of credit cards in India, and with FinTechs entering into this space, there is a long way to go for credit cards as well.

FinTechs have brought in logical and innovative changes that can support the growth of the credit industry. They are disrupting this industry with their best-in-class offerings by leveraging the existing data of banks and API stacks to provide meaningful offerings to customers.

FinTechs have opened up new avenues for the credit industry to tap into the large customer base without credit history. However, this also poses the risk of increase in defaults, which is currently about 5–10%8 due to the ongoing crisis. With these evolving models and many structural changes, an interesting time lies ahead for the credit industry.

With inputs from Geetika Raheja, Aarushi Jain, Benito Jacob, Tanmay Bhatt and Sachin Sehrawat.

Sources

PwC analysis of data from industry sources

India's e-commerce market to surge 84% to $111 billion by 2024: FIS report

At conversion factor of 1 USD = 71 INR as considered in National Infrastructure Pipeline (NIP),India Consumer Durable Finance Market Report 2021: Focus on Smart Phone, Washing Machine, Refrigerator, Air Conditioner, Laptops - ResearchAndMarkets.com

Ibid

PwC analysis of data from industry sources

Payments technology updates

Credit card spends at 8-month low in May; HDFC Bank loses 5.3 lakh credit card customers since ban

CNBCTV18

Credit card spends fell to an eight-month low in May amid localised lockdowns imposed by states to battle the second wave of coronavirus.

RBI bars Mastercard from onboarding new domestic customers from July 22

Moneycontrol

The Reserve Bank of India (RBI) on July 14 said it has taken supervisory action on Mastercard citing non-compliance.

Amazon Pay ICICI Bank credit card on- boards over 2 mn customers

Livemint

ICICI Bank and Amazon Pay on Tuesday announced that over 2 million ‘Amazon Pay ICICI Bank credit cards have been issued so far since its launch in October 2018.

How ‘Buy Now Pay Later’ is changing the lending landscape in India

Financial Express

Buy Now Pay Later (BNPL) has grown to become a prominent form of financing over the last ten years.

Fintech startup Slice raises $20 million from Gunosy, Blume Ventures

Economic Times

Fintech startup Slice has raised $20 million in equity funding from existing investors Gunosy and Blume Ventures at an undisclosed valuation

Paisabazaar rolls out its neo-lending strategy, launches Step Up Credit Card with SBM Bank India

ThePrint

Paisabazaar.com, India’s largest lending marketplace and Credit Score platform, and SBM Bank India, the youngest universal Bank, announced the launch of Step Up Credit Card – a credit builder product designed for consumers with limited access to formal credit, due to ineligible credit score.

Payment System: Innovations like BNPL via POS have led to greater collaboration between fintech’s, banks, NBFCs and payment networks

Financial Express

For India’s small and medium-sized businesses, cash has traditionally been the favoured mode of accepting payments. The perceived cost factor around the point of sale (POS) terminals has been a key barrier to the adoption of digital payments in India.

Contact us