Loyalty programmes in India do they really work

January 2022

Introduction to loyalty programmes

A loyalty programme is a marketing tool used by businesses to retain their existing customers and encourage them to continue using the offerings of the business. Such loyalty programmes are sponsored by retailers and other businesses and offer rewards, discounts, and other special incentives to customers. These incentives are designed to encourage customer interaction and transactions with the business in question.

With the interaction between merchants and customers evolving at a steady pace, the concept of a loyalty programme has also changed over time. Previous models of stand-alone loyalty cards or physical loyalty tokens are no longer useful. This is because customers tend to ignore or forget anything that increases their effort for transacting or reaping benefits of such incentives. This has led to the introduction of payment-based loyalty, which allows loyalty programmes to be linked to payment methods. Such a change allows customers to seamlessly gain loyalty rewards without any additional effort.

There are several types of loyalty programmes. The four major categories are as follows:

Single-product/brand loyalty programmes

These are loyalty programmes unique to a particular product or service. They are conventionally closed-loop programmes with redemption limited to the same brand or company. For example, a large multinational coffee chain has its own rewards programme, which is a single-brand loyalty programme offering customers points for purchases that can be used towards future purchases at its outlets (points are unusable outside of its ecosystem).

Membership-based loyalty programmes

These are paid loyalty programmes that offer customers additional services and privileges that are linked to the subscription and not directly dependent on the transactions. For example, a leading multinational e-commerce giant has a membership programme that provides subscribers with exclusive benefits such as free and fast delivery options. They also provide access to video and music services.

Loyalty programmes with partnerships

These are conventional loyalty programmes that allow customers to accumulate reward points through transactions or interactions with a brand. The points can be redeemed across multiple avenues. For example, a leading credit card loyalty programme allows customers to earn reward points for transactions made via their cards and redeem those points via direct partnerships with different product and service providers.

Coalition/multi-brand loyalty programmes

Coalition loyalty programmes allow customers to earn reward points across multiple brands and redeem them across multiple partners through online portals. Such a portal acts as an aggregator by collating rewards earned across various merchants/businesses. For example, a leading coalition loyalty provider allows its customers to earn loyalty points through all partners into a consolidated pool. These points can then be redeemed through loyalty partner websites or redemption partners. Overall, the programme is managed by a third-party provider and governed by the agreement between the brand and the loyalty provider.

Loyalty programmes generally reward their customers with different forms of loyalty currencies that can be redeemed immediately or exchanged for benefits during redemption in the form of discounts or cashbacks. The following list discusses different types of loyalty currencies used by various programmes.

- Points: Customers are awarded points for transactions and other predetermined interactions with the brand through all or select channels. Brands predetermine the earn and burn rates based on the amount spent. For example, a purchase of INR 100 can earn 2 points.

- Cashbacks: This is another common loyalty currency that allows customers to receive some amount of their transaction amount back – either into an e-wallet or the originally used payment method.

- Offers and discounts: This option allows customers to unlock offers or discounts on products and services as rewards for transacting with a brand. In many instances, they also get an immediate discount on the transaction.

Enterprise-wide loyalty programmes

Enterprise-wide loyalty programmes are the next step in the evolution of loyalty programmes. These programmes are adopted by major banks, which offer rewards for most products and transactions to build their customer base and brand loyalty. For brands in the hospitality and retail foods industry, it is becoming more common to give consumers loyalty points that can be used for redemption only with the brand, which improves customer stickiness. For major banks, such enterprise-wide programmes help the customer earn loyalty points majorly through credit and debit card transactions, account opening, cross-border payments and availing of loans. The idea is to consolidate these individual programmes to simplify and enhance the overall customer experience.

The definition of ‘enterprise wide’ varies for different companies. For example, for retail or manufacturing companies, it may entail the consolidation of product loyalty programmes or the inclusion of related products from across the value chain. Similarly, for banks, loyalty programmes act as customer-retention tools aiming to enhance brand affinity, increase transaction frequency and promote services such as loans. With few interaction opportunities, enhancing the reach and personalising the customer experience is the key to optimising customer loyalty programmes.

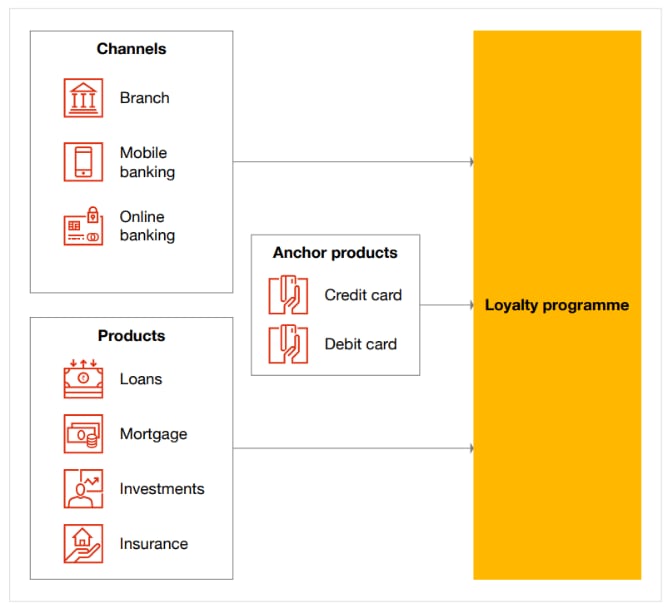

A generic banking enterprise loyalty solution in the picture below shows an integrated business strategy across all products and channels.

The enterprise-wide programmes commonly implemented by banks have an average earn ratio of 0.5–1%. For example, in beginner-level credit cards, the bank provides the customer with 2–4 points per INR 100 transacted using the card. These points usually can be redeemed for a value of INR 0.25. Therefore, INR 0.5–1 is returned to the customer for every transaction of INR 100.

The linkage of loyalty programmes with different payment options is an efficient way to make the whole experience faster and frictionless for the end user. Several large payment networks are also providing multiple avenues to their partner merchants and banks for making the processes far more seamless. For example, merchants can now allow their customers to save their card details in a tokenised format. This can help show the customers all the available card-specific offers in their portal. Another very common use case is when customers are able to integrate their cards with e-wallets and earn points through contactless mobile payments.

The major advantages of loyalty linked payments used by brands are as follows:

- Understanding customer behaviour: The payments profile of a customer helps in gathering behavioural data, which further helps build a more holistic view of the customer and his spending habits. Moreover, this helps improve the experience that merchants and banks can provide to their customers, based on their specific needs.

- Mobile payments and loyalty: In the era of fast payments and financial inclusion, loyalty programmes are increasingly becoming digital. As most consumers move towards contactless mobile payments, it is safe to embed the loyalty programmes with such payment options that will not only boost digital payments but also increase customer stickiness for businesses. Moreover, loyalty programmes are incorporating tap-and-pay options as well, as these simplify and speed up the payment process for the customer.

- Omnichannel payment loyalty programmes: Payment operators and apps are consistently improving customer experience by facilitating payments through multiple modes and giving customers an opportunity to earn rewards through these modes. This is not only allowing more and more customers to opt for digital payment modes but also increasing the customer retention for such payment platforms and apps.

- Invisible earning of rewards: The future of enterprise-wide loyalty programmes is going to be about ‘invisible’ earning of loyalty rewards, without making it a task for the customer to keep track of the same during his transactions or interactions with the brands. The rewards will automatically be credited for all transactions with the brand without needing loyalty card swipes or vouchers.

Innovations in loyalty programmes

With evolving customer expectations and increasing competition, loyalty programmes are seeking innovative ideas in order to stand out and increase their appeal to customers. These innovations leverage technology and focus on maximising engagement with customers. Some key innovations in the market are discussed below.

Key success factors for loyalty programmes

To ensure the success of a loyalty programme, both in terms of adoption and regular usage, there are several factors that need to be considered as highlighted in the figure below.

Loyalty programmes can be optimised if they can reward customers for different actions as they mature with the brand.

The ability to engage customers at early and later stages in the lifecycle through customised reward triggers can help enhance the effectiveness of loyalty programmes.

For example, offering customers dynamic offers through email/SMS campaigns, marketing triggers and loyalty surveys can increase engagement with the company while also connecting with customers through their preferred mode of contact.

Customer segmentation allows for a better understanding of customer interests and behaviours and more accurately provides value that matches their needs.

This allows for similar customers to receive customised rewards and facilitates retention of top customers and re-engagement with lowinteraction customers. For example, offering and promoting redemption towards mobile and DTH recharges for low-income customers.

This would impact the customer by reducing unavoidable costs, thereby increasing brand affinity and loyalty and driving repeated usage in order to avail loyalty benefits.

Fraud poses both financial and reputational risks. Prioritisation of security and fraud prevention in a loyalty programme ensures financial protection as well as safeguards and enhances customer relationships.

For example, as loyalty points can go unused and ultimately be redeemed fraudulently, loyalty fraud detection targets suspicious behaviour and detects anomalies to prevent an array of fraud techniques.

The use of analytics and reporting can provide insights into important elements of loyalty programmes including rewards redeemed, conversions completed and revenue generated while also tracking customer behaviour and preferences to ensure meeting of customer expectations.

This helps in building a customer profile that can be leveraged for improving customer interaction at each touchpoint and finding a better fit in terms of redemption avenues and earn rates.

It is important to explicitly report to the customers and keep a constant channel of communication open about the avenues through which they can earn or burn their reward points.

This helps predict the overall direction in which the customer base is moving and also determine the enterprise-wide earn and burn rates.

Conclusion

Loyalty programmes offer customers additional benefits for choosing a company for product and service purchases and make them do repeat transactions with the brand to ensure customer stickiness. Currently, companies are expanding their loyalty programmes exponentially in a bid to differentiate themselves from their competitors. With the evolving customer expectations as well as the narrowing gap in the uniqueness of products and services offered, loyalty programmes can be the deciding factor for customers when making purchase decisions.

There are several advantages and disadvantages to the various types of loyalty programmes. However, the common factor is to offer customers the most appealing and customisable experience in order to retain existing customers and attract new ones. Some loyalty programmes focus on the redemption options to appeal to customers, while others focus on maximising the earning avenues for customers. This helps facilitate more transactions and increases customer interaction.

For large companies, enterprise-wide loyalty programmes have been viewed as the ideal solution to maximise customer interaction with the brand and incentivise customers to explore and use more of the services offered by the company.

We expect to continue to see innovative initiatives and offerings from loyalty programmes as the battle to attract new customers continues. Such loyalty programmes will continue to be used as an incentive to attract customers to all products and services offered, as well as help existing customers diversify their interactions and transactions with the company.

Loyalty programmes have taken the approach of bombarding customers with redemption avenues, which can be overwhelming and confusing for the customers. There is a potential shift towards providing customers with a more customised experience that is better suited to their needs and behaviours by leveraging data analytics. This is the next frontier for loyalty programmes to explore and will cause a substantial shift in the loyalty landscape in the near future.

With inputs from Geetika Raheja, Neha Dharurkar, Tushar Gupta and Shamik Bandyopadhyay

Mastercard expands cryptocurrency services with wallets, loyalty rewards?

Reuters

Mastercard Inc said on Monday that it would allow partners on its network to enable their consumers to buy, sell and hold cryptocurrency using a digital wallet, as well as reward them with digital currencies under loyalty programmes.

US Bank expands card rewards to put EV charging transactions on par with gas

Business Wire

US Bank wants to make sure that all drivers – regardless of what they drive – are rewarded for their purchases. This is why it has expanded the rewards on its business and consumer credit cards that reward card members for gas station purchases to include equal rewards for electric vehicle (EV) charging transactions.

PayU introduces ‘Pay with Rewards’ with twid, to help merchants get more consumers

ET Online

PayU has announced the launch of ‘Pay with Rewards’ initiative in partnership with twid. By aggregating loyalty points and alternate currencies of multiple brands on a single platform, consumers can pay for up to 100% of their purchases through rewards and loyalty points.

Wedge partners with Cardlytics on smart debit card cashback offering

PYMNTS

Spending app Wedge has debuted a new rewards programme, powered by cashback offer platform Cardlytics, according to a press release dated 20 January 2022, Thursday.

According to the release, Wedge lets users pay for their purchases with any asset using a smart debit card, while Cardlytics works with hundreds of brands and retail partners. The partnership is a step towards helping Wedge realise its vision of spending smarter in real time.

Generation gap in restaurant loyalty programmes

PYMNTS

When it comes to restaurant loyalty programmes, there is a generational divide.

According to PYMNTS research, 64% of the Gen Z diners and 61% of the millennials participate in these programmes at at least one or two of the table-service restaurants they frequent.