Download the report

Our 2023 Global Risk Survey shows that Indian business leaders are doing a reasonable job of identifying opportunities presented by risks. Deemed as value creators rather than value protectors, 62% of surveyed Indian organisations say they are proactively taking risks to create opportunities and 60% say they seek to uncover opportunities within risks.

This year’s global research also reveals four illustrative risk archetypes and a top-performing group of ‘Risk Pioneers’, based on respondents’ risk appetite and preference for value creation versus value protection which is then plotted against the maturity of an organisation’s human-led, tech-powered approach. Spread across all industry sectors, Risk Pioneers are forging ahead in reframing risk as a value creation opportunity for their organisations. This survey highlights how organisations that are yet to harness risk as a value creation opportunity can become Risk Pioneers. Despite challenges or delays, the scope for early advantage is still available to those bold enough to move with agility and embrace emerging technology at speed.

“A positive, proactive enterprise-wide risk strategy is one of the first steps towards building trust in a business. It is not surprising that 41% of our respondents highlight they have already better aligned their risk management with business strategy- Indian businesses seem to be well on course to use risk to their advantage.”

Cybersecurity tops the risk radar of Indian organisations

Cyber risks are cited as the biggest threat faced by Indian organisations, with 38% of respondents feeling highly or extremely exposed to it. With this, cybersecurity has jumped two spots from number three to number one on the risk radar when compared to the 2022 Global Risk Survey – India highlights. Climate change (37%) and inflation (36%) rank second and third among the top threats to Indian organisations. Digital and technology risks rank fourth, with 35% of Indian business leaders concerned about these risks. Globally, business leaders consider inflation (39%) to be the top risk, followed by cyber (37%), macroeconomic volatility (33%), and digital and technology risks (32%).

Top threats organisations say they feel highly or extremely exposed to in the next 12 months

Source: PwC’s Global Risk Survey 2023

The appetite for investments in technology is on the rise

Indian organisations are not shying away from making bold investments in cybersecurity, with more than half the respondents planning to invest in cybersecurity tools (55%) and artificial intelligence (AI), machine learning and automation technologies (55%) in the next 1–3 years. This is in line with the global findings (51% and 49% respectively). To back these investments, 71% of Indian organisations are gathering and analysing cybersecurity and IT data for risk management and opportunity identification. Globally, 61% of organisations are doing the same.

Q. Which, if any, of the following technology and data capabilities does your organisation plan to invest in to navigate risk during the next 1–3 years?

The appetite for investments in technology is on the rise

Source: PwC’s Global Risk Survey 2023

Value creators are proactively taking risks in pursuit of opportunities

The survey reveals that 62% Indian organisations are proactively taking risks to create opportunities, which is 5% higher than the global average of 57%. At 60%, Indian organisations have a higher risk appetite compared to their global peers (52%). Additionally, 60% of Indian firms say they seek to uncover opportunities within risks.

Corroborating this line of thinking is the finding that 51% of Indian business leaders (against 46% globally) are considering changing customer demands and preferences as an opportunity rather than a risk. Similarly, 67% of Indian respondents (53% globally) are looking at the transition to new energy sources as an opportunity rather than a risk.

In contrast, 40% of Indian businesses prioritise regulatory adherence when managing risk, and 50% say ‘safety first’ is a key element of their organisational culture. These approaches to managing risk can differ from value protection vs value creation and a human-led vs tech-powered mindset.

Unlocking the power of data to manage risk and identify opportunities

71% of Indian organisations gather and analyse cybersecurity and IT data for risk management and opportunity identification, as against the global figure of 61%. Similarly, 63% of Indian companies are analysing regulatory and compliance data for risk management and opportunity identification, as against the global figure of 50%.

Further, supply chain and logistics data and environment and sustainability data are also helping 60% of Indian companies with risk management and opportunity identification. Globally, these figures are 46% and 43% respectively.

Bullish about balancing risk and growth

Another significant insight from this year’s survey is that 99% of Indian business leaders are confident their organisation can balance growth and effective risk management. Of this, 66% are very confident about their organisation’s ability. Globally, these figures stand at 91% and 40% respectively.

Q. How confident are you that your organisation can balance growth with managing risk effectively?

Bullish about balancing risk and growth

Source: PwC’s Global Risk Survey 2023

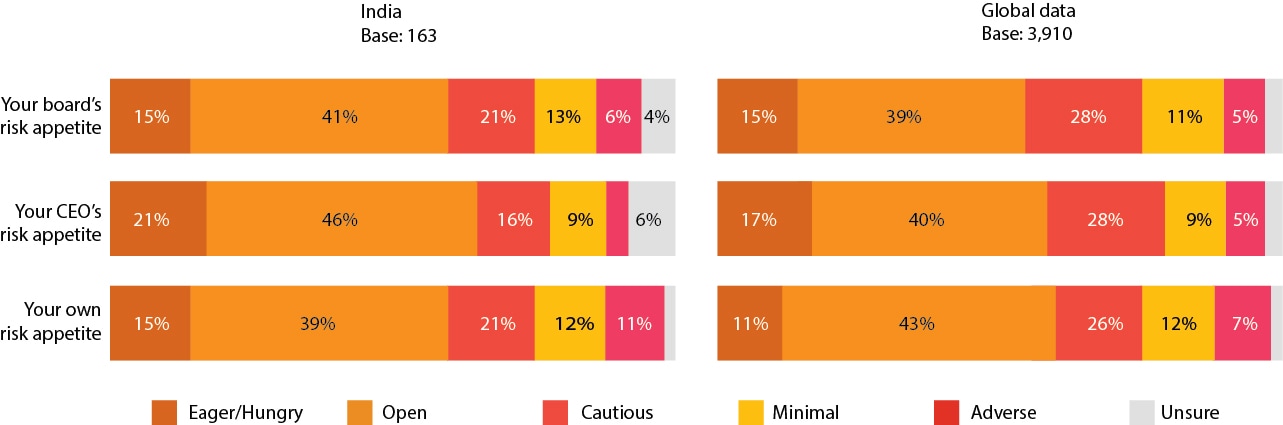

Indian leadership is more open to taking risks

One key finding of the survey is that 67% of Indian executives state that their CEO is eager and open to taking risks to grow their businesses. Similarly, 56% claim their board has a similar risk appetite. Globally, these figures stand at 57% and 54% respectively.

Open to harnessing emerging technologies

Indian businesses are seeing technology disruptors as opportunities, with 69% of Indian executives seeing GenAI as an opportunity (as against 60% globally). This is also reflected in PwC’s 2024 Global Digital Trust Insights – India edition report: 90% of Indian respondents said that GenAI would help their organisation develop new lines of business over the next 3 years.

Apart from GenAI, 60% of Indian respondents view both quantum computing and enterprise blockchain as an opportunity. Globally, the outlook is similar with figures of 53% and 52% respectively

Q. To what extent do you currently see the following technology disruptors as a risk versus an opportunity for your organisation?

Open to harnessing emerging technologies

Source: PwC’s Global Risk Survey 2023

Using technology as an ally for risk management

64% of Indian organisations have an enterprise-wide technology strategy and roadmap, which includes investment in technology specifically to drive resilience and/or manage risk. This is 11% higher than the global average of 53%. Additionally, 28% of Indian organisations and 27% of global enterprises have fully integrated the use of technology and data in risk management with regular updates. The survey also revealed how organisations are using emerging technologies such as GenAI for risk management, with 48% of Indian enterprises having deployed AI and machine learning for automated risk assessment and response to a large extent. This is slightly lower than the global response of 50%.

Legacy technologies are impacting an organisation’s ability to manage risk

It is noteworthy that 30% of Indian companies say legacy technology is impacting their organisation’s ability to comply with newer regulatory standards and 37% highlight a lack of flexibility in adapting to changing business environments and risks. Globally, these figures stand at 26% and 33% respectively. The survey also highlights that 42% of Indian organisations are facing increased security vulnerabilities because of legacy technologies. Globally, this figure stands at 36%.

From a cost perspective, 46% of Indian companies are also incurring higher maintenance costs due to legacy technologies, which is restricting their budget for innovative risk solutions. This is higher than the global figure of 39%.

Investing in building resilience is imperative

When it comes to resilience investments, 88% of Indian organisations have been actively investing in building resilience in their ecosystem over the last 12 months. Globally, 77% of businesses are investing in the same. Similarly, 58% of Indian enterprises have established a resilience team, comprising members from functions such as business continuity, cyber, crisis management and risk management to swiftly respond to risk events as they occur. Globally, the figure stands at 51%.

To have a proactive approach to building resilience, 89% of Indian organisations are upskilling internal teams to be better prepared for potential risks as a priority as against 78% of global organisations.

In the last 12 months, 49% of Indian organisations have already achieved more robust compliance with regulatory standards to improve their approach to risk. This is 9% higher than the global average. Furthermore, 41% of Indian business and 31% of global businesses have already better aligned their risk management and business strategy in the same timeframe.

How Risk Pioneers are leading the way

Risk Pioneers are blazing a trail in reframing risk as a value-creation opportunity for their organisations. This top-performing 5% of organisations, built on enterprise-wide resilience and driven by a balanced human-led, tech-powered approach to risk, are already achieving more successful outcomes than others.

As the chart below shows, Risk Pioneers are consistently outperforming other organisations through their approach to risk, particularly in value creation outcomes such as identifying new commercial opportunities and improving financial performance.

- Total

- Risk Pioneers

- Greatest performance premium

- Enhanced customer trust and confidence

- Identification of new commercial opportunities

- Improved financial performance due to effective risk mitigation

- More robust compliance with regulatory standards

- Better alignment of risk management with business strategy

- Increased accuracy in risk forecasting

- Building competitive advantage

- Expansion into new markets

- Enhanced response time to emerging risks

- Streamlined risk reporting and communication

- Greater integration of risk management across business functions

- Improved identification and tracking of potential risks

- Improved resilience to external shocks or crises

Base: All respondents=3910 Source: PwC's Global Risk Survey 2023

| Status | Risk pioneers | All |

|---|---|---|

| Enhanced customer trust and confidence | 89% | 40% |

| Identification of new commercial opportunities | 84% | 32% |

| Improved financial performance due to effective risk mitigation | 84% | 32% |

| More robust compliance with regulatory standards | 81% | 40% |

| Better alignment of risk management with business strategy | 80% | 31% |

| Increased accuracy in risk forecasting | 79% | 29% |

| Building competitive advantage | 79% | 31% |

| Expansion into new markets | 78% | 28% |

| Enhanced response time to emerging risks | 77% | 28% |

| Streamlined risk reporting and communication | 76% | 32% |

| Greater integration of risk management across business functions | 76% | 30% |

| Improved identification and tracking of potential risks | 75% | 31% |

| Improved resilience to external shocks or crises | 75% | 28% |

The key characteristics of Risk Pioneers

Our survey shows a fairly even spread of Risk Pioneers across most industries. They are particularly prevalent in financial services, retail and consumer, technology, media and telecoms, and from organisations with revenue of USD 5 billion or more. Respondents are more likely than the survey average to be CEOs and the board (34%) and their organisation is more likely to have seen revenue increase in the past six to nine months and be expecting it to increase again in the next 12 months. Almost three-quarters (73%) of Risk Pioneers also have an enterprise-wide technology strategy and roadmap, which includes investment in technology specifically to drive resilience and/or manage risk—compared to 53% of overall survey respondents.

Outcomes achieved

How they achieved them

Significantly more likely for the risk function of pioneers to be already demonstrating strategic behaviours such as challenging senior management on strategy and risk appetite, guiding the business through complex change such as mergers and acquisitions (M&A), and bringing risk insights to the board for better oversight.

These leading Risk Pioneer behaviours and outcomes reveal a clear gap that organisations need to address if they want to make more effective use of tech and create opportunity and value out of risk. Around two-fifths of all organisations have improved their approach to managing risk to enhance customer trust and improve compliance with regulation. But fewer than a third of organisations have achieved successful outcomes across other key areas, highlighting the opportunity to achieve better outcomes from their risk strategy and to provide strategic value.

Are you ready to change the way you see risk? The key questions leaders must answer first

The journey to taking risk more intelligently—powered by technology and through the lens of reinvention, opportunity and growth—requires leaders to start with these four key questions:

Are you clear on how GenAI will disrupt your sector and do you have a plan to ensure your organisation emerges as one of the winners?

Do you have sight of the threats on the horizon? Using this insight, do you have alignment between the risks you need to take to create business value and the practical measures you have in place to respond to shocks and surprises and mitigate risk?

Have you invested appropriately in building your organisation's resilience to disruption, removing critical points of failure and developing your capabilities to swifty respond to risk events as they occur?

Does technology underpin how you assess, manage and take risk, or are you still using manual approaches and spreadsheets?

Organisations can no longer afford to rely on a reactive approach to risk that focuses primarily on avoidance. Nearly 40% of CEOs respondents think their company will no longer be economically viable a decade from now if it continues on its current path. From climate and geopolitical risk to macroeconomic volatility and the disruptive power of technology, organisations must change and reframe the way they see risk to build resilience and unlock opportunity.

The ability to adapt, change and reinvent at pace amid this constant change and uncertainty is vital for survival and sustainable growth. Harnessing the power of technology and data in new ways, combined with building more diverse multi-disciplinary capabilities across the organisation, will be critical to turning risk into that enabler of change and growth.

About the survey

The 2023 Global Risk Survey – India highlights aims to capture views on the top risks organisations faced across industries in 2023. It focuses on the evolving risk landscape and how approaches to managing risk can differ from value protection vs value creation and a human-led vs tech-powered mindset.

The final results of the survey are based on 3,910 responses from business and risk management leaders (CEO, board, risk management, operations, technology, finance, audit) across 67 territories providing their views on the status and direction of risk in their organisation. 163 Indian organisations were a part of this survey.

Contact us