Download the article

Insurance and reinsurance companies have globally experienced accelerated transformation by adopting emerging technologies. In India, insurance companies have often repositioned themselves in the broader economic fabric as stabilisers of business, markets and societies during economic upheavals.

Despite the challenges due to the COVID-19 pandemic, climate crisis and the Russia-Ukraine conflict, the Indian insurance industry, the 10th largest in the world, has grown at a robust rate of 10.3% in FY 2022 compared to the muted growth rate of 7.9% in the previous year.1 Its agility in embracing digitisation across operations and distribution, and robust risk management fundamentals with the overarching principle of placing customers first have reinforced the resilient nature of the Indian insurance industry.

While the Indian insurance industry continues to grow year-on-year on the back of varied factors, the life insurance market penetration remains at 3.2%2 as of 2021 due to increasing protection deficit and limited distribution reach, among other reasons. Alongside, insurers are often perceived as a market stabiliser, and there remains a probability of future shocks on account of current and emerging trends in business, technology, regulatory landscape and policies. Our article scans these factors before weighing in on the CEO’s agenda.

A resilient and fit-for-future India insurance industry

The insurance industry has been globally acknowledged as a key stakeholder in restoring financial stability during uncertain times. As of March 2022, the total investment by Indian insurance carriers amounted to more than USD 700 billion.3

Insurance companies are one of the major contributors in strengthening capital markets by channelising a significant proportion of their investment (> 50%) in the debt and equity market. Given the sheer size of its investment in the economy, the insurance industry plays a crucial part as a stabiliser of market sentiments during a crisis.

Top 20 largest insurance markets by premium volumes, 2021

Source: Swiss Re Sigma Reports, Various Issues

Therefore, the insurance sector is perceived as an important contributor in reducing economic costs by providing further resilience in disaster risk reduction. The government of India recently formed a working group to develop a parametric solution for livelihood protection. These solutions could help mitigate losses by providing a safety net for businesses and individuals impacted by global and regional disasters and help them to recover quickly and reduce the overall impact of the disaster on the economy. It will also work towards reinforcing the customers’ trust in the insurance sector.

In FY 2023, general insurance and life insurance markets have continued to progress on the path to recovery after the COVID-19 pandemic by growing at 16% and 18% respectively in comparison to the previous year.4 The insurance industry is expected to grow at a higher rate in India over the next decade. The near-term improvement in market penetration and growth have been fuelled by easing of regulatory policies, fast-paced digitisation efforts by industry players and increased awareness among customers.

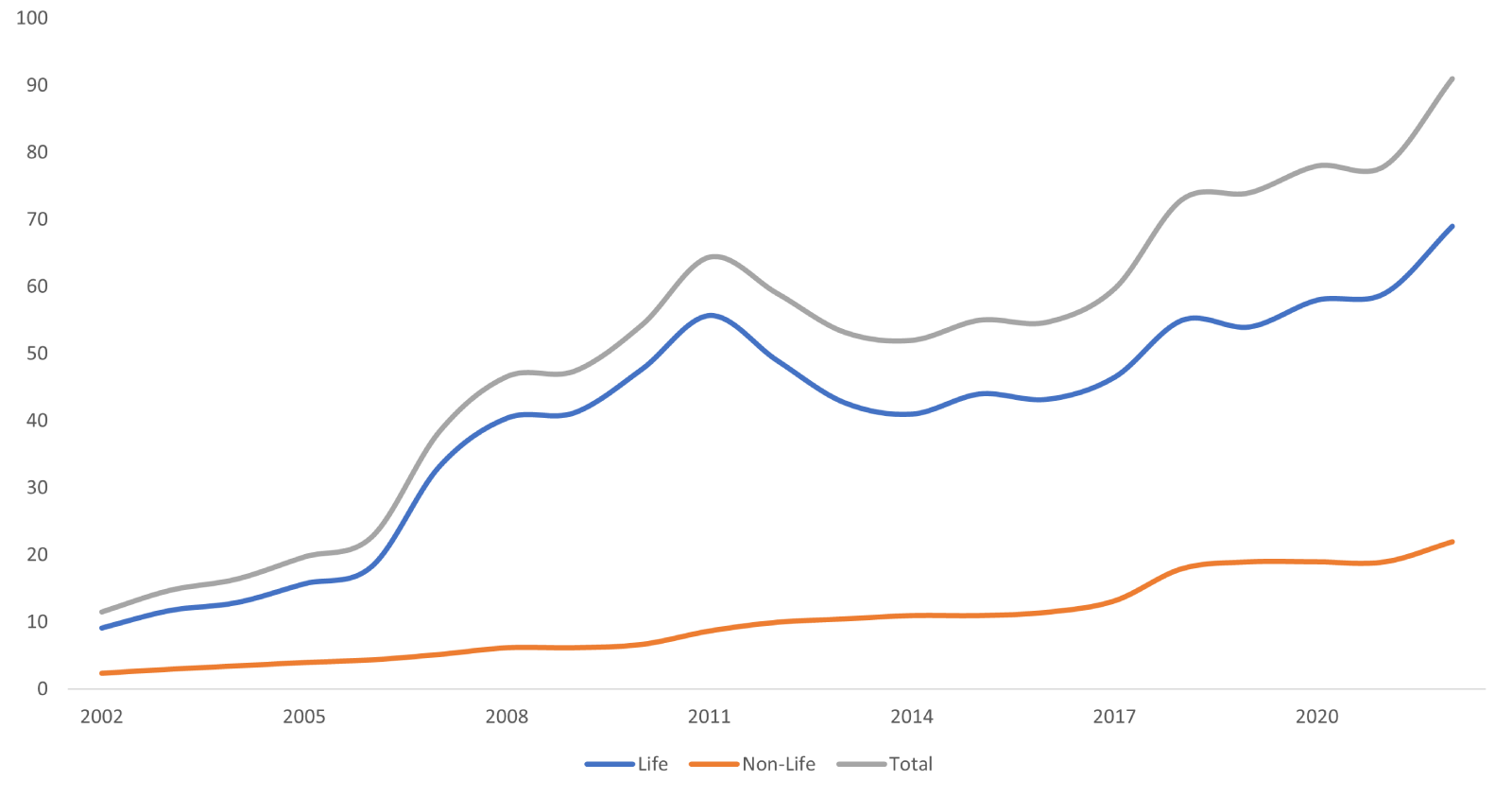

Insurance penetration and density in India

Insurance penetration

Insurance density (in USD)

Source: Swiss Re Sigma Reports, Various Issues

Despite the positive impetus, the protection gap in India continues to widen, which poses a challenge and brings an opportunity for the industry.5 As of FY 2020, only 18% of the eligible population subscribed to pure retail term offerings and the protection penetration (basis sum assured) was at 12% (approx.).6 This protection gap is expected to grow further at 4% per annum.7 As per Swiss Re Institute estimates, the mortality protection gap in India alone stood at USD 40.4 billion (in premium equivalent terms) at the end of 2021.8 Recognising the need for new protection products that will address evolving risks, accompanied by the recent wave of market entrants with digital-first operating models, increase in reach and ease of doing business through technology interventions, and the overall focus of the Government on driving financial inclusion through far reaching insurance schemes are expected to gradually decrease the protection gap in India.

Over the years, insurance carriers have been adopting several self-initiated and regulator mandated reforms in their operational processes that place the customer at the centre of the insurance ecosystem. Simplification of policy wording and standardisation of terminology, ease of getting serviced by the carrier, hassle-free claims intimation and processing are some of the key interventions which have led to an improvement in the customer’s experience with respect to their insurance policies. Claims experience is the single most important factor which determines whether the customer will continue with the same carrier or not. Today, claims settlement ratios across life insurance, general insurance and health insurance elicit greater faith among customers who trust that their interests will be protected.

Insurance claims settlement ratios in India across life, general and health insurance sectors

LI claims settlement (individual)

Health insurance claims settlement

Source: IRDAI annual reports and publications

Key growth drivers of the India insurance industry

The global insurance sector is transforming at a rapid pace. Innovative product offerings, frictionless purchase and service journeys, technology-enabled risk assessment and processing of claims are changing the way carriers interact with their customers. Given below are the key drivers of growth and evolution in the Indian insurance sector:

India has 57 insurance companies, including 24 life insurers and 33 non-life insurers .9 The Insurance Regulatory and Development Authority of India (IRDAI) awarded two new insurance licenses earlier this year and plans to issue 20 new insurance licenses in 2023.10 The existing insurance companies have stood the test of time, and many have managed to profitably list their businesses due to their sustained growth, robust distribution networks and customers’ trust in the brand. Newcomers, however, will need to tap into the uninsured and under-addressed segment through innovative offerings, focused channels and a digital first outreach.

With the increase in new age risks and growing protection gap, two distinct trends have emerged in the Indian insurance market. First, the IRDAI is encouraging the standardisation of existing protection products such as life cover under Saral Jeevan Bima or health cover under Arogya Sanjeevani insurance product to simplify the purchase experience for customers and increase insurance penetration. Second, with the introduction of the ‘use and file’ procedure, insurance companies are looking at launching products with increased speed to market without the regulator’s prior approval and exploring innovative product offerings to cover the expanding risk landscape and insurance needs emerging from changing lifestyles. New age insurance covers such as cyber insurance, electric vehicle (EV) insurance, climate risk insurance, bite-size/sachet insurance (e.g. mobile insurance, disease specific covers), pay-as-you-drive cover and other subscription-based covers will soon form an integral part of the overall insurance market.

Traditional channels continue to be the dominant players and new regulations regarding corporate agency tie-ups between banks and insurers, and relaxation of commission pay-out norms will further bolster these distribution channels. However, with more than 700 million active internet users pan-India, including nearly 425 million users in rural India at the beginning of 2023,11 the future of distribution channels may change. Digital channels, ecommerce platforms and online ecosystems are expected to be the preferred distribution model ensuring greater reach and connection in remote areas and promoting ease of business for the customers.

Contribution of various distribution channels to insurance sub-sectors (new business)

Channel mix by insurance sector

Source: IRDAI Annual Reports and Publications

Several schemes such as Pradhan Mantri Jeevan Jyoti Bima Yojana for life insurance cover and health insurance schemes such as Pradhan Mantri Suraksha Bima Yojana, Rashtriya Swasthya Bima Yojana, Pradhan Mantri Jan Arogya Yojana – Ayushman Bharat, Aam Aadmi Bima Yojana, and Central Government Health Scheme, are ensuring insurance coverage to the marginalised sections of society. Ayushman Bharat alone aims to provide INR 5,00,000 health cover to approximately 107.4 million families which amounts to 500 million beneficiaries. As many as 237.3 million Ayushman cards have been issued till March 2023 in a span of 4.5 years. More than 38 million treatments worth a massive USD 5.49 billion have been provided across the Indian network of 28,000 PMJAY-empanelled hospitals. 12

Another marquee scheme, Pradhan Mantri Fasal Bima Yojana, was launched in 2016. The crop insurance scheme received around 67 million farmer applications and covered 25 million hectares of farmland in 2022.13 As of March 2023, the volume of claims paid out under the scheme stood at INR 1.32 lakh crore.14 These schemes have helped reduce the protection gap in rural areas, where insurance penetration has historically been low.

The pace of technology adoption has accelerated exponentially. Insurers have adopted robotic automation platform (RAP), artificial intelligence (AI), cloud and data analytics, application programming interface integration and developed online platforms and mobile apps to transform front-end and back-end operations across distribution, servicing, claims and product development. Carriers are gravitating towards analytics-driven customer-centric processes to draw in and engage with their targeted customer profile. AI-driven analytics has already made it possible for insurers to offer hyper-personalised products, pricing and product life cycle journeys to their customers. Furthermore, omnichannel servicing is becoming the norm, as customers increasingly expect seamless interactions with the insurers through multiple channels.

Technology has also enhanced transparency and facilitated ease of product research, insurance purchase, claims intimation and processing, and providing information on policy inclusions/exclusions. This has helped in increasing the trust of the customers in insurance providers.

Embedded insurance, though not yet a significant portion of the market, is expected to become increasingly prevalent in the coming years. Digital ecosystems including digital payment apps, ecommerce players, third party application providers and e-tailers will emerge as the primary models driving the penetration of embedded insurance.

Increased use of technology where personal and financial data of customers is collected and stored by service providers at every touch point is a prominent aspect of businesses today. In recent times, several organisations in India faced an average of 2,108 cyber-attacks per week in the first quarter of 2023.15 Insurers have recognised this risk and are now focusing on cybersecurity threats and ways to counter them. This segment is expected to grow significantly large in the near future as corporates and individuals become conscious of and seek protection against growing cyber threats.

Climate risk has been identified as one of the major disruptors for businesses and individuals alike. Climate risk insurance covers a variety of risks from loss of income to indemnification of damages caused due to natural disasters. The IRDAI has set up a panel to develop parametric insurance16 in an attempt to address this requirement. Insurers are also looking at offering lifestyle-driven, personalised covers such as pet insurance, shared property insurance among flat mates, nomad insurance for travellers who are on a career break and mental health cover for millennials.

Several initiatives have been undertaken by the IRDAI to create the right environment for carriers to cater to the changing market demands. Relaxation of regulations for companies which are registering for insurance license is expected to encourage even smaller players to enter the market. Launch of the ‘use and file’ procedure and ‘regulatory sandbox’ will spur product innovation and faster go-to-market for new offerings. Recent regulations on handling ‘expenses of management’ and commissioning obligations that include an increase in allowances for rural/government schemes and InsurTech expenses will provide the requisite financial incentives to insurance carriers to increase their focus on the rural market and transition to leaner tech-led operations.

Another regulatory initiative in the offing is the risk-based capital (RBC) regime. Considering the severe financial stress that the pandemic had placed on liquidity and capital adequacy of insurance carriers, the IRDAI has renewed the focus on introducing RBC norms in the Indian insurance industry. RBC will ensure that insurers have a sound financial position and hold adequate levels of capital to be better equipped to withstand large risks and reduce the impact of social and economic disruptions.

Additionally, the IRDAI is planning the launch of Bima Sugam, an online portal which will be a one-stop shop for all insurance-related queries, policy purchase, claim settlement and insurance advice.

Making rural inroads

At least 65% of India’s population reside in rural areas.17 As per reports, currently less than 10% of people in rural India have life insurance coverage while less than 20% of the rural population have health insurance cover. Apart from government schemes which cater to rural demographics, the life insurance industry also underwrote 6.5 million policies in FY 2022 in the rural sector.18 General insurers and standalone health insurers underwrote a premium of INR 283 billion and INR 33 billion respectively in the rural sector for the same period.19 This is primarily driven by regulatory mandates issued by the IRDAI to drive an inclusive agenda in the insurance sector.

One of the key challenges faced by private sector insurance carriers operating in this market is the cost of distribution and servicing vis-à-vis the average revenue per capita. Changes in the last decade in terms of the reach of the telecom sector in rural areas, exponential growth in smartphone and internet users accompanied by the increased coverage of microfinance institutions in these markets are expected to increase the accessibility of the rural customer and reduce the cost of distribution, thus making the rural segment more attractive for insurance players.

So far, the government has played a pivotal role in introducing and disseminating insurance among the rural demography. Increase in rural insurance penetration has essentially been led by various government schemes. In addition to local media campaigns, the government has extensively used the internet-enabled common services centre network for spreading awareness and connecting rural areas to urban India.

The IRDAI’s Bima Vahak initiative aims to support women entrepreneurs in remote areas of the country to create awareness and build the trust of the customers in insurance products. Bima Vistaar, a committee to develop an affordable, accessible, and comprehensive cover for the rural population on a benefit based/parametric structure, is another attempt by the IRDAI to drive rural inclusion.

With time, it is expected that carriers will increasingly adopt technology solutions such as the use of drones and image recognition in crop insurance, AI-led, real-time risk assessment for health and life insurance underwriting, digital self-service journeys for claims intimation and processing to drive low-cost, automated operations and customised offerings in rural markets. Leveraging technology and digital solutions will be integral for making inroads in the rural insurance market in the coming years.

The insurance watch list – CEO’s agenda

CEOs of Indian insurance carriers are cognisant of the dynamic nature of the market they are operating in and know that they have to be adequately equipped to handle future shocks. Continuous transformation could provide the agility and resilience to overcome disruptions and mindful transformation backed by a carefully defined strategy to monetise investments in technology, develop innovative products and build next-gen customer-friendly processes will ensure profitable growth and market leadership.

Some aspects which the C-suite of an insurance company should consider are:

- hyper-personalisation of product offerings and customer journeys delivered through automation, AI and data analytics

- enhanced customer experience and penetration across urban and rural markets through frictionless purchase, servicing and claims journeys

- hyperconnectivity amidst a changing distribution ecosystem

- seizing opportunities presented by new-age risks and lifestyle-based insurance needs through innovative insurance covers.

Key imperatives for insurance leaders

- Keeping customer experience at the front and centre

- Using technology as an enabler of growth

- Adopting digital-first, leaner operations

- Focusing on risk assessment and product innovation

Keeping customer experience at the front and centre

With hyper-personalisation moving to the centre stage, insurance leaders will need to empathise and understand the target customer behaviour and invest in solutions which help deliver personalised experiences that meet specific lifestyle and behaviour-based customer requirements. For starters, insurance carriers need to leverage master data management, deep data analytics and data sciences to garner insights on the customers and translate them into personalised offerings and tailor-made experiences for them.

CEOs need to look at developing an omnichannel strategy, enabling interoperability among digital assets, and providing access to real time data to transform the customer service experience and improve brand loyalty.

Using technology as an enabler of growth

Cloud technology enables big data analysis and real-time insights, supports partner and customer apps and delivers an omnichannel experience for internal and external end users. Businesses can also consider using generative AI to deliver greater transparency and first time right (FTR) experiences in the areas of customer service, policy information dissemination and claims interactions.

Predictive AI and machine learning (ML) models are helping insurers to avoid adverse selection, implement continuous fraud detection and carry out remote claims assessment, thereby improving the customers’ insurance experience through faster processing and hassle-free settlements. Drone technology coupled with AI is helping insurers bring down the cost of underwriting crop and climate insurance and in seamlessly conducting surveys and loss assessment in calamity-stricken geographies. AI and behavioural analytics are enabling carriers to conduct hyper-personalised interactions with the customers and provide solutions which are most suitable to their needs. Every little convenience such as the preferred time to call, mode of payment, customised product nudges on life cycle milestones can now be provided to customers for increased responsiveness and customer stickiness.

Adopting digital-first, leaner operations

The next wave of growth in the market is anticipated through digital penetration of urban and rural markets. Leaders must adopt a digital-first approach in all customer and partner interactions to enhance ease of business. Digitisation and automation of the mid and back-office in conjunction with the front-end user interface will be crucial to draw out the benefits of a digital first strategy for improved customer experience (CX), leaner operations, lower cost per transaction, lower turnaround time and faster go-to-market.

Online ecosystems, the India Stack and API integration of various platforms for payment and ecommerce present new opportunities for leveraging rich data sources and enabling carriers to reach remote areas through hyper-connectivity.

Focusing on risk assessment and product innovation

With increasing pressure to offer products that align with digital adoption, altering lifestyles, changing buying behaviour and dramatically evolving risks, insurance carriers will need to adopt alternate pricing techniques and principles of RBC to cater to such demands. Building risk assessment capabilities to decipher the nature and quantify the impact of new-age risks will be imperative and big data analytics and AI will play a huge role in understanding and mitigating such risks.

The CXOs then have their work cut out for them. The time is now to factor in technological innovation as a means to an end, rather than an end in itself. Harnessing technology can act as a great lever for the insurance industry to reach out to potential customers with hyper-personalised products via robust distribution channels. Insurance leaders who want to enter digital marketplaces will need to invest in strong partnerships, alliances and integrated infrastructure. A clear vision and strategic mission coupled with intent-driven execution can help companies stay ahead of the curve and eventually transform the insurance landscape.

Author introductions:

Amit Roy is Partner, Insurance and Allied Businesses

Nitin Jain is Partner, Management Consulting

Also contributing to this article were Pragya Shree, Anuja Malvi and Vishnupriya Sengupta

Contact us