{{item.title}}

{{item.text}}

{{item.text}}

PwC’s Global Economic Crime and Fraud Survey (GECS) 2022 surveyed 1,296 organisations across the world, out of which 112 were from India and represented 32 diverse industries. An overwhelming 76% of the respondents from India sit in the C-suite. The India survey covered both small and large organisations.

76% respondents sit in the C-suite

Companies in India have been undertaking measures to combat fraud for several years now. The good news is that their fraud prevention measures are working — 52% of Indian organisations experienced some form of fraud or other economic crime within the last 24 months, as opposed to 69% in our 2020 survey.

52% of Indian organisations experienced some form of fraud or other economic crime within the last 24 months.

External perpetrator

Internal perpetrator

Collusion between internal and external actors

Following the outbreak of the COVID-19 pandemic, organisations faced a huge amount of uncertainty, and a majority of them shifted to digital operations in order to minimise disruption. With employees working from home, companies were exposed to new risks related to digital security, employee safety and disinformation, and this in turn led to new incidents of fraud.

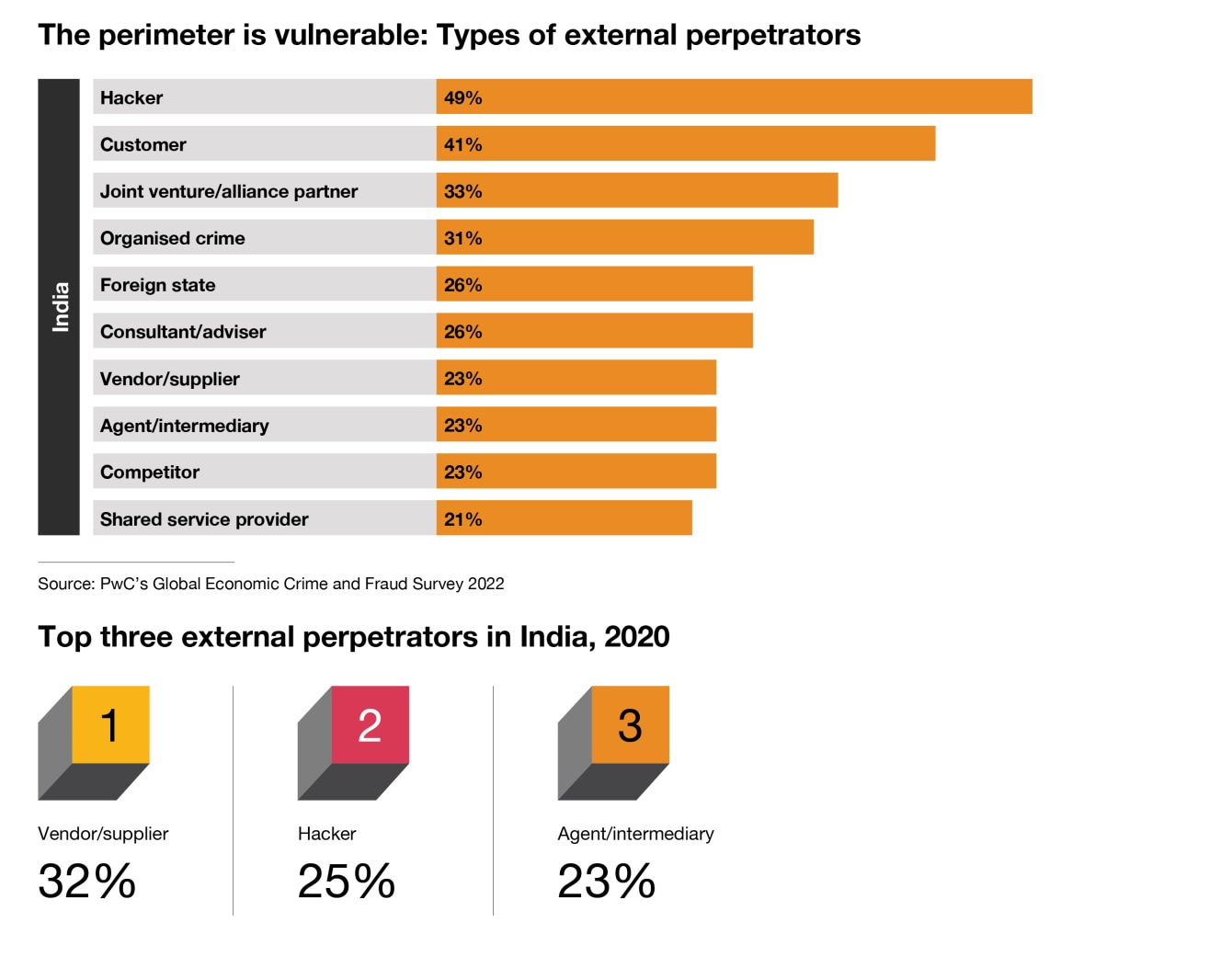

Nearly 67% of organisations in India that experienced fraud reported that the most disruptive incident came via an external attack or collusion between external and internal sources. This proportion was 56% in our 2020 survey. External fraudsters are immune to traditional fraud prevention tools, such as codes of conduct, training and investigation. Among the external perpetrators of fraud, 49% were hackers, 41% were customers and about 31% involved organised crime.

An overwhelming 95% of companies that encountered fraud in India experienced new types of fraud as a result of the disruption caused by COVID-19.

The pandemic saw a rise in new impactful threats. Misconduct was the biggest challenge faced by organisations as bad actors began collaborating and taking advantage of pandemic-related uncertainty and volatility.

Amongst Indian organisations that reported fraud in the last 24 months, conduct risk (or risks associated with individuals within the firm, or vendors, agents and customers) was the biggest threat at 90%.

With the rise of digital platforms to perform business operations, platforms have emerged as new fraud frontiers. Platform risks, or risks associated with digital platforms such as social media, services (rideshare, lodging) and e-commerce, have increased substantially. They were reported by 53% of organisations surveyed in India.

Amongst Indian organisations that reported fraud in the last 24 months, platform risks were reported by 53% organisations.

Our 2020 survey had found cybercrime, accounting/financial statement fraud, and bribery and corruption to be the top three frauds in India. Though globally, the findings of this year’s survey are similar to those of GECS 2020, for India, the top frauds have changed significantly. In India, customer fraud (e.g. frauds involving mortgage, credit cards, claims, cheques) was the top fraud reported by 47% of companies. Cybercrime came a close second, with 45% of Indian organisations reporting this type of fraud. Further, know your customer (KYC) failure was experienced by 34% of Indian firms that experienced fraud, corruption or economic/financial crime in the last 24 months.

Indian organisations are facing multiple emerging risks that have the potential to cause greater disruption in the coming years.

12%

of those organisations that encountered fraud in the last 24 months experienced ESG reporting fraud.

9%

of those organisations that encountered fraud in the last 24 months experienced anti-embargo fraud.

19%

of those organisations that encountered fraud in the last 24 months experienced supply chain fraud.

Organisations also experienced increased risk due to customer fraud (30%) and KYC failure (22%) as a result of disruption caused by COVID-19. With an increase in digital banking and payments, KYC fraud is another emerging risk that organisations need to watch out for.

The pandemic created additional vulnerability as organisations accelerated the shift to digital operations. Meanwhile, new fraud risks are emerging and new predators are gaining strength. What, exactly, is the fraud risk that companies face today? Read the full report to learn more.

Identify where opportunities exist for a fraudster to exploit customer-facing products and cause financial, legal or reputational damage.

Good user experience and effective fraud controls are both achievable, through the right combination of fraud technology, strategy and processes.

Consolidate data from disparate, disconnected systems into a centralised platform that can track the end-to-end life cycle of users (fraudsters or not) and generate meaningful alerts.

{{item.text}}

{{item.text}}