SAP Treasury and Risk Management (TRM): Business, finance and technology

Introduction

The market is dynamic, and it is very critical for the management to have a real-time picture of its various finances in order to make faster and effective decisions.

Any company’s main pillar is its finances which mainly comprises treasury and risk management (TRM) and cash and liquidity management. The treasury and risk mitigation process involve the management of cash, investments and other financial assets, and risks, such as hedge management, hedge accounting and exposure management. This process is aimed at maximising short and medium-term stability and making sound financial decisions.

This article discusses the functionalities of the SAP Treasury and Risk Management (TRM) module and provides an overview of a series of solutions that primarily analyse and optimise business processes that are part of the finance function of an organisation.

Why SAP Treasury?

A consolidated treasury system with efficient processes is needed to meet the rising demand for comprehensive real-time financial information.

A wide range of risks and challenges are handled by the treasury every day, e.g. commodity trading, volatility of foreign exchange (FX), market uncertainty and changing regulations. They affect businesses in different sectors of the market in different ways, placing increased pressure on CFOs to stay on top of current and emerging issues. Organisations need to understand the importance of risk management and other factors that impact financial performance.

SAP TRM provides the treasury manager with an instant snapshot of cash effects and enables prompt distribution of cash to the strategic areas and different divisions of the company. At the same time, the manager can acquire cash in times of need from the most competent and inexpensive source. It is an integrated solution that helps in generating cash and simplifying operations. The integrated treasury and cash management process will provide additional benefits to the company’s finance function, leading to more accurate prediction of cash impact on the company. The system also facilitates better organisation and effectiveness of the corporate treasury function and integration with operational and enterprise finance and accounting systems.

SAP TRM helps in reducing the time spent on:

- combining data

- accessing several banking portals

- producing bookkeeping entries

- analysing and solving tough database formulas.

- entering information again

- building important manual reports and dashboards.

With more time available to the treasury team, they can focus on:

- reporting accuracy (e.g. cash forecasting)

- on-time reporting (e.g. finding unused cash at the outset)

- enhancing execution of treasury (e.g. effectiveness of FX hedging programmes).

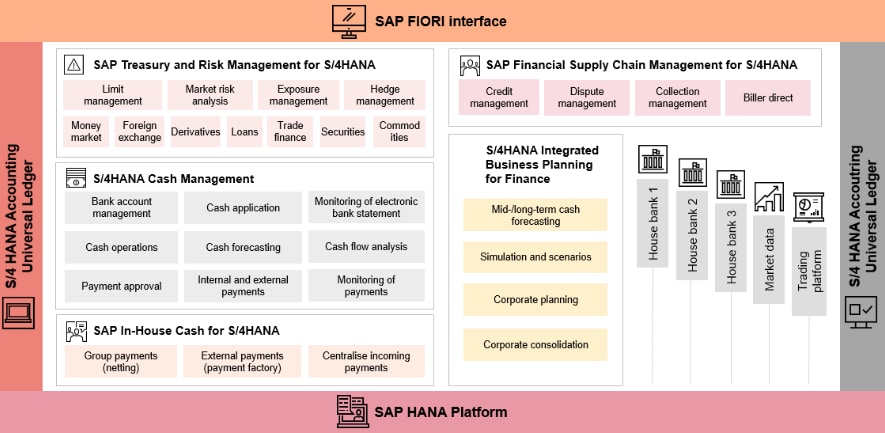

The diverse functionalities of the SAP TRM tool are summarised below:

- money market transactions for short-, mid- and long-term investments and borrowing

- foreign exchange transactions for all types of spot and forward transactions, including swaps, plain vanilla options and many exotic options, through knock-in and knock-out structures and average rate options

- loans covering both bilateral contracts, such as bank loans and syndicated contracts, issuing programmes and facilities

- derivatives covering many types of over-the-counter (OTC) derivatives, such as caps and swaps as well as futures and options dealt on the stock exchange

- securities containing both bonds and stocks (equity), with all types of rights and corporate actions and active, passive and lending position

- different types of commodities with matching of long/short future position and margin management

- trade finance which includes instruments such as letters of credit and bank guarantees.

Components of SAP HANA platform

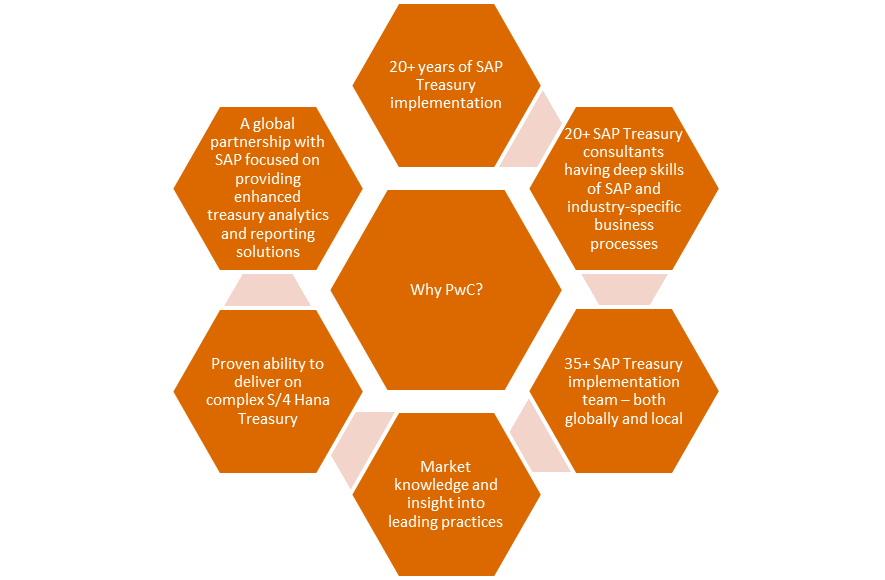

Why PwC for SAP Treasury?

An implementation project is an opportunity for change management, and it is essential that such projects are undertaken by an experienced partner with both technical expertise and business finesse. Our team has extensive experience and competence in implementing the SAP Treasury solution across various sectors and industries.

Client impact

- Client background

- Key challenges

- PwC’s intervention

- Our solution and approach

Client background

The client is a reputed Indian tyre manufacturer with a strong position in the global market. It manufactures more than 15 million tyres every year. It produces a wide range of tyres, and some of the radials are widely used internationally in both B2B and B2C industries.

Key challenges

All the treasury processes of the client were handled manually without much use of technology. The business was heavily dependent on integration between the procurement and treasury teams with respect to the letter of credit (LC) issued and presentation received against it, which was handled over email. Cash MIS report preparation took up major efforts. Records of all loans with the sanctioned amount, drawdown, transfer to sub-accounts, interest payments, repayment dates and instalments, etc., were maintained in Excel, resulting in manual controls. There was no integration with financial accounts and all entries were re-entered in SAP-FI/CO, thereby requiring duplication of data entry, reconciliations, etc. Also, there was no limit management for facility obtained from banks. On balance sheet and off-balance sheet exposure was handled manually for both import and export.

PwC’s intervention

We were engaged to understand the challenges faced by the client and provide solutions that could automate the treasury and integrate it with other finance processes. We proposed SAP TRM as the solution, which comprised mainly of money market instruments (like loans, facility), trade finance, hedge management, etc.

Our solution and approach

We supported the client with its vision of streamlining treasury operations and execution through automation of tracking, monitoring, reporting on various debt and LC trade exposures, and calculation of charges levied by banks as per pre-entered rates. The user-friendly Fiori app is used to forecast liquidity, and the MIS for cash planning has been set up. Hundi transactions are possible without manual intervention to clear the vendor's liability. Cost reservation of PO treasury items is automatically possible with the cost item listed in the PO. Hedge accounting and hedge reporting are managed dynamically on balance sheet and off-balance sheet exposures. The month-end closing process is posted real time in the specific general ledger accounts. Documentation of different positions of financial instruments, cash flows and historical accounts are more reliable and up-to-date. The solution meets crucial requirements for auditing and better security of data due to access control.

- Client background

- Key challenges

- PwC’s intervention

- Our solution and approach

Client background

The client is one of the largest conglomerates operating in the United Arab Emirates comprising various divisions such as automotive, electronics, insurance, services, real estate, retail, industries, and overseas.

Key challenges

There was no automated reporting on country exposures such as cash, investments, loans, contingent liabilities, foreign exchange and interest rate. Visibility into procurement of products and services from financial institutions was not centralised. Further, there was considerable exposure to operational risk due to the high transaction volume spread across multiple geographies and manual operations and controls. Treasury processes across the group were non-standardised and there was a need to bring in best practices and efficiencies (some of the operations and decisions are driven by line of business and relevant geographies).

PwC’s intervention

We were engaged to understand these challenges and provide a solution for automating treasury and presenting a holistic picture of the group treasury. We suggested SAP S/4 HANA TRM 1709 edition and SAP S/4 HANA Cash Management powered by HANA 1709 edition which will help in capturing and providing up-to-date details.

Our solution and approach

We helped the client achieve its vision of streamlining treasury operations and executions through effective automation of financial and country risk management – automated exposure reporting (unit, country, division and group level), better oversight and management of bank procurement, efficient loan and investment management, effective cash and liquidity management, streamlining and standardisation of payment infrastructure, and improved and standardised work processes within the treasury.

Conclusion

We understand your enterprise and aim to provide a one-stop solution for treasury. We have wide-ranging experience, both functional and technical, across sectors and industries in helping organisations manage their treasury function. Our team offers comprehensive strategic and operational support covering the treasury, risk, cash and liquidity functions. Feel free to reach out to us and schedule a face-to-face discussion with one of our team members.