{{item.title}}

{{item.text}}

{{item.text}}

Our introductory post provided an overview of the exciting roles a job aspirant can pursue in the FinTech world. With FinTechs disrupting the traditional financial ecosystem, the innovation story at financial institutions (FIs) has taken an interesting turn. Quite a few FIs have set up dedicated innovation centres of excellence (CoE) and are partnering with FinTechs in full gear to quickly roll out innovative solutions in the market and gain a competitive edge. The second post in our careers series discusses the emerging and dynamic role of an innovation driver at such CoEs.

FIs have traditionally been governed by complex, time-consuming processes and involve multiple levels of decision making. Thus, they have begun to assess ways through which they can become more agile and nimble. On the other hand, FinTechs, which have been able to achieve exponential growth through their innovative solutions, are trying to build strong governance and financial prudence, and minimise financial, operational, and regulatory risks.

The innovation CoE at an FI is uniquely positioned to have the best of the two worlds - namely to drive the innovation story of the FI ahead while adhering to minimum but necessary governance standards and being at arm’s length distance from the day-to-day operations of the bank - or what is typically referred to as business as usual (BAU).

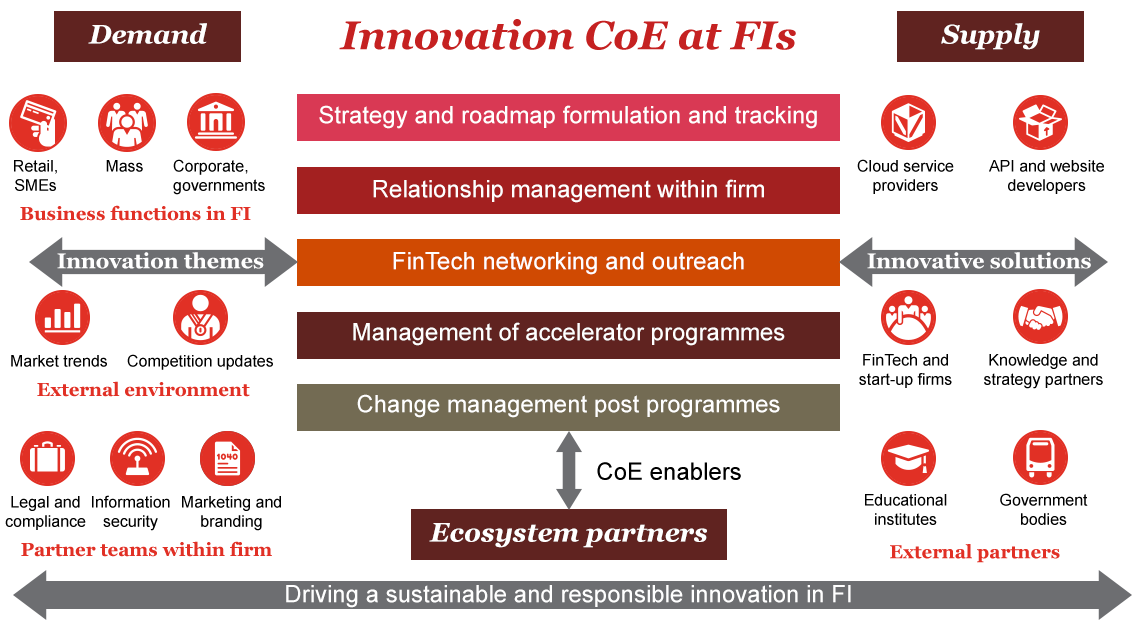

The typical structure and working of an innovation CoE are shown below:

Ecosystem of an FI’s innovation CoE

As depicted, requirements flow in either from business teams or are generated by the competitive external environment. The team collaborates with business and technology stakeholders to transform these requirements into innovation themes which set the tone for the overall working of the centre.

A few of the themes which typically drive innovation at FIs are:

Themes driving innovation at FIs

These constitute the ‘demand’ for innovative solutions. The CoE then collaborates with multiple partners and stakeholders across the FinTech ecosystem to ‘supply’ the solutions, and drive innovation over the short, medium and long term.

The role is a very strategic one from the perspective of the firm and is at the centre of the FI’s growth story. The innovation driver is expected to perform multiple activities.

Thus, along with spearheading accelerator programmes and hackathons, the role entails developing and executing a sustainable and long-term vision and strategy in partnership with knowledge partners and mentors.

The critical success factor of the role is creating a ‘win-win’ situation which is sustainable over the long term for all stakeholders. Businesses should benefit from the roll-out of the innovative solution and FinTechs partnering with the FI should see a significant increase in their visibility in the FinTech space.

A candidate is expected to possess the following skill sets in order to successfully lead innovation at the FI.

Skills sets to successfully drive the innovation CoE

With FI–FinTech partnerships expected to continue to increase, aspirants can target new-age, technology-savvy FIs for exciting roles in their innovation centres.

If there is any specific area that interests you and that you would like us to discuss, do write in to let us know. You can email us or leave a message in the dialogue box.

{{item.text}}

{{item.text}}