Invisible Payments

April 2019

Over the last few years, the digital payments ecosystem has witnessed the introduction of multiple innovative digital payment forms and instruments. Some of the overarching objectives of these have been to boost customers’ convenience and reduce the time spent in completing transactions, among others.

Moreover, the ecosystem has seen the evolution of a transaction type, which is commonly referred to as ‘invisible payments’. Such payments enable consumers to make payments without any manual and explicit intervention at the time they avail services. Consumers are charged for the services they use within the prescribed limit set by them or for using particular services with their prior consent. The figure below traces the forms of invisible payments over a period of time:

The reason people generally prefer cash transactions is because these are convenient. For digital payments, they need to enter their credentials and authenticate these, which takes time. Invisible payments specifically aim to address this issue.

Key benefits of invisible payments

- Reduction in value-draining waiting time: There has been significant emphasis on the Quick checkout solution at various touchpoints, where consumers do not need to wait in queues to make explicit payments. These payments are usually completed within microseconds, unlike in the case of transactions made by using other payment instruments, which require a few seconds. This substantially enhances the customer’s experience.

- Ease of use: Increased adoption of the digital payment option results in a reduction in the number of issues encountered while making financial transactions. Invisible payments eliminate ‘manual intervention’, both for the payer and the merchant, entail automated payment and result in ‘zero human error’.

- Large-scale applicability: Multiple-use cases can be tapped online as well as offline to enable invisible payments. This contributes further to overall adoption of digital payments in the country.

- Cost optimisation and value enhancement: Transactions made by using the digital payment mode significantly reduce the time personnel at checkout counters spend in processing payments. The time thus saved can help them focus on more value-added activities and enhanced customer relationship management.

Major use cases

A prolonged checkout time and heavy manual intervention are some of the major problems faced in processing payments at offline touchpoints.

This has resulted in the last few years seeing a number of initiatives related to invisible payments across sectors. These are at various stages of being rolled out and provide interesting insights on how the invisible payment segment is likely to evolve in the future.

Retail segment

This segment has perhaps seen the largest number of innovations in online as well as the offline space. The following are some of these:

1. An online retailer has launched an unmanned store in Indonesia and has taken the cashier- free check-out concept to the next level beyond QR code scanning. For instance, a customer walks in, scans his or her device and is authenticated through face recognition. The customer picks up items, which have RFID tags attached to them, from the shelves. High- definition cameras and Artificial Intelligence (AI) recognise the person at the time of checkout and link his or her profile with the items purchased. The linked wallet account is automatically deducted. In some closed loop implementations, IoT sensors are used to identify customers during checkout.

2. Another use case is online ordering. A large electronics player has rolled out smart refrigerators in which built-in cameras monitor the quantity of items stored in them, and alerts users when their level decreases below a certain threshold. The user can then order through an interactive dashboard. In another innovation, an e-commerce giant helps users order groceries for several months at one go, as in the case of a subscription, and win attractive cashbacks.

Toll and transit

In Dubai, an electronic road toll collection system, based on radio-frequency identification (RFID), has been implemented on a large scale. This has completely eliminated the need to stop vehicles. These are passive RFID tags that are unique for every vehicle. They do not require a battery and rely on storing and remotely retrieving data in the vicinity through radio waves. This feature is being tried out in the smart parking space as well, whereby shoppers can zip past the parking gates and their accounts get debited automatically.

Restaurants

Restaurants and food outlets are continuously trying to delight customers through innovations beyond their food menus by providing them a seamless payment experience. In China, one of the largest mobile wallet players has partnered with a leading global food chain. Customers can now simply ‘pay with a smile’ and their bills are automatically paid from their linked account.

A FinTech company has rolled out ‘zero click travel insurance’. Based on the geographical location of a mobile phone, insurance cover for the particular country is activated automatically. Once the traveler has left the country, the insurance automatically expires. Other instances of ‘contextual insurance’ include flight insurance, wherein the payout is automatic when the event, such as a delayed flight or person reaching the airport late are triggered. Another use case is ‘automatic application of loyalty points’. At the time of checkout at an offline touchpoint, the mobile application automatically selects the loyalty points or promo code and applies these instantly. There is no need for a customer to search for available promo codes or any other option.

Key considerations for mass adoption

One of the principal enablers of the success of a payment instrument is its cost-effective implementation on a mass scale. To extract the maximum benefits from implementation of invisible payments across use cases in online and offline touchpoints, it is critical to consider the following aspects:

- Uniform standards

- Customer awareness and adequate disclosures

- Redressal mechanism

- Data security and privacy

- Strategic partnerships

Uniform standards

We have seen implementation of invisible payments, using proprietary technology and standards, which are applicable for specific customer segments. This approach is in contrast to the efforts of the Government to promote a seamless and interoperable ecosystem. It is therefore critical for regulatory bodies to define common standards for implementation of such systems. Standards already defined for National Common Mobility Card (NCMC) and Unified Payments Interface (UPI) can be leveraged to achieve this. Guidelines can also be defined for the integration of such systems with new age technologies including Internet of Things (IoT).

Customer awareness and adequate disclosures

Invisible payments may lead to impulse buying Customers may be left unaware about prices charged for services availed until they receive notifications. This may result in disputes with customers and efforts to promote adoption of digital payments may be adversely affected. Hence clear communication to the customer about the service, the way it operates, the transaction flow and pricing is critical. Moreover, the customer should be able to cancel the service at any point in time.

Also invisible payments should not be the only payment mode, and the customer should be able to avail other modes of payments as well.

Redressal mechanism

In line with the previous two points, it is critical to clearly define the framework, accountability and responsibility of all the participants. Clear guidelines related to dispute management, chargebacks, transaction reversal and voiding, among others are critical. This will help to boost customers’ confidence in such initiatives. Furthermore, there should be guidelines relating to the underlying technology, investments, requirements of availability, Disaster Recovery (DR), Business Continuity Planning (BCP), etc.

Data security and privacy

Customers’ data protection through robust security mechanisms has gained significant importance in the wake of breaches across the world. Security and authentication are even more critical for invisible payments, in view of the nature of their construct. Breach of a person’s digital identity, theft of mobile devices, sip swap or compromise of biometric credentials may lead to fraudulent transactions. Therefore, the RBI needs to define guidelines for such forms of payments. Efforts can also be made to augment security by detecting fraudulent transactions based on behavioral analytics, analysis of usage pattern and velocity-related checks.

Strategic partnerships

If implemented right, invisible payments can bring about significant innovation and transform the customer experience across real use cases. Strategic partnerships with payment companies, FinTech players and merchants can drive innovations. Moreover, invisible payments can generate a large number of data points. Customer behavior can be analysed to offer customised offerings.

Way forward

One of the areas where digital payments have trailed behind cash payments is the convenience in paying by cash and its uniform availability. This is particularly evident in high-volume and low-value transactions in the offline space in developing countries such as India

Invisible payments have the potential to penetrate significantly in this ticket size and if implemented well, can provide an experience that is better than current popular ‘tap and go’ payments. Seamless checkout, with a limited transaction size, can enable a positive tradeoff with the convenience and security offered by invisible payments. Invisible payment can also be considered a lever to boost an omni-channel experience, wherein seamless and uniform checkout is enabled across all online and offline touchpoints. However, special attention is needed for the implementation of a robust, scalable, secure and interoperable ecosystem, which addresses real pain-points and does not only entail closed loop experimentation.

Although mass scale implementation of invisible payments may take some time in India, we foresee their adoption in some use cases, where there is a scope to solve real ‘pain points’, in the near future. For instance, they can address the issue of long checkout counters at retail stores. The initial target customer segment could be shoppers who regularly use digital payment modes to shop at organized retail stores. Retail stores, acquiring banks, payment processors and store infrastructure companies therefore need to clearly define the use cases and customers’ journeys, quantify the benefits of shortened queues vis-à-vis the risk of losses due to shoplifting and put the necessary controls in place.

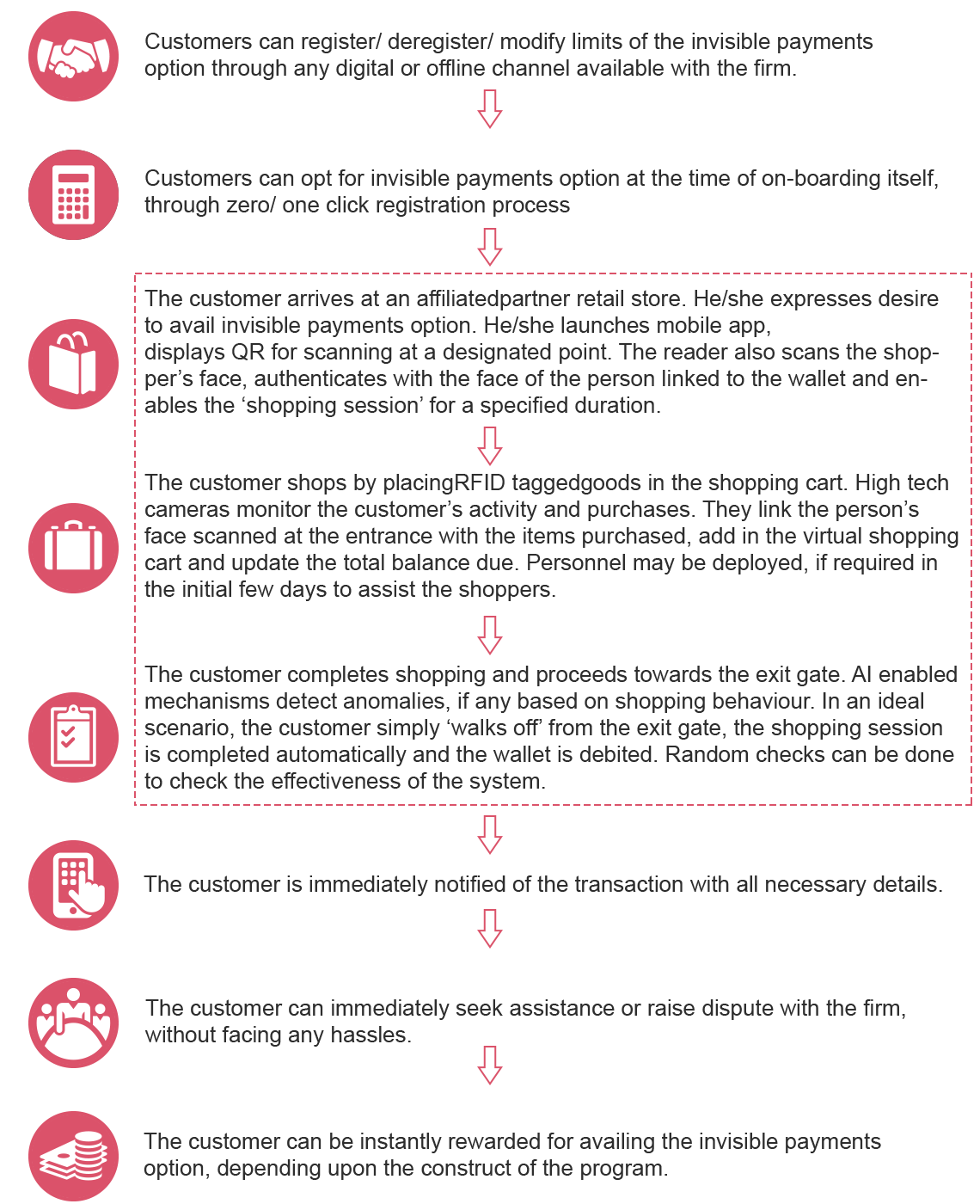

Let’s illustrate a sample end to the end customer journey.

Initially it can be launched for a select few customers in a restricted environment. Based on adoption and learning, the scope can be expanded.

Other areas could relate to toll and transit modes, whereby seamless movement can be facilitated over NCMC rails for transit and Electronic Toll Collection (ETC) for toll.

To encourage their usage, such initiatives can also be linked to reward programmes and provide customers with real-time notifications about offers. This can significantly boost their experience while availing the option of making invisible payments, and subsequently pave the way for addressing pain-points in other areas.

Payment technology updates

The next evolution in commerce: Invisible payments

Consumers’ adoption of mobile payments has lagged behind analysts’ projections in the US. A survey conducted by the Board of Governors of the Federal Reserve System in March 2013 found that only 15% of the respondents had made mobile payments.

MasterCard: Invisible Payments Power Mobility as a Service

In a recent discussion with Karen Webster, Will Judge, head of Urban Mobility at MasterCard, explained MasterCard’s view of the Mobility as a Service concept, why it will become integral to the smart city of the future and how MasterCard is lining up its pieces to become a pioneer in this emerging space.

Towards an invisible payments world

Tech companies need to take a closer look at the budding trend of invisible payments to simplify the consumer journey.

‘Invisible payments’ will have more than a token appearance

Convenience has long been the driver of innovation in payments. As customers crave greater ease in the ways in which they pay, the industry has responded with fast, easy, secure and seamless payment options.

Spanish bank BBVA to test invisible payments at ‘Ciudad BBVA’

According to Spanish bank BBVA, it will test its invisible payment strategy in house, and enable its employees to use an app to pay for purchases without taking out their wallets.

With input from Shekhar Lele, Viraj Dharia, Aditya Gumma, Pooja Lad and Jaya Gupta

Sources

- The Indian Express. (6 September 2018). Watasale, India’s first autonomous retail store. Retrieved from (last accessed on 22 April 2019)

- Khaleej Times. (6 February 2018). All you need to know about Salik in Dubai. Retrieved from (last accessed on 22 April 2019)

- pymnts.com. (16 April 2019). Building The ‘What’ Of Credit Card Rewards Around The ‘How’ Of Delivery. Retrieved from (last accessed on 22 April 2019)

- How Alibaba leads with innovation in Transaction & Payment Technology. Retrieved from. Last accessed on 22 April 2019

- Techinasia.com. (2 August 2018). Jakarta welcomes JD’s first unmanned store outside of China. Retrieved from (last accessed on 22 April 2019)

- gomedici.com. (20 March 2019). Future of Payments Will Be Largely Invisible With Connected Devices. Retrieved from (last accessed on 22 April 2019)

- Techinasia (August 2018). Jakarta welcomes JD’s first unmanned store outside of China. Retrieved from. (last accessed on 22 April 2019)