Withholding Tax Manager

Managing withholding tax can be time-consuming and tedious in today’s complex business scenario. Therefore, we have created the Withholding Tax Manager, a one-stop solution that addresses all withholding tax-related compliance requirements and generates actionable insights for quick decision-making.

Leveraging our strong business understanding of the tax function and our commitment to solving related problems with advanced technology, this solution will make your withholding tax function smarter, digital and more efficient.

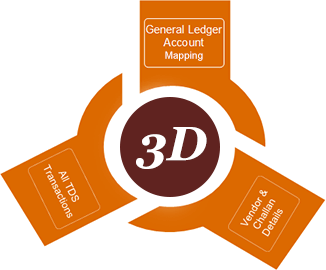

The integrated data covers three facets:

We can enhance your withholding tax function by:

Balancing tight controls and efficiency

Contributing to your business strategy by generating insights

Delivering impactful and focused reports - just the way the regulators like them!

Helping your organisation become audit-ready

Why this tool?

- Provides a ready output for the monthly, quarterly and Clause 34 reconciliation of the Tax Audit Report.

- Traces the financial statement expense line items to its TDS data points (date of payments, reasons for non-deduction, etc.) and vice versa.

- Improves accuracy in applying tax rates and sections using machine learning.

- Helps higher management in re-evaluating their existing control mechanics by examining the applied withholding tax rates.

- Generates insightful analytical reports and dashboards to assist clients in their decision-making.

Key features

Other features