{{item.title}}

{{item.text}}

{{item.text}}

If you’ve found yourself thinking about these questions or similar ones, PwC India’s M&A consulting can help.

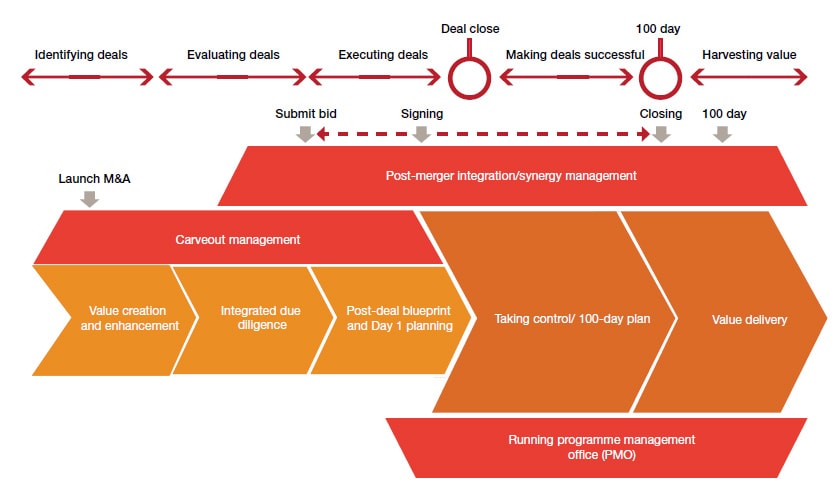

Doing deals is challenging. The large majority of deals fail to achieve their original financial or strategic objectives, with many companies being ill-prepared for the speed and intensity of the deal process. The experience and expertise we can offer through all stages of the deal continuum along with our value creation mind-set at the heart of all M&A and divestiture activities, will help you realise an advantage in this challenging deal environment

Corporate and private equity buyers or sellers need to effectively understand the main business drivers, the areas of upside opportunity and the pitfalls to deliver value from transactions.

At PwC, we offer end-to-end transaction advice and support, helping your business identify, quantify and deliver full deal value, with greater speed, insight and confidence. Right from M&A integration consulting to post merger integration and post deal performance improvement, PwC India is your one stop solution.

If you’ve found yourself thinking about these questions or similar ones, PwC India’s M&A consulting can help.

Delivering deal value continues to be challenging, even in today’s dynamic deal environment. The most experienced deal makers say they know what to do, but success is getting harder to come by. Deal success remains all about execution. A strategic and tailored approach to integration will ensure that your deal delivers its full potential. By setting clearly defined objectives and targets that focus explicitly on value delivery, we maximise the value of your deal while reducing the risks involved in post-close value capture activities.

PwC can support you in integration management as well as extend functional expertise for specific interventions based on requirement.

Here’s how we can help:

Whether divesting part of your business or targeting a disposal, our carve-out process offers the opportunity to challenge and optimize the carve-out entity's operating model. Our services are geared to making sure the carve-out is as smooth and value-enhancing as possible. We understand the costs, practicalities and potential risks of operational separation. We understand both seller and buyer perspectives and their impact on value which can maximize your ability to deliver deal value.

Here’s how we can help:

Failure to assess the full potential for operational savings and efficiency improvements could leave significant amounts of untapped value on the table. We can help you to identify, quantify and prioritize this value and work with you to then develop and execute plans for realizing it. Our team works with corporate and private equity clients to assess potential merger synergies, standalone performance improvement opportunities or key operational risks, on both the buy and sell side of M&A transactions.

Here’s how we can help:

In many ways, one of the most important parts of a deal is its completion because this is where the deal’s benefits and value need to be realized. Too often, though, deals fail to deliver – frequently because of the lack of integration and often because the savings and operational alignment aren’t pursued quickly and decisively enough or are too vague or unrealistic to be realised. Put directly, to make a deal work, considerable resources are needed.

We bring a practical, well-defined and fast-paced approach to developing and executing operational improvement plans for the new business, underpinned by clearly quantifiable targets.

Here’s how we can help:

{{item.text}}

{{item.text}}