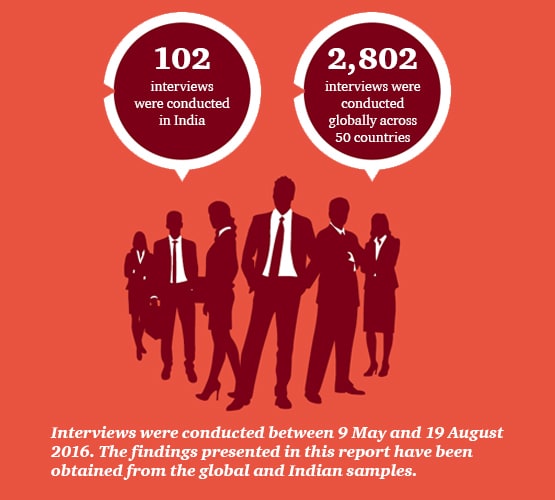

Every two years, PwC carries out a Global Family Business Survey. This year, we spoke to 2,802 family leaders across 50 countries. In India, we spoke to 102 family business leaders. We also bring you some comments shared by business leaders—their stories, outlook and apprehensions.

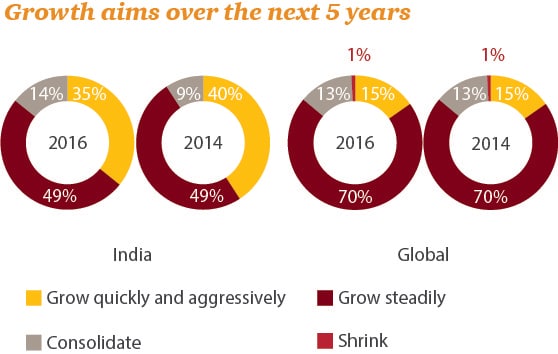

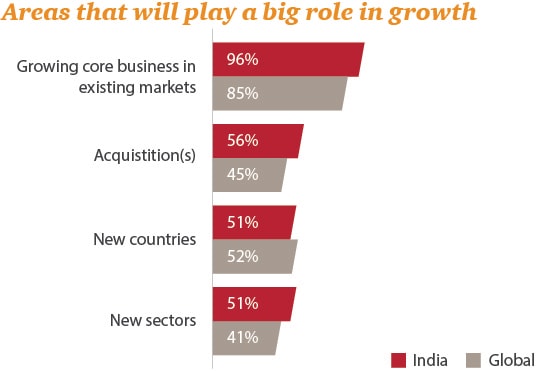

Optimistic sentiment: 75% of Indian family businesses have grown in the last 12 months. This is higher than both the global average and the findings from our 2014 survey (Family businesses: The evolving Bharat story). Family businesses are also extremely optimistic about their growth, with 84% expecting to grow either steadily or quickly and aggressively over the next 5 years. This positive sentiment can be attributed to two broad factors—firstly, we have seen in the past that family businesses tend to remain relatively resilient and stable in adverse conditions; and secondly, the India growth story has been reinforced. About half of those we spoke to said that they would explore new territories and new sectors and also look at inorganic growth.

This short video presents the findings of our global survey

A glimpse into the Survey's key findings

A snapshot of our survey

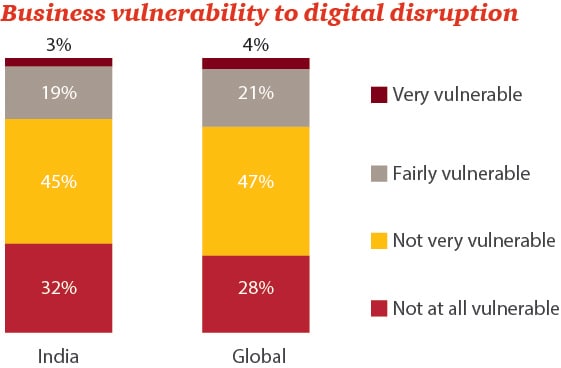

Prioritising right for challenges and digital? Family businesses are aware of the challenges they will face, now and over the next five years. Market conditions, government policy and regulation, innovation, digital disruption, technological changes, attracting and retaining talent, competition and professionalisation featured in most of the conversations we had with family business leaders. However, we found that the personal and business priorities of family business leaders were possibly not geared to meet some of these challenges. For instance, family businesses mentioned they understood the benefits of moving to digital, yet only 22% acknowledged the vulnerability of their business to digital. More than half do not discuss digital on the board.

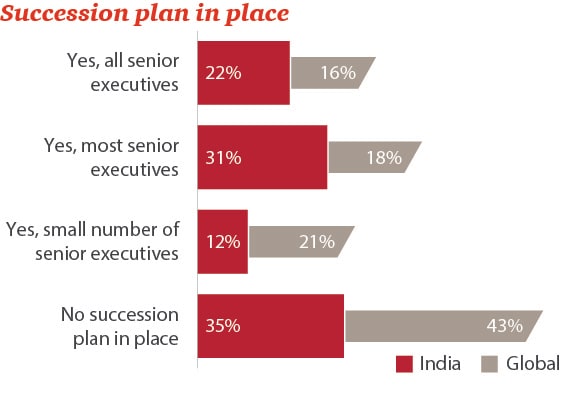

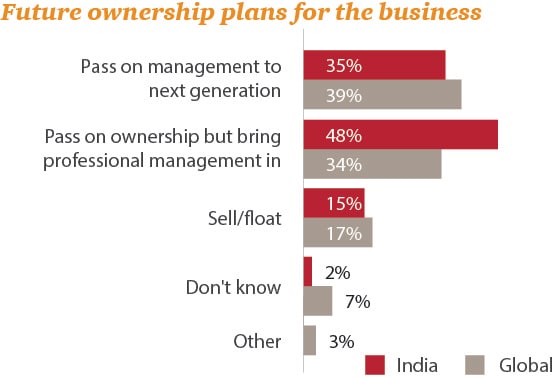

The family, next gen, succession and professionalisation: Family businesses are entrepreneurial by nature and family dynamics play a significant role in defining the way the business is run. About 85% of family businesses said they had a mechanism in place to deal with conflict. However, only 15% had a robust, documented and communicated succession plan. A majority of Indian family businesses have involved the next gen in the business and at the same time are recognising the need to professionalise: Only one third plan to pass the business fully onto the next generation while half plan to pass on ownership of shares while bringing in professional management. Attracting talent, however, remains an uphill task as a number of professionals fear they will not have a clearly defined career path to the top.

A strong sense of pride and optimism about future comes out as a clear trend in the survey. This is demonstrated by heightened entrepreneurial activity being witnessed in the country. To succeed, family businesses should factor the impact of the global megatrends and digital disruption, innovate and leverage technology, professionalise and ensure smooth transition to the next gen. Strategic planning is required to ensure that family and the business remains aligned with each other.

Ganesh Raju

Leader, Entrepreneurial and Private Business

PwC India