Public private partnership initiatives have consistently made a skilled talent pool available, supporting the talent requirement of electronics manufacturing companies.

Under the National Policy on Skill Development and Entrepreneurship, 2015, a Skill Qualification Framework was designed. The GoI created an institutional framework to implement and monitor the various initiatives which have been undertaken to skill and upskill the youth of the country. Under this institutional framework, the Electronics Sector Skill Council was set up to bring the industry and government together and design a national curriculum for the job roles in demand in the electronics sector, enhance the quality of skill training centres and promote skill training in the electronics sector in India. As of 2022, around 1.6 million candidates have been trained across an array of sub-sectors such as semiconductor and components, consumer electronics and IT hardware, EMS, solar and LED, PCB design and manufacturing, industrial automation, e-mobility and battery, communication and broadcasting, and security and surveillance.

While there are nationwide programmes such as Pradhan Mantri Kaushal Vikas Yojana (PMKVY), Pradhan Mantri Kaushal Kendras (PMKK), Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY), and skill training at Industrial Training Institutes which are providing training to the masses across job roles, industry partners have undertaken initiatives under programmes such as Recognition of Prior Learning (RPL) under public private partnerships in order to provide on-the-job training to apprentices and new employees, and upskill the existing workforce.

A total of 314 companies in the electronics sector have received an approval under M-SIPS with a proposed investment of INR 86,824 crore.14 Besides, 32 companies have been approved under PLI for large-scale manufacturing.15 The PLI scheme is expected to generate an additional production worth INR 10,69,432 crore and create employment opportunities for 7,00,000 people.16 It will also facilitate the production of diverse electronics merchandise in India.

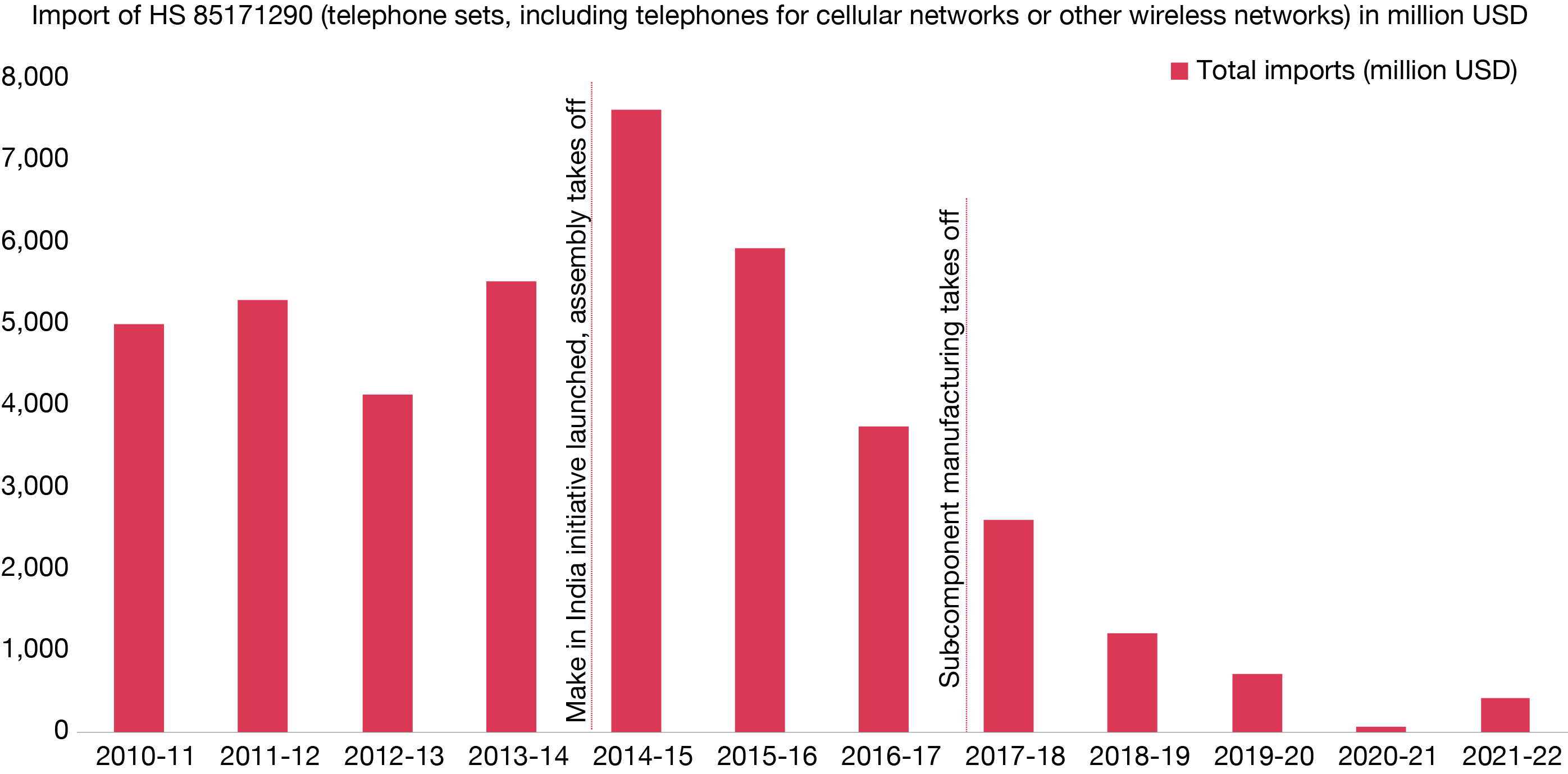

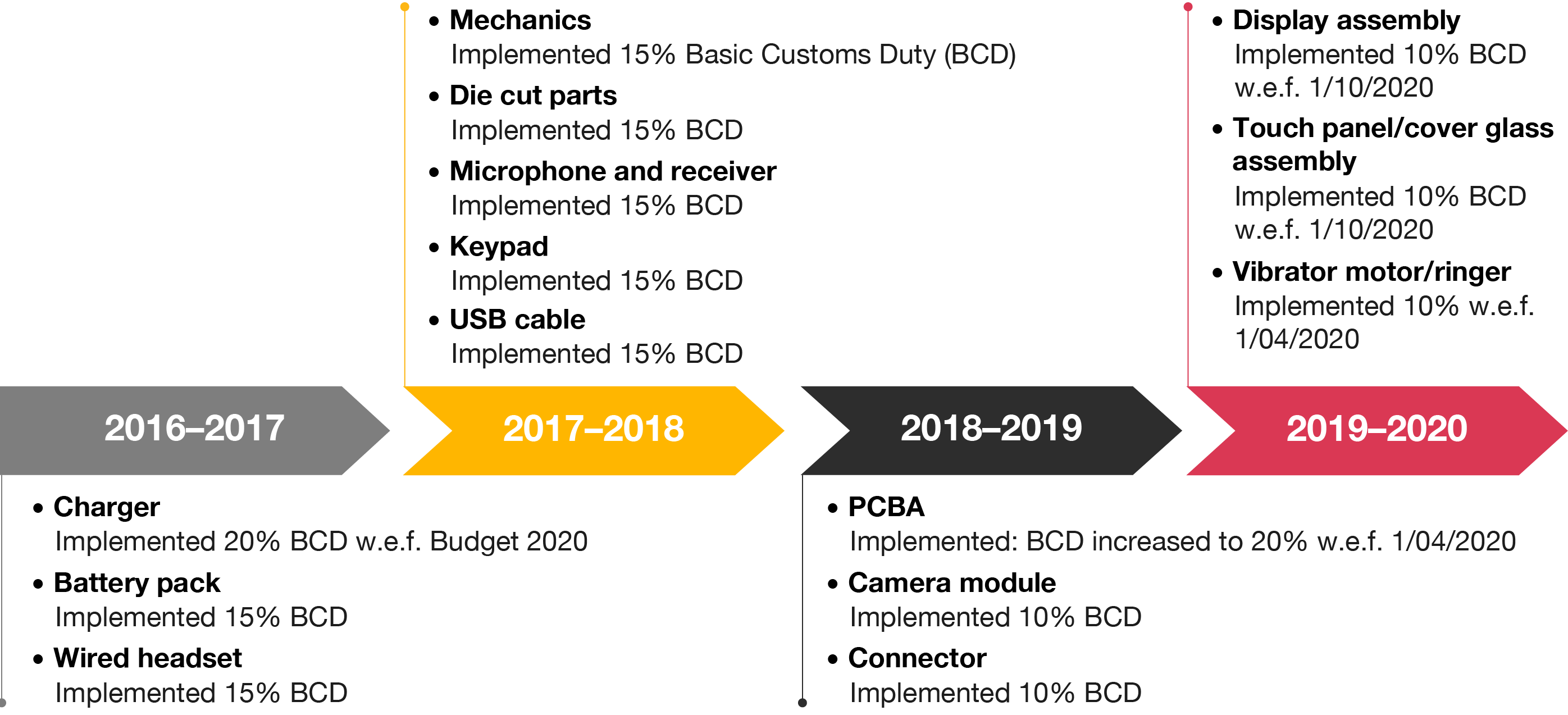

The PMP has provided a boost to domestic manufacturing of mobile phones. About 120 new manufacturing units for mobile phones and components were set up in India by 2017–18. These units led to an increase in the production capacity and India manufactured mobile phones worth USD 20 billion in 2017–18 compared to USD 3 billion in 2014–15.17