Introduction

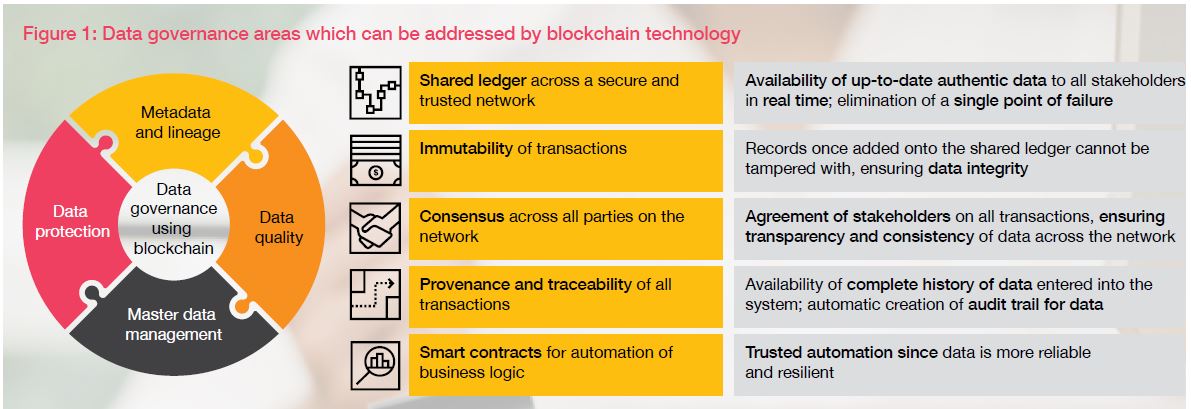

In a world where the volume of data is constantly increasing, the importance of strong governance around data is growing. Data governance helps to build data trust and accountability, maintain privacy and compliance, and ensure that data assets are formally, proactively, and efficiently managed throughout the organisation. As a technology, blockchain aims to improve trust and security of transactions by distributing responsibilities and restricting any changes to approvals by most stakeholders.

In this edition’s topic of the month, we discuss the concept and benefits of using blockchain to address multiple aspects of data governance. As we see it, the concept is currently at a very nascent stage and the benefits and/or challenges will only evolve over a period with implementations at scale.

The newsletter also includes industry news and updates on proposals in the regulatory landscape by Government bodies such as the Reserve Bank of India (RBI) and Insurance Regulatory and Development Authority (IRDA). These proposals aim to align the interests of customers through continuous improvement in benefit programmes and to adapt to dynamic customer needs. Happy reading!

Topic of Month: Enabling data governance through blockchain

Blockchain and data governance may complement each other in a myriad of ways. Blockchain is an immutable distributed ledger of all network transactions. The participants in a blockchain network are called nodes. It follows a consensus mechanism where all the nodes have to be in consensus for a transaction to be performed on the blockchain.

The features of blockchain are such that it can enable data governance by design.

There are many ways of designing a blockchain network by leveraging an intelligent combination of chain and off-chain data.

- On-chain: When the data is stored purely on the blockchain network and not on a connected database, the data is said to be ‘on-chain’. This ensures that the data remains unchanged and trackable, due to the immutable property of blockchain. However, it may not be the best choice in case of high volume of data storage and an extremely high-speed transaction rate.

- Off-chain: When the data is stored off the blockchain network and on a connected database, the data is said to be ‘off-chain’. Only the metadata/transaction data gets stored on the blockchain network. There are certain advantages to this method:

- Since any changes to the data are done off the blockchain, and only the audit is recorded on the blockchain, these changes/transformations get instantly recorded and there is no time lag. Hence, it is faster.

- It is more private, since all the data is not visible to the nodes. Only the metadata is visible to the network participants.

- It is cheaper since it does not have to bear the load of storing all the data

Data governance areas which can be enabled using blockchain

Tracking data throughout its lifecycle is a very important aspect for many organisations since it is essential to maintaining records and helps in finding the authoritative data source.

On-chain and off-chain

In both the on-chain and off-chain methodologies, the data lifecycle can be tracked. Blockchain can be leveraged to capture metadata. Since every block has to be validated by all the network stakeholders (nodes) at every stage, potential misuse or tampering of data can be identified. Also, due to its immutable nature, the record of the lifecycle of the data and any transformations it may have undergone cannot be tampered with, and the record maintained is permanent.

Data quality management is one of the most important components of datagovernance, which helps to make data accurate, reliable and trustworthy.

On-chain

In this methodology, the data quality rules are not only defined but can also be implemented via smart contracts which are immutable (the conditions of the smart contract cannot be altered) and distributed (the output of the contract has to be validated by all on the network). The conditions of the smart contract are predefined and agreed upon by all the nodes. However, while this methodology improves the quality of data, data availability decreases since every data element may not pass the stringent requirements needed to be a part of the blockchain network.

Off-chain

In this case, blockchain is used to maintain records of the data lifecycle. This makes it easy to perform root cause analysis and remediation in case of any data quality issues. Blockchain can be used to store the metadata information such as the data quality rules and data quality scores. This information is continuously validated on the blockchain and is time-stamped; hence, it is accurate and reliable.

Using smart contracts, it is possible to define data quality thresholds and ensure that the data is monitored.

The core purpose of MDM is to have a single source of truth across all the entities of the organisation for enterprise data relating to customers, products, services, suppliers, partners, employees, etc. Blockchain technology helps in MDM by enabling a single source of truth.

On-chain and off-chain

Issues which crop up when data is shared within an organisation, such as delays due to organisational or bureaucratic inefficiencies, erroneous duplicates and challenges faced due to data silos (e.g. lack of data collaboration and data reconciliation), get remediated.

Transaction

Two parties exchange data: This may be money, medical records, customer details, vendor data or any other asset that can be described in the digital form.

Verification

Depending upon the condition of smart contract/network parameter, the transaction is either verified instantly and accepted or rejected.

Structure

Each block is identified by a hash, a 256-bit number, created using an algorithm agreed upon by the network. A block contains a header, a reference to the previous block and a group of transaction.

Validation

Block data validation occurs through consensus mechanisms such as proof of work and proof of stake.

Block proposal

Validators try to propose the next block by following the parameters set by the designated consensus algorithm.

The chain

After block validation, the proposed block is broadcasted to each and every node in the system and the block is added to the chain, enabling a single source of truth across all the relevant stakeholders.

One of the key goals of data governance is to ensure privacy and security of data. Blockchain has many features which serve the purpose of data protection.

On-chain and off-chain:

Data security: Blockchain provides a good solution for maintaining the security of data records, one which is resistant to tampering and completely auditable. The hashing nature of blockchain enables each new block to be connected to all the previous blocks, forming a cryptographic chain which is nearly impossible to disrupt. Therefore, once a block is added to the blockchain, it cannot be altered.

On-chain:

Data encryption: In distributed architecture like blockchain, a transaction is transmitted peer to peer. Transmission of the transaction across the network takes around 1—2 seconds. The following is a representation of a blockchain transaction.

Off-chain:

Data privacy: In the off-chain methodology, the data itself is not maintained on the distributed ledger and hence its privacy is maintained. Only the metadata will be tracked and, thus, there can be no leakage of any personal information.

How PwC helped a client with blockchain implementation and enhance data governance

The client wanted to support a well-established social welfare institution in raising funds for setting up a centre of excellence.

In the conventional system, there were multiple data governance issues which had to be addressed and, therefore, the objectives of the project were as follows:

- Improve transparency and auditability, and eliminate data manipulation to build data trust.

- Enable secure financial transactions for project funding and maintain data privacy.

- Prevent any alteration to transactions once recorded by third parties.

- Enable donors to view their transactions and feel secure about making payments on the portal.

- Immutably record every transaction after a successful payment is made via the portal.

- Provide a single, shared view of transactions to all entities, thus increasing trust.

PwC implemented Ethereum as the blockchain framework and used relational database management system (RDBMS) for off-chain data to address the challenges faced by the client.

Data governance advantages:

- Data lineage: Audit trails along with time stamps of donations have increased end-to-end traceability.

- MDM: A single and shared view of transactional data has been created for all stakeholders in the system.

- Data protection: An append-only ledger protected by strong cryptography helped in increasing trust in the portal. Also, the immutable transactions have boosted data and system security.

- Data trust: With improved transparency, traceability and data reliability, donor confidence has improved.

A few concerns around blockchain-enabled data governance

On-chain

- Permanent record: Records on the blockchain network are immutable — i.e. no data can be deleted or modified by a single authority, thereby ensuring the data is stored perennially. This can be a problem when it comes to the ethical purging of data and complying with data retention policies (especially in the case of personal data). However, by the use of advanced blockchain mechanisms like zero-knowledge proofs, the risk of disclosing any confidential information can be mitigated.

- Data availability: Since a block can only be added with the consensus of all the participating nodes, if it does not match the stringent requirements of the blockchain protocol, it will be rejected by the network. While this helps in increasing data Quality, it may hamper data availability since not all data may be available in the main chain.

Off-chain

- Data security: Since the data is not stored on the blockchain, it is not as secure as it would have been (blockchain is very secure due to its immutable nature), and there is a potential risk of data breach.

Conclusion

Blockchain has the potential to enhance data governance and solve many of its challenges. As a distributed ledger, it is easy to share across the organisation. It can be relied on as a trusted source because of its strong security features. With new developments in blockchain technology every day and stronger cryptographic algorithms, more organisations will be inclined to turn to blockchain for some of their most important data governance requirements.

1. FIS Global launched the ‘RealNet central’ solution for Central Bank Digital Currency

FIS Global has created a solution on the lines of blockchain or distributed ledger technology wherein market participants can make real-time cross border payments using centralised digital token, i.e. CBDC. The solution supports 1 million transactions per second with a latency of less than 1 second.

2. Global artificial intelligence (AI) market will reach USD 450 billion in 2022

According to International Data Corporation, the AI market will reach USD 450 billion, including services, hardware and software. In 2021, the AI market saw a rise of around 21% with a revenue of USD 383 billion, primarily relying on key benefits like fast- tracking digital transformation journeys, automation, better decision making and higher productivity across all industries and functions. The AI services market increased to USD 24 billion with 22.4% year-on-year growth.

3. FinTech solving age-old credit accessibility issues by bringing nano and micro businesses on the same platform as non- banking finance company (NBFC), mutual fund institutions (MFIs), and small finance banks

Founded in 2017, Fundfina is capitalising on cutting- edge tech to build a full stack marketplace for lenders and micro, small and medium enterprise (MSME) borrowers. Brands can mix and match the start-up's APIs and build smart use cases across user acquisition, conversion and retention.

4. NBFC that finances small truck owners wins ‘Best Tech-Driven NBFC of the Year 2022’

Shriram Transport Finance Company Limited (STFC) is the first NBFC in India to deploy blockchain for fixed deposits. The company has a centralised contact hub with a smart interactive voice response, AI bots and a simplified campaign management process.

5. Bambu announces predictive planning wealth management solutiond

This would allow relationship managers (RMs), financial advisors, agents, and financial businesses to access and prioritise their customers' requirements. Users will be able to foresee and analyse major life events, as well as recommend feasible financial objectives and solutions for future financial planning with the help of AI and machine learning models like the Hidden Markov Model and Generative Adversarial Network.

1. Finance Minister (FM) stresses new technologies for customer convenience and prevention of financial crime

At the Indian Banks' Association, the FM stressed how banks should leverage advanced technologies like Web 3.0, AI and analytics to increase efficiency and detect financial crimes like fraud, money laundering and cybercrime. Further discussions were around benefits of the account aggregator system and how regional rural banks could leverage them and increase financial inclusion in unbanked regions.

2. Draft released for third-party premium rates for motor insurance for FY 2022—23, additional discounts for EVs proposed

The IRDA has issued a draft notification containing third-party motor insurance premium rates for cars, two-wheelers, electric vehicles, etc. There were no changes in the tariffs for the last two years due to the pandemic. For this financial year, the IRDA has proposed discounts on electric vehicles to encourage people to drive eco-friendly vehicles. A 15% discount will be given to all electric vehicles, and hybrid electric vehicles would get a 7.5% discount. Premium rates will take effect on 1 April 2022.

3. To increase insurance penetration, the IRDA further cuts compliance burden

To increase insurance penetration in the country and to encourage ease of doing business, the IRDA has reduced the compliance burden by reducing the number of returns to be filed in a year. Instead of 17 returns, general and health insurers will now have to file eight returns and life insurers will have to file only three returns. This will be applicable with immediate effect.

4. New approaches recommended for Pradhan Mantri Fasal Bima Yojana (PMFBY) to rationalise premium and increase participation

To rationalise the premium rate and encourage participation of more insurers, new approaches have been recommended to revamp PMFBY. The changes will be implemented from the 2023—24 crop year (July—June). Due to lack of participation from insurance companies and lack of competition between existing participants, farmers have to pay high premium rates. The Government has also suggested the use of the latest technologies like drones for early prediction of crop loss and payment of claims and multiple risk transfer approaches.

Acknowledgements: This newsletter has been researched and authored by Abhishek Chandra, Aniket Borse, Anuj Jain, Arpita Shrivastava, Dhananjay GoeI,Harshit Singh, Krunal Sampat, Prakash Suman, Sitikantha Satapathy, Md Imtiaz Khan and Sneha Baliga.

Contact us