Trade validation at front office to reduce pre/point of trade risk in capital markets

Introduction

After the 2008 global financial crisis, governments and regulators have been monitoring banks and have taken a hard look at the integrity of the market and the confidence of investors in general. Banks faced newer challenges which needed to be addressed for the market to function well.

Regulators such as the Federal Reserve, the US Securities and Exchange Commission, the Commodity Futures Trading Commission, and the Joint Audit Committee are specifically urging banks to pay attention to certain conditions concerning limits, margin calls, limited recourse, and grace periods when dealing with their clients. Failure to manage these aspects properly could potentially lead to a bank’s default.

Furthermore, the markets crash in March 2020, the subsequent period of volatility, along with events like default of a large family office fund later that year, have prompted regulatory bodies to conduct thorough assessments and reviews of risk management practices within the industry.

- Prime brokerage business and family office funds: What went wrong?

- Understanding gaps in risk management for prime brokerage business

- Looking from a regulator’s perspective

- The Securities Exchange Board of India’s (SEBI) perspective on regulatory oversight

Prime brokerage business and family office funds: What went wrong?

A family office is a privately held company that manages wealth for a single family, however, unlike a hedge fund, family office was not regulated until recently and HR4620, the Family Office Regulation Act of 2021 intends to change that.1 Family funds invest a large amount of money via the prime brokerage service provided by one or more investment bank. One such family fund adopted a strategy to make significant and concentrated investments in various companies, often utilising a financial instrument known as total return swaps (TRS). These swaps are agreements facilitated by major Wall Street banks, enabling users to assume both profits and losses associated with a portfolio of stocks or assets in exchange for a fee.

However, soon the cracks started to appear in the prime brokerage business due to unsuccessful bets placed through TRS. The collapse was attributed to excessive reliance on TRS and deficiencies in risk management, resulting in substantial financial losses for several wall street banks which had provided loans for the family fund’s TRS trading activities.

Understanding gaps in risk management for prime brokerage business

The collapse represents a comprehensive failure in various aspects of risk management, including credit, market and operational risk. The absence of stringent risk management practices facilitated the accumulation of highly leveraged positions by the family-owned funds which lead to its collapse and incurred huge losses for investment banks (prime broker).

The following are some of the gaps identified in the family office (investor) operations:

- Insufficient checks by prime brokers.

- Establishment of substantial notional positions across multiple prime brokers.

- Pledging of shares underlying the TRS as a collateral collectively contributed to the development of extensively leveraged positions.

- Minimal supervision by regulators

The following are some of the gaps identified in the broker-dealer (investment banks) operations:

- Lack of a centralised view of counterparty exposures via an entity master

- Unable to aggregate risk exposure across market risk, credit risk, finance and treasury.

- Absence of a centralised booking model control.

- Lack of a data-centric view of risks, e.g., different legal entities had different checks and trade validation processes.

Looking from a regulator’s perspective

In March 2022, the Division of Trading and Markets issued statements addressing market and counterparty risks during periods of increased volatility and global uncertainties.2 The statements advises all broker-dealers and other market participants to maintain vigilance. The division also emphasised the following key points for broker-dealers to consider:

- It is recommended that broker-dealers collect margin to the fullest extent possible from counterparties, adhering to relevant contractual requirements and regulatory guidelines.

- Concerns arising from concentrated positions held by prime brokerage counterparties. The staff encourages broker-dealers to gather adequate information to assess counterparties’ overall positions in potentially liquid markets and collaborate with them to mitigate risks.

- Broker-dealers are advised to conduct stress tests on positions, considering current events and potential market movements, and take appropriate steps to manage the risk especially for concentrated positions.

- Close monitoring of risk management limits throughout the day, aligned with the financial resources of the broker-dealer, is advised. Any breaches should be promptly escalated to senior management.

The Securities Exchange Board of India’s (SEBI) perspective on regulatory oversight

Indian regulators like the SEBI have often commented on the oversight of capital market and ways to manage the associated risks to acceptable limits.3 Some of the pre-trade controls mandated by the SEBI are:

- value/quantity limit per order

- for each stockbroker, the cumulative limit on value of orders unexecuted.

- implementation of dynamic price bands for stocks which have derivative products attached to it.

Furthermore, in 2022, SEBI implemented an additional pre/point of trade rule so that one customer’s fund cannot be used for another’s margin requirement.

The gaps identified and the subsequent perspective of the US Securities and Exchange Commission (SEC) drove PwC to look at the risk involved in the current market and design a better risk framework to meet the challenges which might arise in the future.

Designing a better risk framework: Our approach

To manage risk and create a better risk framework for a financial institution (e.g., broker dealer), a comprehensive risk management framework must be adopted and exercised at every step of the operation. One of the steps financial institutions can take to mitigate some risks is the pre/point of trade validation process at front office. The pre/point of trade validation is an additional layer of validation at the front office where trade validation is performed even before execution.

The pre/point of trade validation moves the validation of trades upstream towards the front office. Most of the trade validations currently happen at the middle office once a trade is already booked into the system by the trader. However, by designing a pre/point of trade validation before a trade is executed or at the point of execution reduces the trade exceptions. This results in reduction of operational risks associated with trade when it reaches the middle office.

PwC’s proposed framework for pre-trade control checks

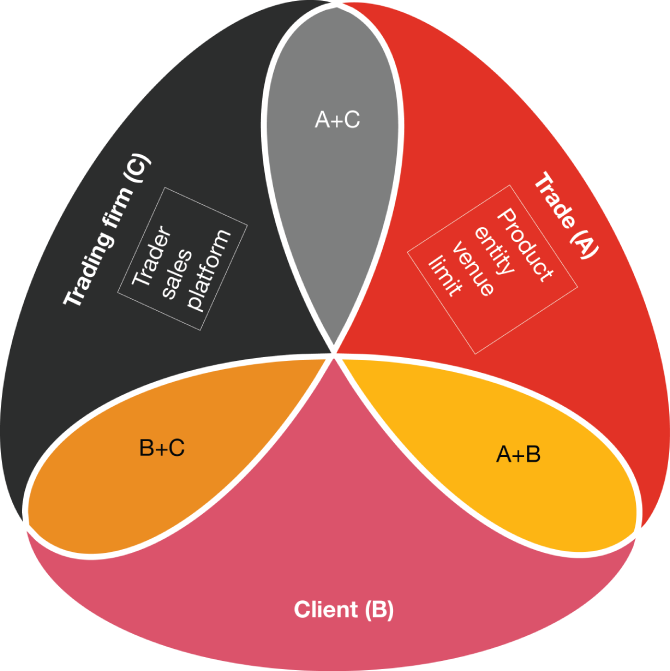

PwC’s proposed framework has three driving factors for making trade-related decisions. The three-set Euler diagram with three common groups sets out the key components associated with each factor of the pre-trade control framework.

Figure 1: Proposed PwC framework for pre-trade control checks (WIP)

- B+C: Checks between the trading firm and the client

- A+C: Checks between the trading firm and the trade executed

- A+B: Checks between client and trade executed

B+C: Checks between the trading firm and the client

- Is this KYC process completed for this client?

- Is sales permitted to cover this client?

- Is client allowed to do straight through process (STP) trades for a certain asset class/product using the firm’s infrastructure?

A+C: Checks between the trading firm and the trade executed

- Does the trader have a mandate to trade this product?

- Is the product approved through product taxonomy?

- Is the sales team/trader authorised to trade on this entity?

- Is the sales team/trader authorised to trade on this venue?

- Is the trade within relevant limits (market, credit, any manual error)?

A+B: Checks between client and trade executed

- Is there any do not trade (DNT)/restricted list?

- If a counterparty moves out to DNT list, will it notify the trader/sales team?

- Is the trade within relevant limits (execution, credit)?

Only if the common group (A+B), (A+C) and (B+C) are okay should companies be able to conduct the trade.

Trade validation process

PwC examined the shortcomings of an existing ‘as-is’ model and came up with a proposed to-be model which aims to address these limitations.

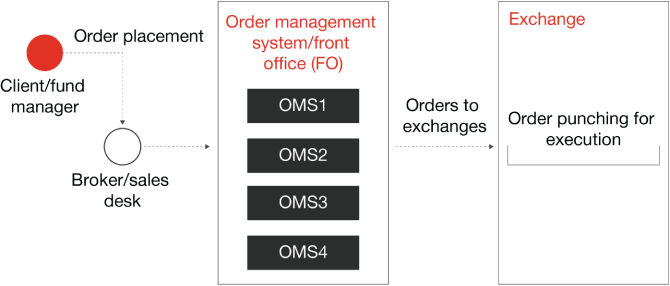

When a client places an order, the broker in turn places these orders from the sales desk of order management systems (OMS). Primary validations like quantity, type, etc., will be done during the order entry stage by OMS. Further validations take place at the middle office (MO) level and finally, the orders will be punched to the exchange as shown in the diagram.

Figure 2: As-is model of trade validation process

Below are some of the limitations associated with an as-is model:

- Complexities in regulatory compliance: Complexities in regulations are higher than ever before and a lot of checks need to be performed for each trade to comply with the regulations.

- Reducing exceptions by early intervention: Handling validation exceptions at the middle office level needs human intervention, which often leads to operational inefficiency in the process.

- Need for improving operational efficiencies: Accuracy of executing a fair trade suffers when validations do not happen upfront.

- Absence of risk rules sync: An as-is model lacks coordination between trading infrastructure and compliance management systems.

- Need for hedging reputational risks: Inefficient processes, fraudulent activities, capital losses are perceived negatively by the customers and may cause damage to the reputation of the firm.

- Re-keying of data: Inconsistency in data referencing prevents automatic passing of trade details across systems, e.g., primary security details, counterparty identifiers, etc.

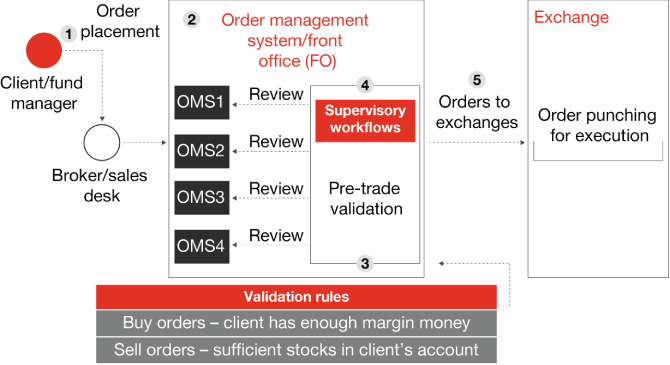

The objective of the model is to conceptualise and design a trade validation process which seamlessly integrates with the existing order management system (OMS). This trade validation process serves as a critical component in the proposed ‘to-be’ model and aims to enhance the efficiency and accuracy of order validations. The diagram below depicts the conceptualised model.

Figure 3: Proposed model of the trade validation process (WIP)

- Client requests for order placement.

- Order placed from OMS by broker. Basic validations happen during OMS entry.

- Rule-based, real-time validation of orders takes place at the pre-trade validation phase. E.g., regulatory, firm and policy level compliances.

- The trades are further checked for any sort of undetected misconducts, frauds, or mistakes with the help of supervisory workflows like maker/checker functionality. Elevated privileges to suppress rule breach for master users could be granted at this stage.

- Post validation, orders will be punched to exchange.

The proposed ‘to-be’ model introduces a trade validation process interfacing with the OMS, incorporating real-time rule-based validations, supervisory workflows, and enhanced risk management capabilities. This approach solves several challenges and facilitates early intervention to reduce exceptions and operational inefficiencies, and provide synchronised risk rules. Further, potential risks like data inconsistencies and reputational damage are minimised in the proposed model.

Conclusion

The regulatory space is evolving quickly to take up the new challenges which are arising from a dynamic and fast-paced financial system. Banks and financial institutions should be proactive in anticipating the changes in the market. Pre-trade validation as part of front office checks is the need of the hour due to the following reasons:

- Moving the risk upstream reduces the overall risk which needs to be tackled downstream. It reduces manual efforts and improves the operational efficiency.

- Pre-trade validation is an important check to improve the booking model of an investment bank. Pre-trade validation along with booking model control improves the overall risk of a firm. Booking model control is a control in place after a trade is executed and is based on the legal entity identifier (LEI) as a control point. Based on different booking model controls, different trades are subjected to different rules in terms of booking the market risk/credit risk of a particular trade.

The Indian capital market is growing day-by-day with India playing a bigger role in the global economy. Global interest in Indian conglomerates shows how important it is for regulators to frame the risk framework properly and to ensure that the framework is adopted by regulated entities to protect the integrity and faith in the capital market.

Pre-trade validation, as part of the trade lifecycle, can improve the overall risk controls of a bank and the market by reducing the penalties levied on banks for illegal trade. It may also improve the trust of clients on the overall market. There is a lot to be done by banks and financial intermediaries to meet all the challenges. However, pre-trade validation is a small step in the right direction.

Acknowledgements: This newsletter has been researched and authored by Muzaffar Khan Waris and Girish Kumar L.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 152 countries with over 328,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

© 2023 PwC. All rights reserved.

Contact us