Trends in the APAC payments landscape

Overview

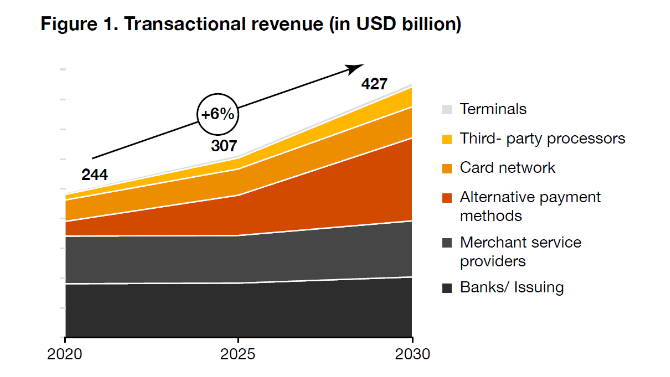

The APAC payments industry has witnessed significant innovations in the last few years, catering to two-thirds of the global population. A series of developments has introduced significant enhancements to real-time, crossborder payments, e-commerce and central bank digital currency (CBDC). This has helped modernise the cash-led market into a digitised payments landscape. As a result, digital payments transactions in APAC grew at a compounded annual growth rate (CAGR) of 6%,1 reaching USD 427 billion in 2030.

Some of these developments have set an example for the rest of the world to initiate transformational changes in the global payments landscape:

- real-time payments methods – like QR codes, immediate payment service (IMPS) and near-field communication (NFC) for interbank settlements in retail payments – using platforms such as the New Payment Platform (NPP) in Australia, PayNow in Singapore, the Unified Payment Interface (UPI) in India and DuitNow in Malaysia

- improved cross-border payments ecosystem to facilitate swift, secure and transparent payments with distributed ledger technology (DLT), application programming interfaces (APIs) and automation

- growing acceptance and scalability of CBDC in countries like China, Singapore and India

- enhancing digital/payments banks to provide cost-effective banking services under a unified platform, through a completely digital solution

- enabling digital lending in B2B and B2C spaces with online loan platforms, corporate cards, FinTech co-branded cards and buy now pay later (BNPL).

To cater to the growing demand, new projects are gaining momentum and being supported by disruptions in technological and infrastructural areas. As for the success of these payments innovations, factors such as FinTechdriven and consumer-driven projects come into play.

FinTech enablers play a crucial role in new payments product offerings, which has resulted in an 8%2 increase (from 68 to 76%) in the banking population from 2017 to 2022. Financial institutions with enhanced technology are partnering with FinTech players at the module level to create innovative and efficient solutions for consumers. Blockchain technology, especially DLT, has played a prominent role in digital currencies and improved the payments ecosystem significantly, with smooth, real-time transactions, and reduced payments friction.

In recent years, the APAC region has seen a surge in the utilisation of modern payments options, primarily due to the influence of consumer- and market-driven facilitators like:

- adoption of smartphones3 among 62% of the APAC population

- adoption of the internet4 in 64% of the APAC population

- acceptance and use of banking5 in 76% of the APAC population.

Following are some indicators of the adoption of cashless payments in the APAC region:

- Digital payments6 were done by 88% of the APAC population at least once in the last year – i.e. a 69% increase Y-o-Y.

- Credit card penetration7 increased from 13% in 2021 to 29% in 2022.

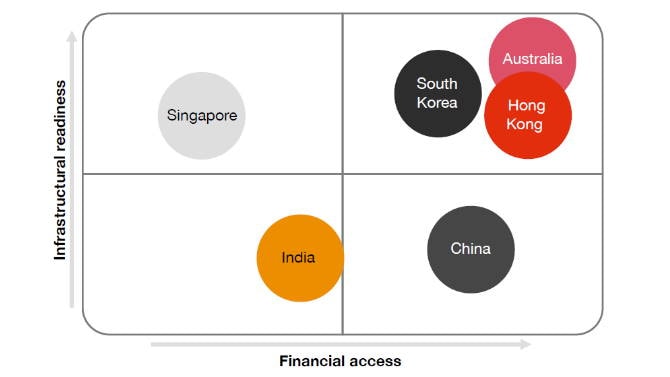

After examining certain countries in the APAC region and considering their payment capabilities – such as access to financial services and infrastructure preparedness – it is apparent that some economies are well-positioned to promote financial inclusion and advance payments transformation.

Figure 2. Payments trend enablers in selected countries of the APAC region

Source: PwC analysis

In the above graph, financial access is measured in terms of adoption of digital payments, overall banked population and the credit card penetration in the country. Meanwhile, infrastructure-readiness is measured basis the usage and penetration of smartphone and internet among the people of that country.

The above-mentioned enablers have supported the rapid adoption of new payments trends and can be observed in countries undergoing rapid development.

Key trends in the APAC region

As a fast-growing and technologically advanced region, APAC has become a central area for the innovation and adoption of digital payments solutions. To this end, we’ve highlighted a few trends that have played a pivotal role in shaping the payments industry in the region, driving the shift towards a more cashless and digital-centric payments ecosystem

Figure 3. Key trends in APAC

Although cash is still preferred over digital payments methods in some APAC countries like Thailand, Japan and Vietnam, recent trends show that there has been a gradual fall in its usage. Furthermore, it is expected that the value of cash utilisation in retail transactions would get halved by 2026, from 16% to 8%.8 This is mainly due to the governments across APAC countries and digital players promoting real-time payments via mobile wallets and QR codes actively.

Four countries in Asia- India, China, Thailand and South Korea are among the top five real-time payments markets. UPI in India is the world’s most popular payments system, processing over 89 billion transactions in 2022. Next is China’s Internet Banking Payment System (IBPS), which processed over 17 billion transactions in 2022.10

Lately, real-time payments have significantly grown due to an increase in the usage of digital apps, which have incorporated seamless sign-ups and interoperability features. UPI has accounted for 75% of the total transaction volume in retail digital payments in India in 2022.11 The rapid adoption of QR code payments in countries like China and India has contributed to the dominance of faster payments platforms.

Below are some key factors that contribute to the adoption of mobile and QR-based real-time payments.

- Easy onboarding: Most applications offer instant onboarding and activation for customers. Transactions can be done in fewer steps, encouraging users to leverage these apps for all expenditures.

- Transparency of transactions: Unlike cash transactions which are anonymous in nature, digital transactions are transparent. This helps customers keep a track of receipts in case of any dispute and avoid fraud and money laundering.

- Fast and convenient: Real-time payments provide quick and convenient settlements. In addition, it can be accessed at any time, from anywhere.

- Optimised operational costs: Real-time payments are not a new phenomenon. Back in 1973, Japan had a real-time paper-based payments system in place.12 In an attempt to digitalise payments, governments are now pushing digital modes to reduce the paper trail and optimise operational costs. Due to the COVID-19 pandemic, digital payments have become the more preferred alternative to carrying cash.

Real-time payments have now transcended into the next phase, with continued governmental push expanding the use cases. Additionally, factors such as expanding into global markets, digital currency interoperability and consolidation of cross-border payments for a real-time experience are major areas of growth in real-time payments.

Figure 4. Volume of real-time payments in APAC13 during 2022

Volume of real-time payment transactions in Asia (in billion)

Source: ACI Worldwide report

Some significant examples of real-time payments expansion have been outlined below.

- Indonesia, Malaysia and Thailand have already interlinked their QR code payments systems to ease transfers between borders.

- Singapore has interlinked its real-time QR-based payments with those of Thailand and India and is working to integrate the same with Indonesia by the end of 2023.14

- UPI is being made available to non-resident Indians in ten countries to expand the scope of global remittances.

- UPI has been adopted by countries like Bhutan and Nepal and is being integrated with the payments systems in Saudi Arabia and France.

Below are some technology-related considerations for the government and digital players to take real-time payments disruption to the next level:

- The payments technology disruption is bringing a massive shift in customer behaviour. To ensure adoption, the target use case should consider the dynamic nature of the market.

- Ensuring privacy and security through comprehensive encryption, real-time fraud detection and authentication is a prerequisite for any payments technology implementation.

- The technology must be flexible and compatible to accommodate any expansion needs. Real-time payments systems must be designed to integrate with CBDCs or any future digital payments rails.

Owing to rapid growth in global economic integrations, improving crossborder payments systems becomes a necessity. China and other emerging manufacturing hubs, such as India, Vietnam and Cambodia, are attracting trade flows. India has reportedly received the highest remittance in a single year, worth more than USD 100 billion in 2022.15 Asia alone, on average, accounted for over 63% of the total increase in global remittances in 2021 and 2022.16

Integration with a regional payments platform is a new trend to enable faster, secure and affordable money transfers across borders. Various countries, such as France, Russia and Singapore, are working on integrating the Indian UPI system. Similar developments include Singapore’s PayNow, which is linked with Malaysia’s DuitNow and PromptPay in Thailand.

These interlinkages are a step towards making improvements in the crossborder payments ecosystem which is aligned with the policy focus of the G20 summit. The rationales behind the push to improve the system are as below:

- Improving the slow and complex process: In the case of SWIFT payments, there’s a dependency on correspondent banks17 and complicated compliance checks, which take up to five days to settle. This dependency also increases costs and is not accessible to migrant workers. This is one of the major priorities endorsed by G20 to make cross-border payments cheaper, more transparent and accessible.

- Effortless execution of growing remittances in the APAC region: As per Asian Development Bank reports, global remittances have grown by 5% in FY 2022 with India, China and the Philippines ranking among the top 5.18 This trend will continue to grow, fuelled by the increase in remittances by migrant workers to their origin countries.

- Increasing the affordability of the remittances: According to Asian Development Bank reports, the true value of remittances may be 50%19 higher than the quoted numbers as most migrant workers cannot afford the officially approved routes in the existing digital money transfer systems.

Figure 5. Top recipients of remittances globally (in USD Billion)

Five Asian Countries in the list of Top Recipient of Remittances (Value in USD Bn)

Source: Weforum.org

In order to revolutionise the cross-border payments ecosystem to make it more secure, transparent and faster, there are some key components that should be in place. These components have been outlined below:

a. leveraging DLT to enable swift and secure cross-border wire transfers or sanction screenings to decrease settlement times

b. facilitating API integrations between systems to enable real-time visibility to the treasurers into forex rates for effective management and accelerating reconciliation

c. enabling rapid transformation through automation to avoid delays in accounts receivables, digital invoicing and automated data reconciliations in order to reduce dependency on business hours

d. introducing an in-built fraud and compliance check mechanism to improvise complex compliance checks to make them more consistent

e. streamlining the process of translating and converting the data from messages to make it more readable to generate actionable insights and optimise time and costs.

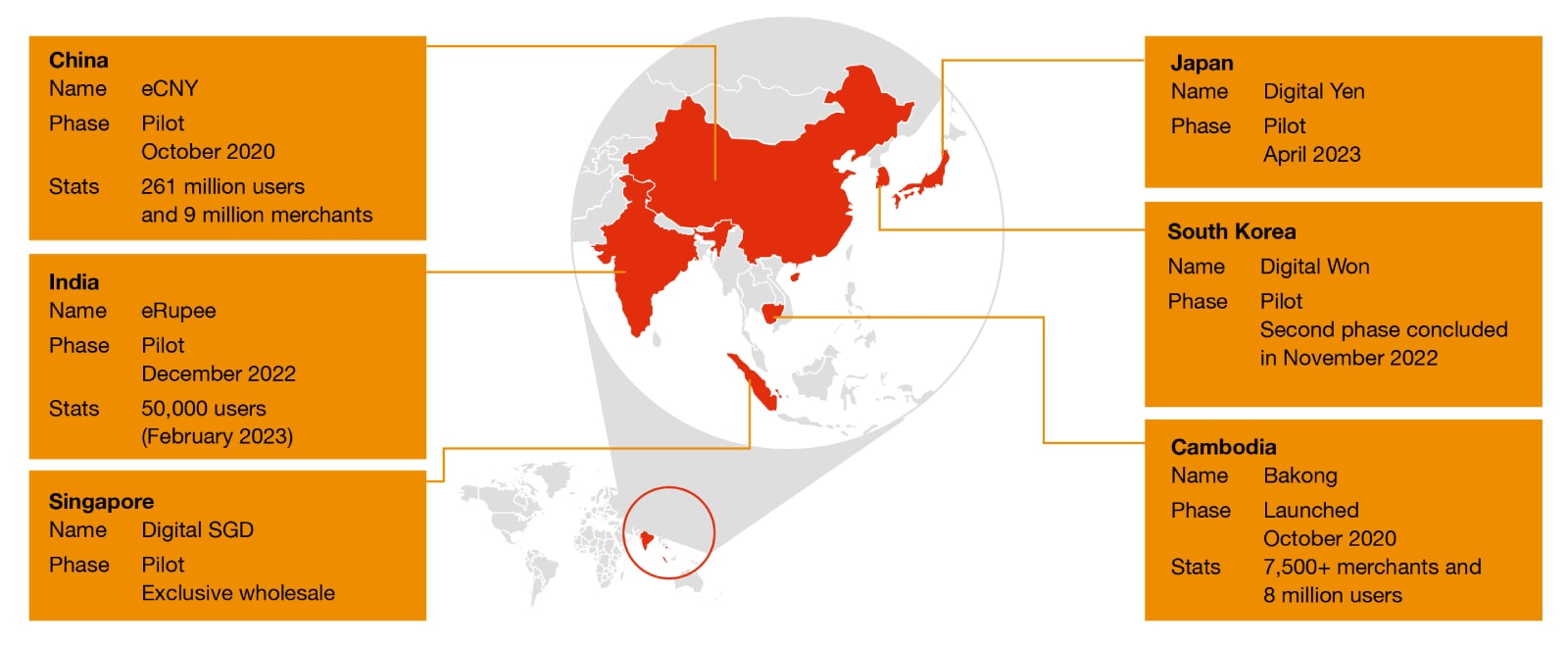

Figure 6. Leading CBDC implementation initiatives in Asia

Source: Bank of international settlements

The CBDC20 is a global strategic priority for most jurisdictions, including the APAC region. The main objectives for central banks to introduce CBDC include increasing financial inclusion, reducing transactional and operational costs, accelerating innovation, and modernising payments systems.

At present, the APAC region is leading the adoption of retail CBDCs as it is home to one of the most successful CBDC implementations – i.e. Cambodia’s CBDC Bakong. This CBDC was launched in October 2020 and has been largely popular in terms of adoption. Reports state that almost 8.5 million users in a population of 17 million are using CBDC Bakong.21 Retail CBDC implementation is also gaining momentum in other APAC countries like India, China,22 Japan and Singapore.

Figure 6 highlights the countries with major CBDC initiatives within the APAC region.

Along with retail projects, the central banks of various countries are collaborating with wholesale CBDCs to explore scenarios such as efficient clearing and settlement processes, international trade, and faster crossborder payments. Some significant projects have been highlighted below:

a. banks of Singapore and the Philippines testing wholesale CBDCs for efficient cross-border payments

b. Project Dunbar, where the central banks of Malaysia, South Africa, Australia and Singapore have partnered with the Bank of International Settlements (BIS) to explore settlement platforms

c. Project M-bridge – a collaborative effort for multi-currency wholesale CBDC between the Bank of Thailand, Hong Kong Monetary Authority, People’s Bank of China and Central Bank of UAE – in partnership with the BIS

d. the Reserve Bank of India (RBI) and Central Bank of UAE being in an exploratory phase of CBDC-based pilot and proof of concept to facilitate remittances and trade.

The key motivations for stakeholders to introduce CBDCs in retail and wholesale are to:

- Increase financial inclusion: CBDCs can be leveraged by governments to dole out grants and benefits via wallets that will promote the usage of wallets, resulting in increased financial inclusion.

- Decrease in operational costs: Printing, circulation and spoilage involve a lot of costs. For example, the cost of operations is around 17% per currency note in India,23 which has prompted the Government to shift towards digital wallets and promote the use of digital payments.

- Promote stable digital assets: Developing CBDCs can provide the masses with risk-free virtual currencies and safeguard their interests by countering the concern around the stability of other digital assets.

- Improve cross-border remittances: The introduction of CBDC will ease the process of compliance checks, and settlements will be automated without any dependence on time zones. Instant settlement of wholesale transactions will gradually eliminate the need for settlement security/deposits.

Most economies are still evaluating the need for CBDC – both in the retail and wholesale space – in terms of feasibility and security. For a successful CBDC implementation, the following must be considered:

a. The technology stack should support the underlying legacy payments systems and be interoperable with the existing domestic payments system.

b. A low-cost, simple interface that provides easy onboarding and is accessible to users without a bank account will be appealing to participants at the grassroots level.

c. Strict authentication features and protected communication channels should ensure that the solution is fail-proof.

d. Awareness drives and incentivising the usage of wallets are key to boosting adoption.

A variety of digital-only banks and neo-banks have emerged over the last decade in the region. These were founded in the aftermath of the 2008 global financial crisis with the vision of making banking services more accessible and equitable.

A digital bank and a neo-bank aren’t quite the same thing, even though they appear to be based on a mobile-first approach with an emphasis on digital operating models. While the terms are sometimes used interchangeably, digital banks are regulated players in the banking sector with largely an online presence only. Neo-banks, on the other hand, are FinTech entities which don’t have a banking licence of their own but rather partner with commercial banks to provide services through their digital modes.

The APAC region is expected to witness notable growth in digital banking in the future. One of the leading digital banks in Hong Kong got 10,000 applications in the first ten days of its operation, and an active customer rate of 56%24 in its first year. Digital banks have shown positive returns and faster profitability models. In Japan, a purely digital bank became profitable within five years of its launch. Similarly, digital banks in China and South Korea produced positive results within a couple of years of their launch.

Some of the key drivers for the growth of digital banks in APAC are:

- higher technological adoption by digital banks with their mobile-first approach with an enhanced technological stack and API banking

- cost-efficient solutions with service bundling or leveraging of smart services to drive adoption

- superior customer experience using smooth UI/UX for a seamless onboarding journey in a few clicks, and smart services that deliver differentiated customer experiences

- increasing financial literacy in the next generation to enable trust in digital banking solutions

- providing access to infrastructure with increasing smartphone and internet penetration.

Regulators are actively promoting the growth of digital banks by issuing more licences and ensuring compliance with proper KYC regulations. For example, the RBI introduced payments banks as a category for financial institutions, which led to the upgradation of leading prepaid payment instrument issuers to payments banks. Following in-line, Singapore licenced four digital full banks (DFB) – including two retail DFBs catering to retail customers and two wholesale DFBs catering to small–medium enterprises and non-retail segments – in 2020. Furthermore, Bangladesh rolled out guidelines in June 2023 to set up digital banks, foreseeing their advantages and growth potential in addressing the market for digital financial services.

The substantial growth potential for these entities is driven by their lowcost model for end consumers, and the supportive efforts of regulators to regularise new policies for customer onboarding and convenient digital transactions.

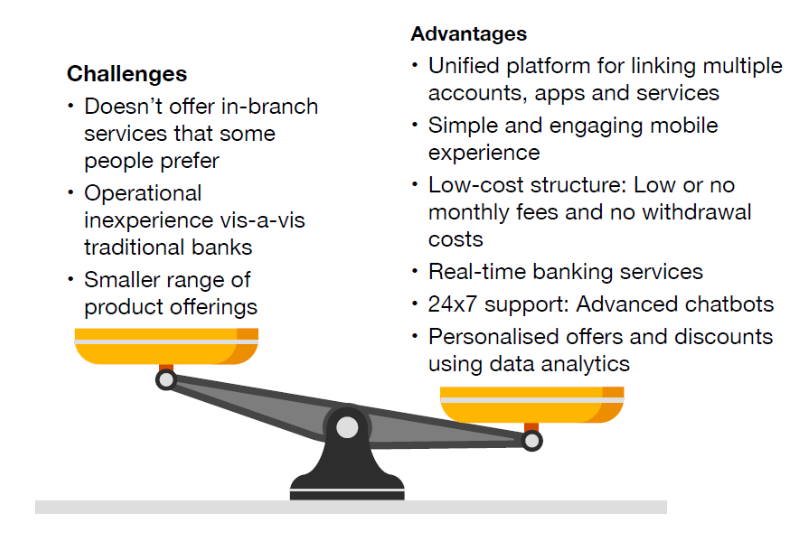

To understand the pros and cons of digital banks, we’ve highlighted their advantages and challenges in Figure 7.

Figure 7. Advantages and challenges of digital banks

Digital banks and neo-banks have proven themselves to be a boon for various new customer segments that are tech-savvy and trust API banking to help automate their operations. Below are some examples where these entities will prove to be immensely useful and add significant value:

- e-commerce sellers and marketplaces to digitalise their collections from customers and facilitating direct payments to suppliers

- marketplaces – investment, insurance, credit protection and working capital

- travel industry – easier foreign exchange and multiple currency handling

- IT outsourcing – salaries, expense management and tax compliance

- small multinationals with multiple banking alliances and need for global access.

In order to transform digital banks to grow exponentially, effective strategies, as outlined below, must be adopted.

- Expand services, like developing a bespoke digital wealth management solution by facilitating financial planning for the masses.

- Increase the limit of deposit funds to encourage more customers to invest.

- Create micro-KPIs for measuring the operational efficiency of a firm and its staff.

FinTech start-ups and neo-banks are at the centre of the evolution of the digital lending model. These entities are capitalising on customers’ need for instant funding by leveraging data from various sources. These digital lending trends are not just focused on B2B lending but are also expanding into the B2C side with BNPL and FinTech-enabled co-branded cards.

On the B2B side, financial institutions are increasingly focused on leveraging third-party data for value-added services such as B2B lending. These lending platforms use the in-house data from customer relationship management (CRM), enterprise resource planning (ERP) and accounting – especially for micro, small and medium enterprises (MSMEs) – analyse the cash flow patterns and understand the need for lending. This helps to bring in more inclusivity and close the financial gap25 within the ecosystem by giving MSMEs better access to financing.

Figure 8 represents the current volume of financing and the gap in select developing economies in the region.

Figure 8. Current volume of MSME lending and gaps in select Asian markets

Source: https://www.smefinanceforum.org/data-sites/msme-finance-gap

In this context, account aggregators26 can prove instrumental in accelerating change by ensuring the flow of data to lenders, which results in reduced transaction costs. This enables banks or lenders to offer lower ticketsize loans and tailor lending needs as per customer requirements. Some significant B2B lending examples include the following:

- China’s leading savings bank is leveraging data from a major ERP player for digital lending to small and medium enterprises (SMEs).

- A digital bank based in China is leveraging a blockchain-based platform that utilises tokenising and splitting account receivables to create flexible credit opportunities for MSMEs.

- New Zealand-based banks are partnering with a major accounting software company that leverages its data to provide invoice financing and B2B credit cards for small business owners.

Motivations for financial institutions to promote digital lending for B2B:

- Promoting asset ownership: MSMEs are traditionally characterised by a lack of asset ownership or formal documentation and are majorly cashbased. Risk assessment exercises associated with lending will help these enterprises to understand their liabilities and asset ownership.

- Improving cash flow: MSMEs are majorly mired by limited cashflows which curb their exposure to opportunities. Thus, access to capital will increase their bargaining power, resulting in business expansions.

- Increasing financial inclusion of MSMEs: FinTechs and banks are offering co-lending through their partnerships, leveraging banks’ reach to the last mile. This will give a boost to SMEs and bring them under the financial inclusion agenda.

In the instant lending space, prominent B2C trends include the rapid evolution of FinTech-enabled co-branded credit cards and BNPL models. FinTech-enabled co-branded credit cards and co-branded cards, in general, are a major phenomenon in the APAC markets – including India, Singapore, Malaysia, Thailand and the Philippines. A leading multinational bank aims to increase its current customer base by two million through its co-branded model alone.27 The bank has already launched multiple cobranded cards in India, Australia and Southeast Asia. An online aggregator in India has reported a Y-o-Y increase of 48% in rewards card applications, thereby highlighting the popularity of co-branded cards.28

BNPL accounted for more than USD 100 billion in e-commerce transactions in APAC29 in 2022. It has witnessed a gradual growth in popularity in countries such as Vietnam, the Philippines and Indonesia, where the regulatory policies are still at a nascent stage. Mature markets such as Australia, Hong Kong and New Zealand are already taking steps to protect the rights of consumers and lenders. These new regulations aim to mandate the KYC processes and lenders’ licences. Furthermore, these regulations will address issues around dispute resolution, unsolicited credit increase and customers creating multiple accounts to avail credit. Stringent rules like these will result in fewer onboardings but will govern the unprecedented growth in these markets.

B2C lending platforms are attracting customers through easy onboarding (no collateral), lucrative offers and rewards across categories, and surcharge waivers on fuel, airfare and railways.

Motivations for financial institutions to promote digital lending for B2C by creating value for customers via instant credit:

- Improve point of sale (PoS) and e-commerce financing: Merchants are opting for the instant lending route to offer additional PoS and e-commerce financing for their customers to increase the conversion rate. This also puts a minimum amount of liability on the merchants for any fraud or risk with the customers.

- Increase customer stickiness: Most banks and digital players are tying up for co-branded credit cards to potentially connect with customers and offer lucrative rewards based on their lifestyle requirements. This creates a stronger value proposition and increases customer loyalty.

Conclusion

APAC has emerged as a trailblazer in the digital payments space due to its revolutionary innovations that are fast, easy to scale and accessible. Until now, no region apart from APAC has managed to make such concerted breakthroughs in this space that have seen such rapid adoption by the masses. Innovations in the payments landscape are taking place at a much more frequent pace than ever before. Although there still remains vast untapped potential in these countries, the inroads made till now have distinguished APAC as an ecosystem that the world can imitate in order to accelerate growth of digital payments.

Real-time payments rails have had a significant impact in the APAC region for digital payments adoption. The interoperability of real-time payments methods is helpful in the integration of global currencies and bridging the gaps between cross-border payments to provide faster settlements. To further boost real-time payments, the technology has to be flexible and compatible to accommodate any expansions.

Digital currencies are undergoing various developments across the region, with some ongoing projects to increase financial inclusion and decrease operational costs. To promote CBDC in the region, in addition to retail CBDC, wholesale CBDC can be used for government-security (G-sec) settlements and delivery versus payment (DVP) settlements. Traditional retail banks can reassess their current offerings and augment it with CBDC to create new revenue streams for programmable and cross-border payments. This will attract new businesses and optimise operational costs in the long run.

With the emergence of various FinTech players and modifications in regulations to increase financial inclusion with new and disruptive solutions, the digital payments landscape is seeing transformational changes. Digital banks are able to provide various solutions by leveraging their technological capabilities and cost-efficient models. Further growth of digital banks and FinTech can be achieved by the adoption of expanding use cases and services, FinTech partnerships to cross-sell credit instruments, and FinTechenabled co-branded credit cards. FinTech partnerships will also help financial institutions improve their loan recovery management and overall profit by reducing their non-performing assets (NPA).

Digital lending models are gaining traction in both B2B and B2C domains, by leveraging vast data resources available at their disposal and their easy onboarding and disbursal processes. Moreover, it is promoting asset ownership, working capital and financial inclusion for MSMEs. Lenders should implement processes for KYC and approval, leverage data for fraud detection, and identify delinquent customers.

As the APAC region continues to evolve and increases the use of digital payments among its inhabitants for easy and secure transactions, disruptive technological changes will keep catering to growing demands, resulting in significant economic growth and global economic integrations.

Sources

- PwC analysis – Payments 2025 and beyond

- COVID-19 Drives Global Surge in use of Digital Payments

- Adoption rate of smartphones in the Asia-Pacific region from 2019 to 2022, with a forecast for 2030

- Asia & Pacific

- Share of banked population in the Asia-Pacific region from 2017 to 2022

- APAC consumers ahead in digital payments uptake: new Mastercard research finds institutional support and buy-in key to even greater adoption

- Credit card penetration in the Asia-Pacific region from 2017 to 2022

- THE GLOBAL PAYMENTS REPORT

- India saw record of ₹149.5 trillion UPI, card transactions in 2022; THIS city tops the list

- 2023-Prime Time for Real Time Report by ACI Worldwide

- UPI transactions to account for 90% of retail digital payments by 2026-27: PwC India report

- 2023-Prime Time for Real Time Report by ACI Worldwide

- 2023-Prime Time for Real Time Report by ACI Worldwide

- Singapore-Indonesia QR payment link to be ready by end-2023: Bank Indonesia

- Remittances to India cross $100-billion mark in 2022

- Asian Development Bank, ADB Briefs, ‘Labor mobility and remittances in Asia and the Pacific during and after the COVID-19 pandemic

- A correspondent bank, in the context of cross-border payments, refers to a financial institution that provides banking services on behalf of another financial institution in a different country or currency jurisdiction.

- Remittances Grow 5% in 2022, Despite Global Headwinds

- Harnessing Digitization for Remittances in Asia and the Pacific

- Harnessing Digitization for Remittances in Asia and the Pacific

- Bakong Users Continue To Grow – Now More Than 8.5 Million

- A Report Card on China’s Central Bank Digital Currency: the e-CNY

- Digital Rupee to save costs of printing, distributing and storing cash

- Q&A: Decoding Hong Kong’s Digital-Only Banks — WeLab Bank

- MSME finance gap is the difference between current supply and potential demand which can potentially be addressed by financial institutions. The MSME finance gap assumes that firms in a developing country have the same willingness and ability to borrow as their counterparts in well-developed credit markets and operate in comparable institutional environments – and that financial institutions lend at similar intensities as their benchmarked counterparts.

- Account aggregators act as intermediaries between financial institutions and individuals or businesses, facilitating the access to and management of financial data in a consolidated manner.

- Citi launches co-branded credit cards with SE Asia's Grab in push for more customers

- More co-branded credit cards expected in 2023

- THE GLOBAL PAYMENTS REPORT