Integrating ESG in the payments ecosystem

Overview of ESG

The term ‘ESG’ refers to a set of environmental, social and governance considerations in an economy. It represents the risks and opportunities which may impact an organisation’s ability to create long-term value, including but not limited to the following:

- climate change and resource scarcity

- data security and compliance

- board diversity

- executive pay and tax transparency

- societal impacts.

Over the last decade, people have started realising that several challenges in our ecosystem – such as climate change and social imbalance – are all symptoms of a deeper problem – namely, the failure of our economies to deliver sustainable, affordable and inclusive outcomes for society. In addition, the COVID-19 pandemic has amplified some of the biggest challenges our society faces, creating an urgent need for systemic change in areas like social inclusion, reskilling and the broader agenda of ESG. Further, guidelines provided by regulatory bodies on the ESG initiatives act as a trigger for institutions to become ESG compliant.

As a result, commitment to the ESG criteria is fast emerging as the touchstone of good business practices. ESG business principles have gradually become more mainstream. Socially responsible and ethical behaviour defines the present and future of corporate standards. These non-financial goals are now at the forefront of corporate agendas. Owing to the growing demands of investors and stakeholders for companies to adopt these non-financial goals, many organisations have linked their executive pay to ESG targets.

Several drivers are pushing financial institutions (FIs) to embrace higher ESG standards. A few of these drivers have been highlighted below:

- Environmentally conscious customers want to take sustainable financial decisions. Customers today are willing to pay more for eco-friendly products and green initiatives so as to directly increase sustainability.

- Investors expect FIs to ensure that they are ESG compliant. It has been observed that organisations with strong ESG practices typically achieve demonstrably higher valuations and risk ratings than their competitors with lower ESG scores.

- Integrating ESG practices into core business activities can lead to a strong brand and market positioning in the community.

- Governments and regulators are also adopting drastic measures to make sure that operators in the banking industry act sustainably. Regulators and reporting agencies – including the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) – are also increasingly focusing on the ESG parameters.

ESG initiatives offer several benefits to FIs, which include reduced costs, financial inclusion due to social focus, positive stakeholder impact, and sustainable economies and value creation. Realising the importance of ESG, several FIs have actively started focusing on incorporating these aspects. Accordingly, the shift from ESG being just a buzzword to its actual application in global organisations is evident.

Overall, given how closely related ESG issues are to the payments industry, it only natural that a compelling ESG scenario could add value to this industry in the future.

ESG from a payments perspective

Having looked at the basics of ESG and its relevance for the entire economy, let us now focus on how ESG intertwines with the payments domain.

Integrating the ‘E’ with payments

What is ‘E’?

The ‘E’ in ESG stands for the environmental criterion. It indicates how an organisation interacts with and impacts the physical environment and ecosystems.

How can the environmental aspect be intertwined with payments?

The environmental aspect of ESG is a critical factor in the banking and payments space. To incorporate this in the upcoming ways of industry operations, payment firms and banks have introduced various initiatives, as illustrated below:

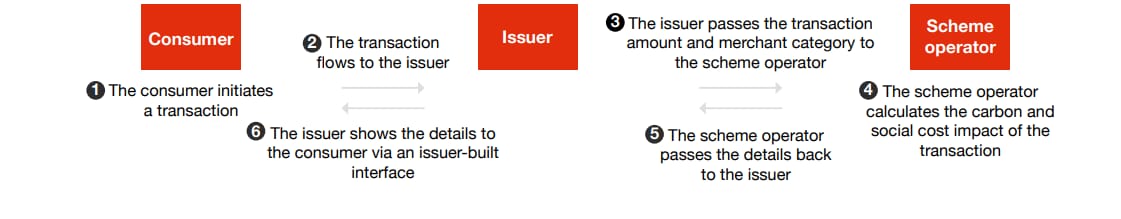

Payment transaction flow to determine the carbon and social impact of customers’ transactions

Application programming interfaces (APIs) to launch green products

Banks and technology vendors are repurposing the overall banking service capabilities to optimise their financial wellness goals and ESG impact. Retail divisions in various multinational banks have introduced additional APIs to collaborate with external partners who have committed to designing new green products and increasing customer awareness about the environmental impact of transactions.

For example, a Stockholm-based FinTech start-up and a bank have developed a solution that enables banks and FIs to offer transaction-based impact calculations to customers, using merchant category codes or invoices. This technology is available via one of the largest cloud service providers as a straightforward API that organisations can incorporate into their digital banking and payment services to provide clients with pertinent information directly.

Carbon offset rewards and loyalty programmes for financial transactions

Many FIs have started offering loyalty and rewards points for customer transactions in the form of carbon offset programmes.

For example, a leading global FI has introduced digital spending accounts that provide customers with prepaid cards that offer loyalty rewards designed to help customers reduce their carbon footprints. For every dollar spent on the card, the company offsets one pound of CO2 on the customer’s behalf. Moreover, the FI has one of its international reforestation partners plant a tree for every person who uses the card.

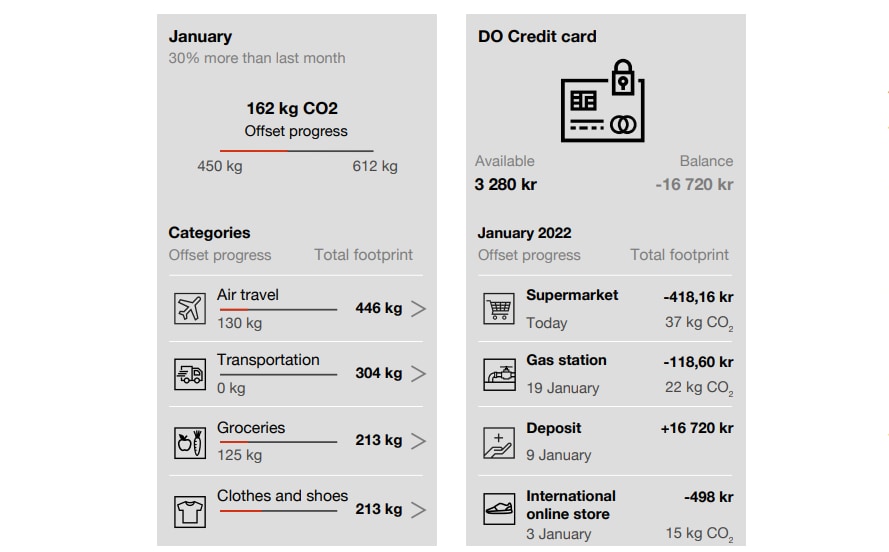

Samples of digital payments insights provided by an FI to a customer on a mobile app

Adopting eco-friendly materials for payments products

Recently, FIs are increasingly switching to green energy providers and vendors for low-energy lights in offices, ATMs, etc.

One of the best examples is that of plastic cards which have a significant carbon footprint. To help reduce this, eco-friendly credit cards are being introduced and distributed in order to offset the plastic ones. Today, many issuing banks have switched to biodegradable plastic cards. These are the ideal substitutes for traditional plastic cards as they are easily recyclable, chlorine free and nontoxic when burnt.

Apart from promoting the use of biodegradable cards, FIs are also enabling and encouraging customers to explore and make other eco-friendly and digital choices. Some of these initiatives include transacting with digital branches, making paperless payments, using biodegradable or recycled plastics for cards, using green PINs, and conducting virtual know your customer (KYC) processes instead of the paper-based ones.

The use of e-receipts in ATMs and point-of-sale (POS) devices has decreased the needless consumption of paper in manual transactions.

Use of sustainable FinTech products and technologies

Banks and FIs strategically deploy relevant FinTech solutions to drive sustainability in their products and operations and make sustainable investment decisions. This is often referred to as sustainable digital finance (SDF).

FIs use blockchain, machine learning, artificial intelligence, big data and internet of things to capture data and integrate sustainability into existing products and services and offer new sustainable product and service offerings. Recently, firms have also started considering ESG parameters while making investment decisions in the financial sector.

Integrating the ‘S’ with payments

What is ‘S’?

The social criterion, represented by the ‘S’ in ESG, refers to an organisation’s relationships and reputation among individuals and institutions in the communities in which it conducts business. This aspect comprises labour relations, diversity, human capital development, labour and management, working practices and conditions, health and safety, supply chain standards, and equal opportunity initiatives.

How can the social aspect be intertwined with payments?

Over the past two decades, the scope of the social aspect of ESG has progressively expanded, reflecting the changing business environment of the twenty-first century, where markets and businesses are becoming more integrated and interdependent. This criterion considers a company’s relationship with its community, customers, suppliers and staff.

The payments sector is addressing the social aspect through various actions for stakeholders. Some of these initiatives, being undertaken on the behalf of the stakeholders, have been highlighted below.

Initiatives for financial inclusion

Various initiatives are being implemented for the financial inclusion of the socially marginalised sections of society. Some of these are mentioned below:

- DBT programmes: In direct benefit transfer (DBT) programmes, funds are sent directly into the bank accounts of people eligible for pensions, scholarships, benefits and subsidies.

- Offline payments: In areas with a lack of or no connectivity or internet access, offline payments programmes help the underserved population to access digital payments modes.

- Financial literacy initiatives: These initiatives aim to raise awareness about financial services and products, help customers make well-informed financial decisions, adopt digital modes and protect their rights.

People development initiatives

Companies have been putting more effort into bringing about change within their organisations by assisting their staff, providing best-in-class training, creating employee engagement programmes, enhancing workplace diversity, and launching numerous digital upskilling and learning and development programmes for employees.

Encouraging ESG adoption among vendors and suppliers

Financial firms assess prospective vendors’ adherence to ESG factors while onboarding new vendors. Stringent ESG parameters are evaluated during vendor sourcing via the request for proposals (RFPs) process. Firms are now asking vendors to complete regular questionnaires for various parameters around sustainability. For example, a leading card scheme joined the Customer Data Platform (CDP) Supply Chain Program to collect accurate and frequent climate change and carbon information from key suppliers. This information was gathered through supplier questionnaires to identify areas for improvement and opportunities for partnership on emission reduction strategies.

Initiatives to raise social awareness

Several FIs provide mobile application features that record users’ spending and provide them with a report on the social impact of their consumption at the end of each month. Many of these apps track data points around issues such as diversity, employee pay, energy efficiency and carbon footprint. Using these apps, FIs can encourage companies and merchants to make significant environmental and social impacts.

Mobile app sample showcasing users’ spends, with a report on the social impact of their consumption

Integrating the ‘G’ with payments

What is ‘G’?

The ‘G’ in ESG stands for the governance aspect, which comprises the internal system of rules, controls and processes adopted by businesses to govern themselves, make effective legal decisions and fulfil the needs of external stakeholders.

Governance is an important and necessary parameter for any entity with a legal status. Business ethics, tax transparency, CEO compensation, shareholder democracy, and board diversity and structure are some examples of governance. Understanding this aspect of ESG is essential because governance risks will likely grow with the ever-changing social, political and cultural landscape.

How can the governance aspect be intertwined with payments?

The governance aspects of ESG pertain to decision making – ranging from formulating policies to allocating rights and duties among various stakeholders in organisations. These stakeholders include the board of directors, management, employees and shareholders. Although there are many aspects that make up governance, the key areas of corporate governance frameworks for businesses include organisational goals, functions and structure of senior management, as well as CEO compensation and management.

FIs need to ensure that all business decisions are made ethically and in compliance with the defined rules and regulations by the Government. The focus of corporate governance is to aid the development of the climate of trust, accountability and transparency required for promoting long-term investment, financial stability and enabling societies with better growth. An example of this is that of an Indian FinTech payments company, which in preparation for being listed on stock exchange, intended to increase transparency and rigour in governance by hiring independent directors.1

One of the key initiatives being undertaken by FIs is the linking of employee payouts to ESG goals. ESG is increasingly being adopted by various FIs as a new criterion in the CEO variable pay and incorporated into the top management’s key result areas (KRAs).

A leading card player has initiated linking incentive compensation for senior leaders to various ESG priorities such as gender pay parity, financial inclusion and carbon neutrality. They have also linked the bonus calculations for every employee to various ESG goals.

In addition, ESG data is being disclosed through ESG reporting. Several banks in India have started publishing a separate ESG report along with their annual reports. These ESG reports are aimed at raising awareness about a company’s ESG initiatives, improving investor transparency and encouraging other organisations to adopt and incorporate ESG programmes.

Implementing ESG

We have already discussed how ESG goals can be integrated in FIs. Let us now look at the key steps for integrating ESG principles in the operations of FIs.

Step 1: Determine the ESG approach and regulatory compliance requirements

FIs should recognise fundamental ESG principles, including sustainable development objectives and net zero goals or reduction of greenhouse gas (GHG) emissions. With the increasing focus of regulators and authorities worldwide on ESG, FIs must determine the ESG-related compliance requirements and applicable regulatory standards, and ensure that these are being followed.

In the Indian context, SEBI requires the top 1,000 firms by market capitalisation to include a business responsibility and sustainability report as a part of their annual reports. Therefore, companies are attempting to raise their ESG scores and complying with this regulation metric.

Step 2: Establish a stakeholder working group for ESG

To encourage and effectively track the implementation of ESG, FIs should evaluate the ESG priorities and identify internal stakeholders to drive these initiatives.

Step 3: Benchmark ESG results and outcomes

FIs must understand the methodology for computing the ESG rating and comparing it to industry standards. Accordingly, they can adopt initiatives that bring them on par with the industry.

Step 4: Create a key performance indicator (KPI) strategy

FIs can specify the KPIs for achieving ESG objectives at a departmental level. Thereafter, employee payouts can be linked to the KPIs achieved.

Step 5: Formalise stakeholder ownership

FIs must validate their key performance measures with stakeholders to ensure ownership and transparency.

Step 6: Create use cases

FIs should create use cases to achieve ESG targets, align them to a design or pricing framework, and test them to check for value addition.

Step 7: Track internal and external performance

FIs can track their internal and external performance by reporting on internal metrics and external scorecards. This can increase transparency around the present and future state targets.

ESG reporting helps internal stakeholders to evaluate and review the approaches related to ESG factors. Meanwhile, it facilitates external stakeholders to witness what a company is doing in terms of sustainability and social responsibility.

Step 8: Assess ESG results

FIs can partner with other industry players to conduct active checks to determine whether their proof of concept related to ESG initiatives has advanced.

Overall, FIs must develop an end-to-end approach to achieve their ESG goals.

Benefits of ESG

In this section, we discuss some of the key benefits of ESG for corporates, FIs, customers and regulators in the banking and payments industry. We also touch upon how value can be created in the payments sector by implementing the ESG components.

- Benefits for banks, payments industry and FIs

- Benefits for investors and regulators

- Benefits for customers

Benefits for banks, payments industry and FIs

- Reduced costs due to environment-friendly and digital alternatives: ESG reduces costs for FIs by including numerous measures like cutting back on paper use, recycling, switching to low-energy options and using eco-friendly raw materials.

For instance, digital payments technologies reduce the need for paper money. ATMs, which use resources such as electricity and paper, now provide an alternative in the form of mobile applications that do not require paper. Also, they are increasingly opting for e-messages/SMSs rather than offering paper receipts, further reducing paper use. Automated payments methods help simplify firms’ operations, reducing the expenses related to paper management and office supplies. Small businesses have been adopting various software options that do not require POS machines and instead accept digital payments. Owing to existing and upcoming digital payments modes, less labour is required to manage payments, which can increase labour cost savings.

- Strong brand and market positioning: Branding and community positioning can be enhanced by incorporating ESG practices into core business operations. Integrating an ESG focus into brand positioning is rare, yet an increasing trend among FIs. Today, FIs also prepare separate ESG and sustainability reports to promote a company’s brand image and better its positioning in the market. Moreover, firms that are planning to launch their initial public offerings (IPOs) are looking forward to strengthen their ESG scope and parameters.

- Increased worker motivation: Banks and FIs prioritising ESG attract new talent due to their elevated social position. As their work has a significant societal impact, ethical and social goals are prioritised to improve employees’ intrinsic motivation. Inclusion and diversity among employees are also encouraged by ESG principles, which enhance the overall working environment of the banks. Employers can thus manage to retain their current employees while attracting new ones, owing to policies that support employee wellbeing.

Benefits for investors and regulators

- Regulation favours strong ESG: As ESG factors are receiving more attention from regulators and reporting organisations (including the RBI and SEBI), ensuring compliance with these lowers the likelihood of unfavourable Government action for FIs.

- Positive influence on stakeholders: Nowadays, accomplishments in sustainability are acknowledged by stakeholders in addition to traditional KPIs. Stakeholders closely examine a firm’s mission statements, sustainability goals and its level of commitment to ESG goals before making investment decisions. On the other hand, investors of payment firms are also committed towards improving the ESG parameters to set a benchmark for the companies they are investing in.

Benefits for customers

- Increased customer acquisitions and revenues: The social aspect of ESG initiatives is being emphasised globally. Accordingly, FIs are now targeting previously underserved groups (rural population, gig workers, etc.) to promote their service offerings. The pointed focus of such ESG efforts has helped the underserved sections of society get access to better products, services, and credit and investment opportunities.

- Helps customers to make conscious decisions: Modern payments applications offer a range of analytical and statistical capabilities that may encourage users to spend their money on greener goods and activities and help them keep track of their sustainable practices. These applications can be used to promote the use of sustainable products and help customers make conscious choices.

Conclusion

ESG can ideally be described as a framework for stakeholders to understand how an organisation handles opportunities and risks connected to the ESG criteria.

Given the increasing focus on ESG initiatives within organisations – driven by consumers, investors and regulators alike – it is no longer an option but an important consideration for FIs. Customers are consciously demanding eco-friendly financial products, regulators are becoming stringent about the adoption of ESG practices, and investors are defining the ESG criteria as an important component of an organisation’s market positioning and brand image.

Considering this, FIs need to take a proactive approach towards integrating ESG in payments. As a next step, FIs can devise long-term and short-term strategies to implement ESG initiatives as well as to track ESG compliance. It is also important for the top management at FIs to allocate stakeholders and adequate resources to drive ESG-specific initiatives. Defining and targeting immediate ESG initiatives and tracking them until successful completion along with timely reporting are all crucial components of this endeavour. Overall, defining the roadmap towards being ESG compliant and proactively taking necessary actions will go a long way for FIs.

Having said that, incorporating ESG principles may seem like an additional financial and operational burden for some payment firms. However, if embedded correctly in a company’s culture and business model, it can be an opportunity for the organisation to maximise shareholder value, along with improving its brand image. Moreover, such a change would make it a part of an exclusive group that supports ESG in the competitive global market. ESGfocused financial organisations have the potential to achieve rapid growth, deliver ESG-focused innovation and attract new customers and investors.