Analysing faster payment systems (FPS)

A faster payment is a payment that enables real-time or near real-time availability of funds to the payee and is available nearly 24x7 in most supported payment schemes and systems across the globe.1 Fast payments are facilitated by the faster payment scheme and faster payment systems (FPS).

An FPS is an electronic payments system which facilitates inter-bank fund transfer and sends confirmation of payment to the receiver and originator within a minute or less (the time duration may vary across different geographies and payment schemes). These payments are irrevocable – i.e. they cannot be reversed by the payer or the financial institution once the transaction has been successful.

In this document, we have analysed the key points in the vision document and their implications for industry players. These have been categorised based on the focal areas below:

Evolution of FPS

In the last decade, the FPS have started to gain considerable attention across the globe in spite of being around for quite some time. In 1973, Japan launched its doJapan was followed by South Kmestic FPS known as Zengin, becoming the first country to do so. Originally, Zengin was a real-time gross settlement system (supported during weekdays within business hours) that underwent multiple upgrades over five decades. In 2018, it became a real-time payments (RTP) system supporting 24x7 operations for retail and wholesale transfers. Japan was followed by South Korea, which started its process of building an FPS in the 1980s and was able to launch a technologically advanced system in 2001. Other countries followed suit to develop their own systems including the RTP® network from the Clearing House in the US, Faster Payments Service in the UK, PIX in Brazil, New Payments Platform (NPP) in Australia and Unified Payments Interface (UPI) in India, to name a few.

In terms of classification, FPS across the globe can be broadly classified into two categories based on the way they were developed/introduced as depicted in Figure 1.

Figure 1: System categories

Using legacy/existing systems

- Developed by using legacy/existing payment systems

- Cost advantage by implementing incremental improvements coupled with minimum new developments to make system FPS ready

- Restricted agility hinders speed, functionality and scalability

- Examples: Zengin (Japan), SPEI (Mexico)

Creating new systems

- Built from scratch using latest technology and bottom-up approach

- Advantageous in terms of reduced complexity, increased scalability and flexibility to incorporate new use cases without sacrificing speed and overall system throughput

- Examples: NPP (Australia), UPI (India)

Source: PwC analysis

Growth of FPS

In recent years, technological advancements and market dynamics – coupled with radical global events – have put FPS at the epicentre of the global payments industry, financial markets and economies. The remarkable growth of the FPS can be attributed to the speed, security, accessibility, convenience and efficiency with which it enables payment transactions. As a result, all major economies worldwide either already have, or are working towards, building a robust FPS. Currently, 81 countries across the globe have live RTP2 and nine more have planned to go-live in the near future.

Looking at the trends of a few major economies, the payments industry has seen significant growth in the FPS transaction volume, reaching USD 118.3 billion in 2021 which depicts a 64.5% year on year (YoY) growth,3 with major contributions from developing economies like India (UPI – USD 48.6 billion) and Brazil (PIX – USD 8.7 billion). Going forward, this trend is expected to continue, mainly due to the increased adoption and acceptance among enterprises and consumers alike. The share of fast payments in overall nonpaper-based transactions is shown below is shown in Figure 2.

Figure 2: Share of FPS in overall non-paper-based transactions

Source: ACI Worldwide, Prime time for real-time global payments report

The top five economies leading the FPS adoption race are from the Asia Pacific region (APAC), with the exception of Brazil (Americas). Out of these, India is way ahead of its peers in terms of transaction volume, which is attributed to the countrywide roll-out of the UPI.

Figure 3: FPS transaction volumes in 2021

Source: ACI Worldwide, Prime time for real-time global payments report

Analysing the speed of FPS

Overview

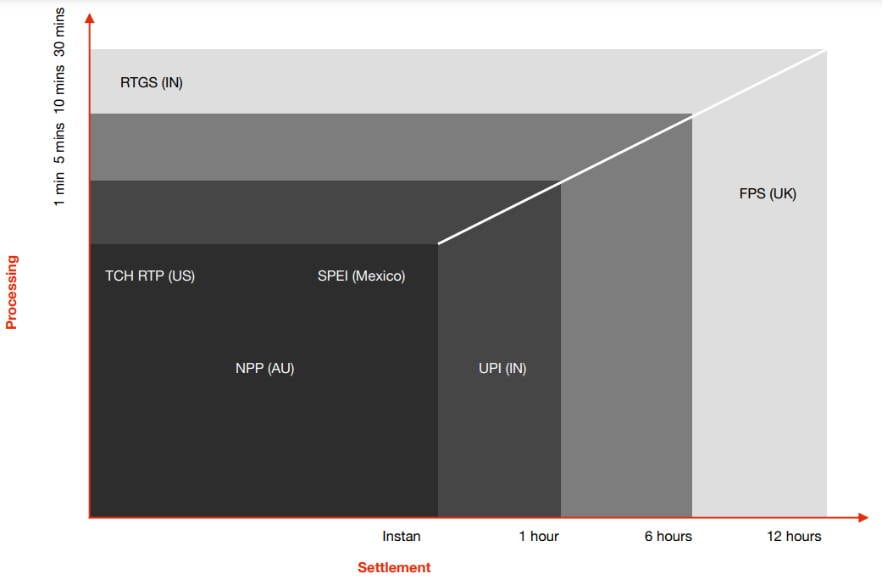

FPS, being one of the biggest financial innovations in recent years, needs three types of stakeholders to initiate and execute the transactions: payer financial institution (FI), payee FI and intermediaries. Further, these stakeholders play an important role in the time taken to process and settle transactions. Hence, the speed of payments can be calculated as the time taken for end-to-end payment processing and settlement.

A successful transaction consists of two key steps – processing and settlement.

1. Processing

It involves the transmission of payment information, payment confirmation and payment notification between the payer, payee and intermediaries.

2. Settlement

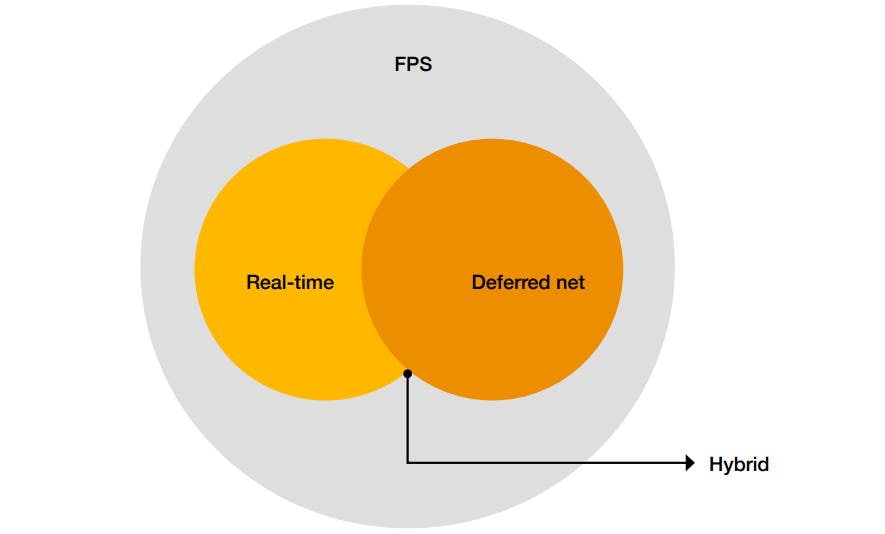

Owing to its similarity to RTP in terms of instant availability of funds, FPS is often confused with RTP. While FPS posts and settles the funds faster than traditional payment systems, it may or may not settle the funds between FIs instantaneously. An FPS can be categorised into three broad systems based on the type of settlement – real-time, deferred net and hybrid systems.

Table 1: Attributes of categories of FPS

| Attributes | Real-time system | Deferred net system | Hybrid system |

|---|---|---|---|

| Payment processing | Instant | Instant | Instant |

| FI-to-FI settlement | Instant | Delayed | Instant/ delayed |

| Type of settlement | Individual | Batched | Individual/ batched |

| Examples | NPP – Australia, TCH RTP – US | UPI – India | SPEI – Mexico |

Source: PwC analysis

Although FPS have been a huge value add to traditional payment streams, the route to achieve faster speeds from an FPS implementation continues to remain a challenge. This challenge is mainly with respect to offsetting high implementation and adaptation costs. The higher the expected results from an FPS implementation in terms of speed, agility and scalability, higher would be the cost to implement the system. Another challenge for FPS is the resistance of partner banks as these players have multiple, tightly coupled processes and making changes to such a system is exponentially risky. Hence, based on the end goal, different FPS implementations have different processing and settlement times based on the prioritisation of tasks.

Figure 4: Processing and settlement time of key FPS across the globe

Factors impacting the speed of payments

Multiple factors play an important role in the speed at which funds are processed and settled. A few of these have been highlighted below.

Technological factors significantly influence payments systems. With most other aspects being similar, technological advancements and their successful incorporation in a payments system is what differentiates it from the others, providing it an edge over its competitors. Some of the key areas that system providers can focus on include the following.

- System design

- Infrastructure

- Choice of messaging standards

- Straight-through processing (STP)

System design

A payments system has numerous components coupled together and each component can provide the intended outcome. As a result, a complex FPS may either necessitate numerous hops for a transaction between the components or depend on them for multiple activities, which will in turn increase the processing time. To maximise the speed of a transaction, minimum hops are recommended, which will increase the transaction processing requirements of each component.

Infrastructure

Hardware and networking are two important components of a payments system infrastructure. The processing power can be improved with a higher hardware configuration. Moreover, faster network throughput and lower network latency would also result in faster transaction processing. An example of this is the NPP in Australia, which was built from scratch to have better use cases, implementation flexibility and maximum output.

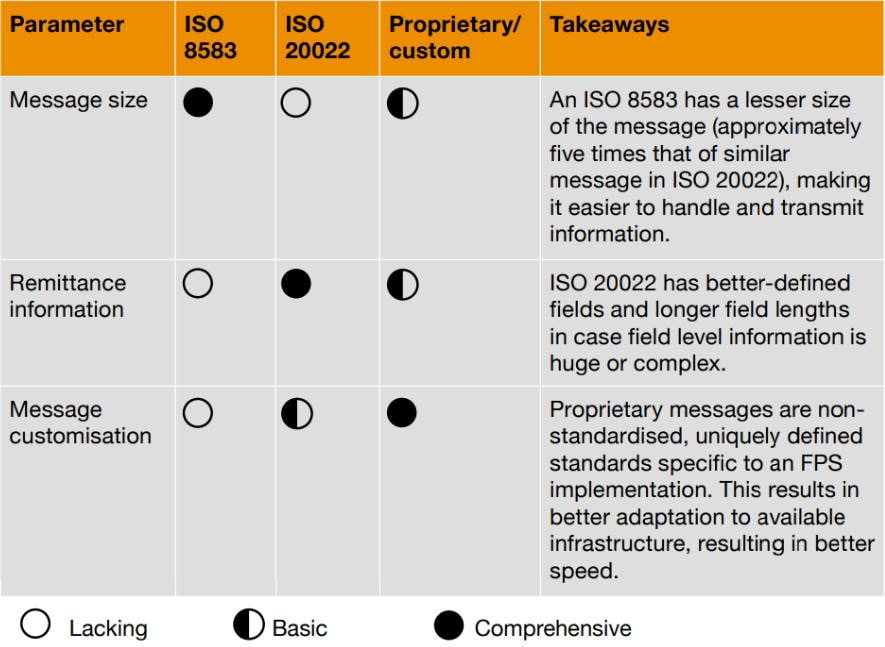

Choice of messaging standards

Messaging standards ensure that a message transmitted by one stakeholder is understood by other stakeholders while being machine friendly. There are three major types of messages used in FPS – ISO 8583, ISO 20022 and proprietary/custom messages.

The speed of payments varies significantly according to the messaging standards, which depend on the scheme requirements and expected outcome of the use case. Messaging standards can be compared using various parameters, of which the three most important parameters are shown in Table 2.

Table 2: Key parameters in messaging standards affecting the speed of payments

Source: PwC analysis

Generally, core banking systems are operational on legacy systems, which might not be compatible with any of the standard message formats defined above. Making changes to these systems is a challenging task. A resolution to this is using convertors which helps to convert one message standard to another based on field-level inputs.

Straight-through processing (STP)

The automatic processing of payment transactions, which requires no manual intervention, is known as STP. STP plays an important role in accelerating payments and boosting system effectiveness. In case an unstructured message type is chosen by the implementor, the derivation of a clear message (by bifurcating an unstructured input field) is difficult and may hinder the STP. This in turn will slow down the average transaction processing speed of the system.

Operational factors play an important role in the day-to-day working of FPS implementation. Some operational factors that determine the speed of payments are given below.

- Liquidity management

- Proxy resolution

- Message validation

- Transaction flow

Liquidity management

Most FPS implementations are available to end users round the clock, which increases the liquidity risks for payment service providers (PSPs). Transactions could get held up in a queue or get rejected if the PSP of the payer has insufficient liquidity for settlement. Therefore, additional operational arrangements are required to avoid liquidity risks.

Proxy resolution

Most FPS implementations offer end users the ability to make transactions using a proxy (mobile number, email, virtual ID, etc.) instead of their account or card details – for example, Zelle in the US uses email and mobile number as proxies. During a transaction, payee details are fetched from the payment scheme and the transaction is verified, adding another leg to the transaction, thus reducing the speed. This is a cost overhead as the proxies are to be maintained and fetched for each transaction along with an added hop in transaction processing. If complete account details of the payee are provided by the payer, it may improve the speed of the transaction and reduce the overall cost.

Message validation

The transaction message sent over an FPS needs to be validated for schema correctness and the presence of characters in a particular field. These checks can happen at one place (scheme, payer PSP or payee PSP) or multiple places during the transaction processing. For example, for RTP in the US, scheme validations are performed by the operator as well as the participants. The greater the number of checkpoints, better is the accuracy of the message transmitted. However, having more checkpoints will increase the processing time of the transaction.

Transaction flow

The transaction flow defined by a scheme greatly influences the speed of payments. Generally, the payee bank notifies the scheme with a positive/ negative response after validating the account details in the transaction message. Once confirmed, the scheme approves the response, and both payer and payee banks are notified to settle the transaction. In most ISO 8583 implementations, whenever a transaction message is received, the payee bank validates the message. Moreover, it settles (credits) the customer account before sending a positive response message to the payment scheme. This validation and settlement to the payee in a single leg increases the overall transaction speed.

These factors encourage participant collaboration while ensuring that scheme operations adhere to a pre-defined strategy.

- Customer authentication

- Transaction security

Customer authentication

Customer authentication is the first level of security installed in order to avoid unauthorised access to a customer’s account. The operator- or regulator-led guidelines define single or multiple factors to authenticate customer accounts. The speed of transactions is inversely proportional to the number of factors – i.e. higher the number of factors, lesser is the speed of transaction. Most FPS work on two-factor authentication systems.

Transaction security

Along with faster payment schemes, regulatory bodies across the globe place various sanctions on individuals, businesses, groups and regions, which need to be validated before a transaction is complete. For example. RTP in the US mandates fraud and anti-money laundering checks to be performed by the participants. These checks impact the speed of transactions.

Cost is an important consideration for FPS implementation. To achieve economies of scale and reduce the cost burden on end users, FPS providers may trade off transaction speeds with cost.

- Implementation cost

- Transaction settlement cost

Implementation cost

Implementation costs vary based on the utilisation level of the existing FPS infrastructure. An FPS built over existing infrastructure may provide economies of scale but may adversely affect the transaction speed. This happens as with the increase in the utilisation of network and hardware devices, the computing power and bandwidth decrease.

Transaction settlement cost

A transaction cost comprises both processing and settlement costs. Scheme regulators generally pass these costs to the end user or PSPs. To reduce these costs, transactions are batched, or netting is performed. Although funds are available to the payee instantaneously, there is a delay in the settlement from the FIs’ end, which reduces the overall speed of the transaction.

Key highlights from various implementations

Digital payments have undergone rapid changes due to the implementation of innovative solutions by industry newcomers, tech giants and PayTechs alike. The myriad of smart gadgets allow customers to make payments with improved speed and efficiency, unlocking a range of social and economic benefits. This makes payments one of the most influential technology sectors, while FPS is envisaged as the game-changer of the payments industry. Some of the innovations/trends in FPS are listed below:

Conclusion

Faster payments are gaining the required traction due to increasing customer demands for speedy transactions. Such payments are enabled by rapid growth in computing technology, transaction processing, decline in overall cost and a competitive market environment. Efforts are being made by different regions to foster their own FPS or upgrade their systems to make payments fast, seamless and convenient for consumers. Going forward, FPS frameworks will focus on quick and easy processing and settlement. Moreover, integration and involvement of key payments stakeholders will play a key role in streamlining and reducing the overall time to settle transactions. This will not only help stakeholders to offer enhanced solutions, but also help in streamlining processes by taking advantage of real-time data flow.

Speed in FPS will help promote liquidity as the transactions are settled fast between the FIs involved in the transaction as compared to traditional methods. This will require FIs to maintain lesser float in their transaction accounts. From a cash-management standpoint, insights from real-time payments will help to pinpoint the exact time and amount of borrowings required.

Additionally, the choice of settlement – individual, netting or hybrid – by the implementor will play an important role and depend on some key factors such as cost advantage, resource utilisation, reuse of existing components, and efficiency and adoption of a new use case.

However, FPS implementations can incur huge costs and involve considerable risks. In order to mitigate or control such risks, a detailed objective, in-depth research, and careful and comprehensive planning will be required to achieve useful outcomes.