Omnipresent banking: Redefining the financial supply chain

Banks have always tailored the delivery of products and services around the latest technologies. With the proliferation of smart devices and the increased availability of information from such devices, banks are now leveraging such data access to evolve to a ‘banking of things’ (BoT) model. By enabling banking services over smart devices such as wearables and sensors, banks can reduce visits to banking touchpoints such as branches.

Raising the bar for omnipresent banking

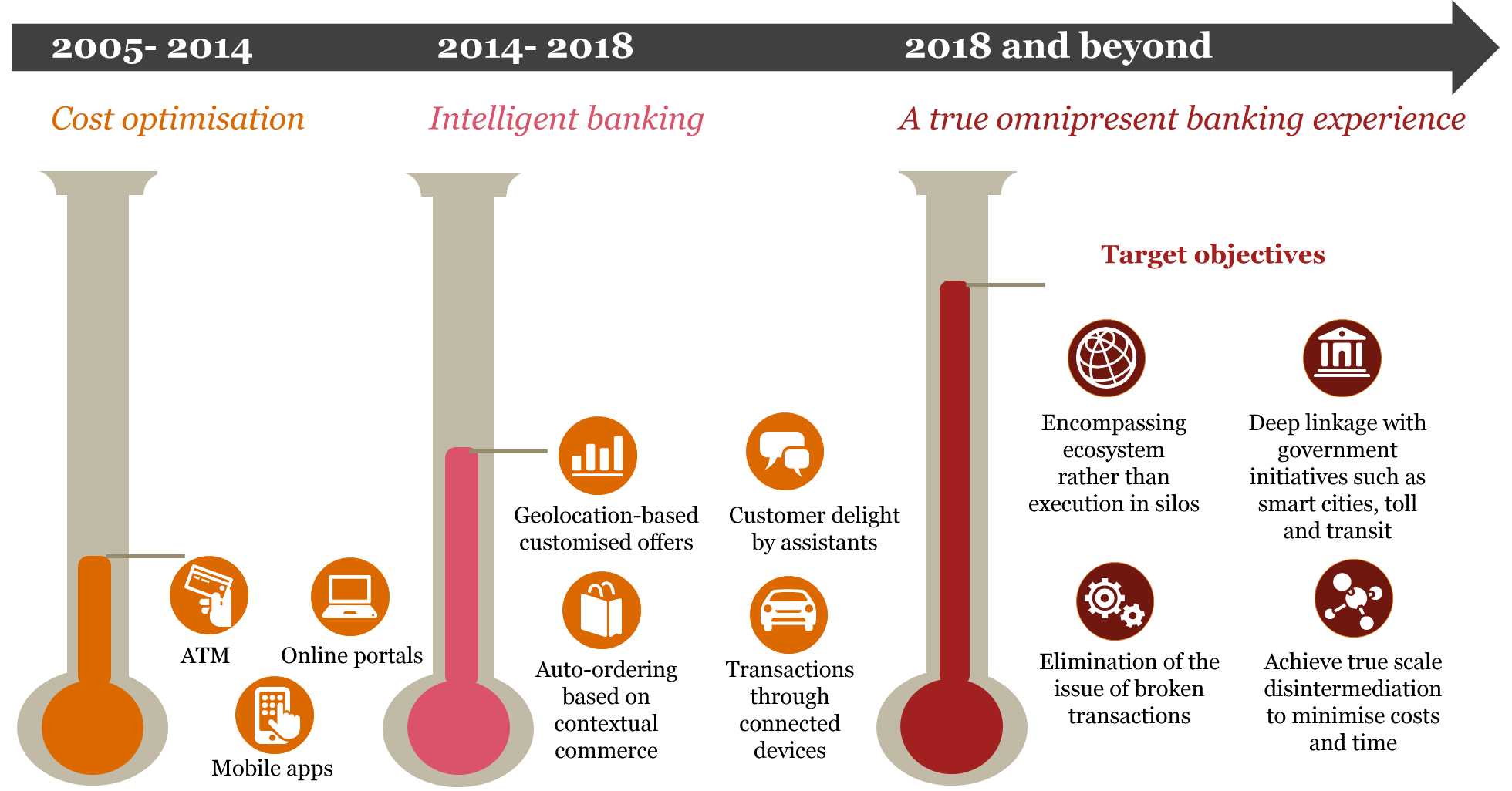

Banks worldwide are already making efforts to leverage the increasingly sophisticated technology built into end-user devices to generate rich real-time insights. However, such efforts have been restricted to disjointed use cases in specific closed loops. As a result, customers have still not been offered a seamless experience when they transition from a service provided by one firm to another.

Achieving a seamless omnipresent banking experience

An encompassing ecosystem will require participation from multiple stakeholders. Along with technological advancements, the key drivers would be interoperability and standardisation. Banks are no longer strangers to such models of openness. One of the major learnings of the FinTech wave has been the value of collaboration and building an ecosystem of partners. Banks and other FS players have realised the need for partnering with technology-forward start-ups, and must now look at restructuring their architecture in order to provide banking services beyond the traditional FS touchpoints.

A full-scale ecosystem for omnipresent banking

A potential future state of omnipresent banking

The standardisation of banking touchpoints and next level of usage of interconnected devices will transform the customer experience, and potentially lead to a state of true consistency:

While we should be mindful of challenges such as security and privacy concerns, low visibility of RoI, implementation issues and technological fragmentation, there is huge potential to change the game and make banking absolutely seamless.

Conclusion

The Indian FS industry continues to enjoy phenomenal innovation in terms of customer experience and service delivery. Industry players across FS sectors have already experienced the benefits of partnering with FinTechs who bring with them different technological capabilities and advantages to provide unique engagement options to customers. However, the ownership and final control of such propositions have remained predominantly with industry incumbents.

The current trends provide opportunities for superior technology companies and non-FS players to enter the FS space, as consumer experiences previously catered to by disparate industries begin to converge through digital platforms. Recent moves by global technology giants signal a changing landscape. Industry incumbents would need to step up their technological capabilities in order to continue to enjoy a superior economic position in such an environment.