Since its launch one-and-a-half years ago, Unified Payments Interface (UPI) has allowed full-scale interoperability in transfer of funds. The transaction volumes have grown 123 times from 2 million in December 2016 to 246 million in June 2018, while transaction values grew 58 times from 7 billion INR to 408 billion INR in the same period. With the launch of the second version on 16 August 2018, efforts have been made to shape UPI into an end-to-end digital transacting platform.2

Enhancing trust for both customers and businesses

One of the key asks in achieving massive adoption of digital payments is enhancing trust in digital transactions pan-India, both at the end of the payer as well as small merchants. UPI 2.0 aims at addressing concerns by providing more context to the underlying transactions. Most UPI transactions have been payer initiated and focused on person-to-person (P2P) transfers. The ability of merchants to send a digital invoice along with a collect request in UPI 2.0 can help the payer with the purpose of the request and boost collect request side transactions. Another noteworthy feature is related to the quick response (QR) code—the payment instrument which promotes digital payments at micro merchants. There have been instances of frauds in QR transactions in a few global markets where the code is widely adopted. The intent/signed QR feature is aimed at better establishing the authenticity of the payee and thus addressing such concerns and boosting offline merchant payments.

Salient features of UPI 2.0

- Linkage of overdraft account

- One-time mandate

- Invoice in inbox

- Signed intent and QR

Offering unique credit facilities

As of June 2018, there were only 3.93 crore credit cards outstanding in the country.3 In addition, a large number of customers with limited credit history struggle to avail credit facilities. There has always been room for more innovative products offering credit facilities, to help users to ‘defer payments’. Innovative features of UPI 2.0 such as one-time mandate activation and ability to link overdraft (OD) account are steps in the right direction for offering need-based, short-term credit facilities. The facility would allow users to avail credit through OD accounts, and in the process complete withdrawal/payments even if the account doesn’t have sufficient balance. This can be a significant contributor towards boosting both P2P and person-to-merchant (P2M) transactions.

There is thus huge scope to position enhanced UPI as a small-ticket, limited period, scenario-based digital lending platform, which eliminates the need for the customer to undergo any traditional credit risk assessment.

Tapping use cases

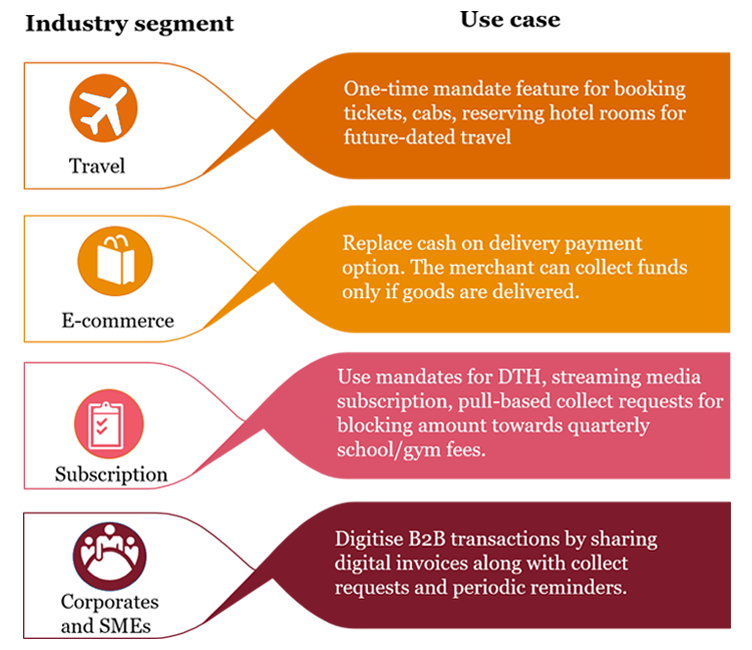

With the launch of the second phase, UPI has the potential to digitise the entire ecosystem around the core payment functionality. Financial institutions (FIs) can look at utilising the enhanced version of UPI and its features for multiple P2M transactions across innovative use cases. High-value products/services will now also become attractive for UPI transactions as the amount has been revised and capped to 2,00,000 INR. A few illustrative use cases are depicted below:

UPI 2.0 can serve as a great tool for financial institutions, especially for the collection of small-ticket loans. Banks can run a cyclical process to generate collect requests. The monthly EMI statement can be auto-generated and sent to the customer, along with such collect requests. The customer can view the details in the request and authorise it for instant repayment of EMIs.

Enhancing adoption

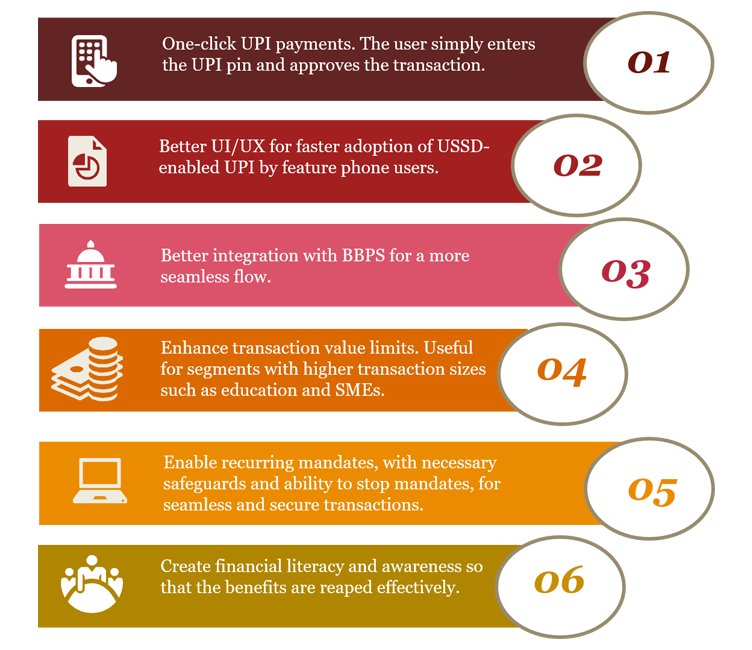

Although UPI 2.0 has many features that will make customer payments convenient and ensure better security during transactions, the introduction of certain new features can increase adoption. A few potential features are illustrated below:

There is huge potential to harness UPI 2.0 for the development of next generation digital platforms for lending and payments in the future. For instance, containers can be built over the core mandate feature in UPI for a seamless transaction flow. With digital invoices, UPI provides better context and information, along with transactional data. There is potential to aggregate and analyse invoice-level data to assess needs for invoice-based financing. These innovative models have the potential to provide the next level of digital experiences to the end user.

Sources:

1 NPCI. (June 2018). Retail payments statistics on NPCI platforms.

2 Gupta, K. (2018). UPI 2.0 launched. Here are its key features. Livemint. Retrieved from https://www.livemint.com/Money/Cog3dAvOZka0OsNg8M9S8O/UPI-20-launched-Here-are-its-key-features.html (last accessed on 20 August 2018)

3 RBI. (2018). Bankwise ATM/POS/card statistics - June 2018. Retrieved from https://rbi.org.in/scripts/atmview.aspx (last accessed on 20 August 2018)

Contact us