The Steering Committee on FinTech Related Issues, which has been constituted under the chairmanship of Secretary, Department of Economic Affairs (DEA), Ministry of Finance, submitted its final report to the Finance Minister Nirmala Sitharaman on 2 September 2019. The committee was constituted after a formal announcement by the ex-Union Minister of Finance Arun Jaitley, during his budget speech of 2018-19. The Report of Steering Committee on FinTech Related Issues draws attention to the objectives of the committee, which are:

- to consider various issues related to development of FinTech space in India

- to make flexible FinTech related regulations

- generate enhanced entrepreneurship in areas where India has distinctive comparative strengths, vis-a-vis other emerging economies

- focus on utilising FinTech to enhance financial inclusion of micro, medium and small enterprises (MSMEs)

We present an overview of the report’s key highlights and recommendations, which have been structured in line with the committee’s core objectives:

Measures required for expanding fintech services.

General policy, technology and databases related actions required for creating right environment and base for expansion of fintech and gov-tech services.

Measures required for expanding gov-tech services which would have implications for expansion of fintech services.

Organisational and administrative measures in Government of India for promoting and monitoring expansion of fintech and gov-tech.

Measures for expanding FinTech services

FinTech investments in India, which recorded only 54 deals worth USD 640 million (1.2% of global levels), are relatively lower in comparison to global investment records in FinTech which stood at a record USD 57.9 billion in the first half of calendar year 2018, in about 875 venture capital (VC), private equity (PE) and M&A deals. To expand FinTech services, the committee has made the following recommendations:

Actions on general policy, technology and databases

The committee has suggested some key actions that the government, regulators and public sector firms can take to enable FinTech growth in India and sustain its utility to solve problems arising from policy restrictions and lack of technology implementation. These actions consist of general government policies, financial regulations, technology policies, and better use of government databases, and focus on other areas where the government can act directly.

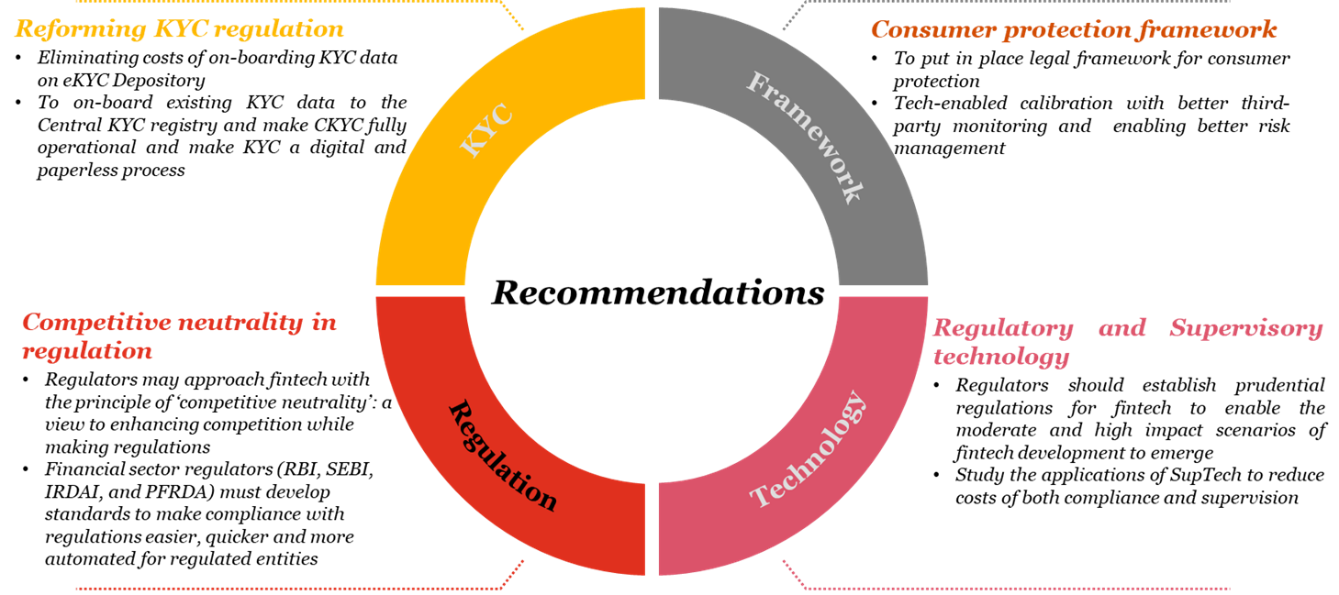

Recommendations for creating a financial regulatory framework

Other recommendations:

- Dedicated innovation teams and sandboxes in Public Sector Financial Services companies to evolve pronzising fintech solutions.

- Use Artificial Intelligence to automate back-end processes

- To develop public sector block chain-based trade finance.

- Encourage Remote Sensing & Drone Tech for Credit & Insurance

- Draw up a blueprint for Digitisation of Land Records

- Re-engineering Legal Processes by adopting digital alternatives

- Create APIs of relevant datasets which helps in building fintech solutions eg : India AgriStack, India MSME Stack

- Expanding Open Government Data which spaws new businesses and improves business models

- Regulators should consider permitting new or innovative business models that can reduce costs, enable choices for consumers, while preventing conflicts of interest

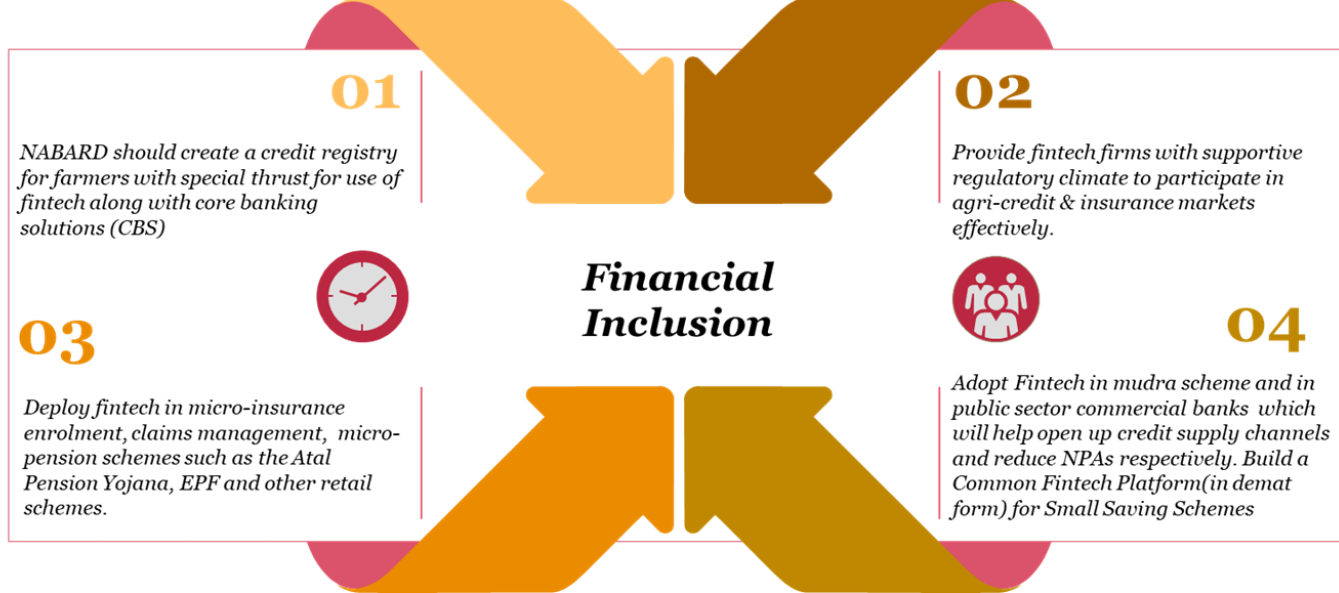

Fintech for financial inclusion

Many individuals and firms are outside the ambit of the traditional financial system and cannot access formal financial instruments. The key obstacles to financial inclusion can be overcome by using FinTech innovations. The committee recommendations for financial inclusion include:

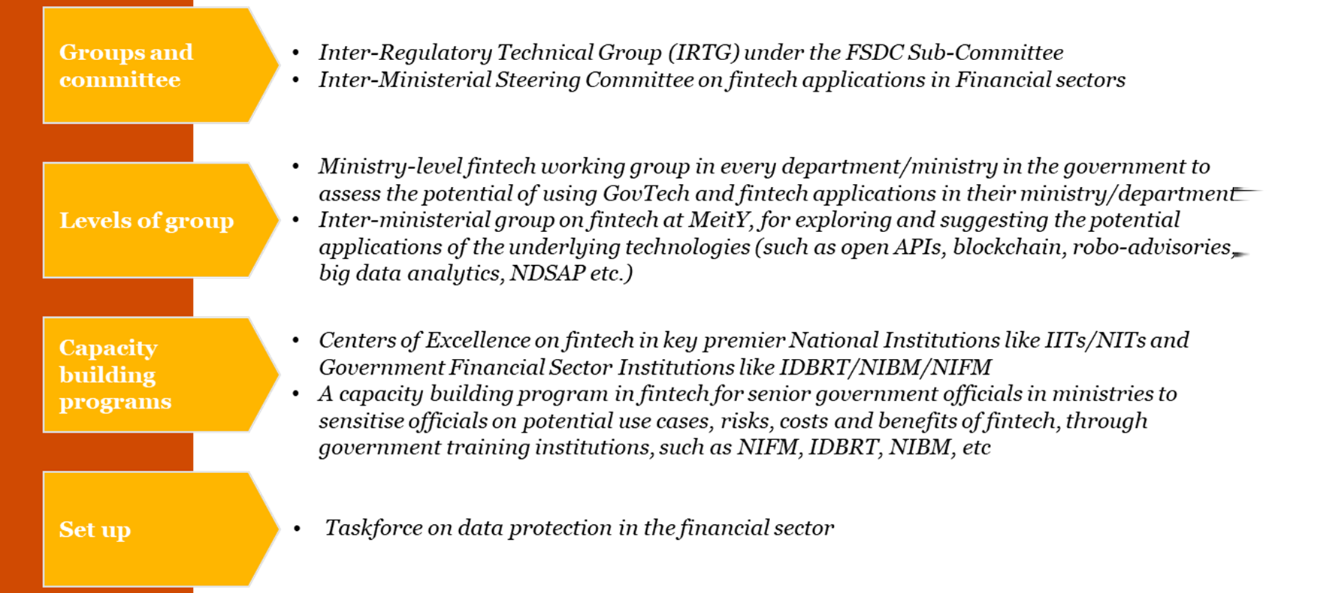

Measures for promoting and monitoring expansion of FinTech and GovTech

For the government and regulators to keep abreast of Fintech developments, it is essential that they interact regularly with stakeholders from industry, academics and consumers. This would enable a dynamic regulatory framework that is responsive to the latest FinTech developments, thus facilitating innovation and ease of conducting business. The committee believes that institutional arrangements need to be established at the Ministry of Finance and regulatory levels. The following section elaborates on how this could be achieved.

- Every financial sector regulator should set up an advisory council on FinTech to modernise the regulatory architecture, develop use cases for regulatory technology or RegTech and SupTech, design better risk management systems, and share innovation and consumer protection standards.

- Effectively build forums like the joint working group (JWG) set up between India and Singapore in 2018, to connect Indian regulators and the FinTech industry with foreign counterparts to enable cross-learning.

Apart from the above recommendations, setting up of other groups and organising capacity building programmes are also recommended, as elaborated below:

PwC’s point of view

Given the rapid pace at which technology is being adopted by private sector financial services, the committee has rightly recommended that the Department of Financial Services (DFS) work with public sector banks to bring in more efficiency to their work and reduce fraud and security risks. Significant opportunities in this area can be explored to increase the levels of automation using artificial intelligence (AI), cognitive analytics and machine learning in their back-end processes. The creation of a financial regulatory framework would enable the growth and development of FinTech in India.