Over the past twelve months, demonetisation has attracted mixed reviews, depending on the analyst’s lens. While a few businesses may have been impacted in the short to medium term, digital payments companies stand out as one of the most significant beneficiaries of the move. Post demonetisation, there has been a marked reduction in the resistance towards digital payments, and this medium should continue to see sustained adoption going forward.

Exponential rise in digital payments in the last one year

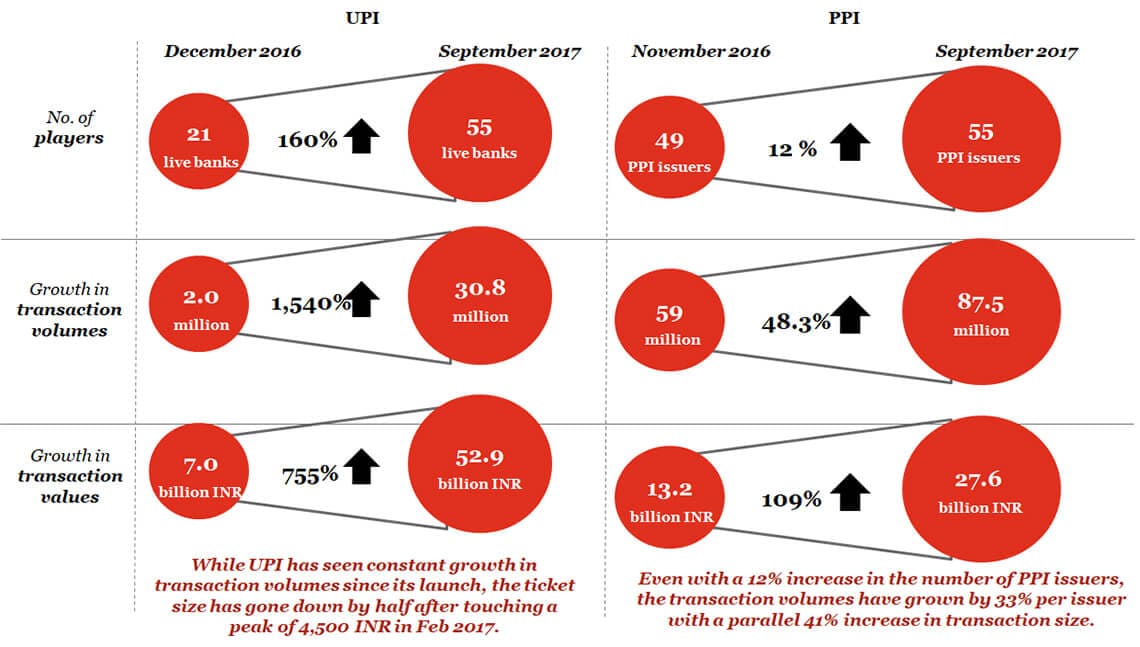

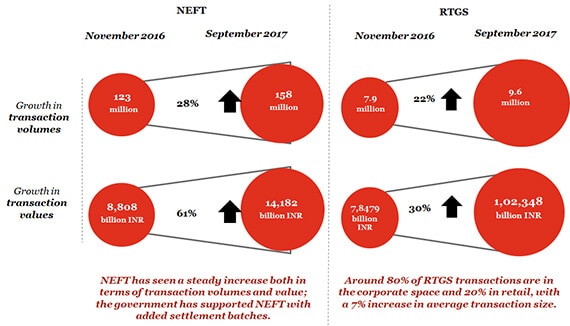

One of the talking points of the digital payments story has been the phenomenal growth witnessed by new age instruments such as Unified Payments Interface (UPI), prepaid payment instruments (PPIs), Aadhaar Enabled Payment System (AEPS), along with well-established ones such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS) and cards.

Notably, there has been an almost 50% decline in the average ticket size of UPI transactions, from 3,149 INR in 2016 to 1,717 INR in 2017. This was primarily due to the growth in the number of UPI-led micropayments post demonetisation.

Exponential increase in the use of new age payment instruments

The government’s push for the use of Aadhaar to authenticate transactions over micro ATMs and banking correspondent (BC) outlets fuelled the growth of AEPS over the last one year.

A few institutions have rationalised charges for NEFT and RTGS to encourage the adoption of these systems.

Steady rise in the adoption of well-established payment instruments²

Moreover, government promotions, emphasis on reduction in merchant discount rate (MDR) from banks, among other factors, contributed to an increase in card payments at point of sale (POS) terminals.

Factors that have driven the rise in digital payments over the last 12 months:

Embedding of offline space in the business growth strategy

Offline space has evolved into the most recent battlefield for payment service providers. Acquiring banks have deployed almost 29 lakh POS terminals across the country, up by almost 95% from last year. 3 This space has also attracted the attention of UPI and PPI players, and many of them have developed innovative solutions to assist large merchant outlets, micro-merchants, cash on delivery payment facilitators of ecommerce firms, etc., in accepting payments seamlessly over mobile phones. Customers facing issues with cash availability post the note ban began to experiment with these digital payment modes.

Building of ecosystem around digital payments

Quite a few players rolled out multiple solutions allied with digital payments, which further helped in their adoption. A notable few were:

- Integration of enterprise resource planning (ERP) of corporates with the UPI solution for real-time management information system (MIS) updates

- Disbursement of instant loans based on the footprint generated by digital payments

Boost to interoperability

One of the most significant changes in the payments landscape is the push towards interoperability, with instruments such as UPI allowing transfers between 55 banks, independent of the acquirer payment service provider mobile app.The increasing adoption of the Bharat Bill Payment System (BBPS), Bharat QR and interoperability guidelines for PPI players will lend a further push to seamless, secure and interoperable payments.

Promotional efforts by players

Several payment processing firms and FinTech companies leveraged demonetisation to penetrate the market. In an effort to expand their market share, quite a few of them offered loyalty points, instant cashbacks and referral rewards to users. While some may have doubts about the long-term sustainability of such offers, the promotional efforts definitely provided an impetus to users considering a switch to digital payments.

The way forward

The growth streak of digital payments is likely to continue in the future. The next push to the adoption of digital payments could come from relatively slow adopters such as the rural economy and the small and medium-sized enterprises (SME) sector. Government incentives such as discounts on digital GST payments and set-up of accelerator programmes will provide an added boost. A few specific use cases may emerge in the space of business to business (B2B) payments, Electronic Clearance Service (ECS) mandates, equated monthly instalments (EMIs), person to government payments (P2G) in smart cities, etc. These are likely to have a positive impact on transaction volume size going forward.

Sources:

1. NPCI statistics.

2. RBI statistics. Retrieved from: http://rbidocs.rbi.org.in/rdocs/content/docs/ELECT07022016_SEPT17.xls (last accessed on 7 November 2017)

3. Chitra, R. (October 2017). Banks prefer to increase PoS machines than ATMs. Times of India. Retrieved from https://timesofindia.indiatimes.com/business/india-business/banks- prefer-to- increase-pos- machines-than- atms/articleshow/61194451.cms (last accessed on 7 November 2017)