Digitising payments in the government sector

May 2019

Government business and opportunities for digitisation

The Government of India is divided into the executive, the legislature and the judiciary, which are empowered by the Constitution of India to formulate and maintain law and order in the country. The Central Government comprises Cabinet Ministers headed by the Prime Minister, while state governments comprise a Council of Ministers headed by the Chief Minister. The judicial system consists of the Supreme Court, a High Court in each state and district and sessions courts at the district level for interpretation of laws.

There are 57 ministries under the Central Government (Electronics and Information Technology, Finance, Environment, Forest and Climate Change, Defence etc.). Under the Urban Development department of State, the cities are managed and maintained by Urban Local Bodies (ULBs) which include municipal corporations, municipalities and panchayats depending on the population in the area. The mode of collection and payments in these government departments was predominantly cash, followed by cheque and demand draft.

With the increase in the population and number of transactions over the years, departments, the following challenges have arisen:

a. Issues in reconciliation of cash and cheques

b. Risk of revenue loss due to soiled or fake bank notes

c. Revenue loss due to human error

d. Long queues at physical locations

e. Cost of manpower deployment at each department

f. Lack of standardised process for payments

Growing adoption of digital payments in the government sector

The Government of India, through its Ministry of Urban Development, selected 100 cities in the country as ‘smart cities’. The main objective was to create a model city that is advanced in terms of infrastructure, services offering and citizen convenience.

The Digital India (DigiDhan) mission, which aimed to improve the online infrastructure in order to facilitate digital collection and payments, was a boost to the Smart Cities programme, and cities have begun to adopt digital payments for collection of revenue and disbursements.

Regulatory push for adoption of technology/ automation

The Government of India, along with the Ministry of Electronics and Information Technology and the Reserve Bank of India, has been actively promoting digital payments through various initiatives, decisions and mandates, which has increased digital payments. Banks have played a pivotal role in this endeavour by offering multiple payment services and channels to customers, in collaboration with various technology partners and FinTech players.

a. One Nation One Card: Promoted by the Ministry of Housing and Urban Affairs and with standards defined by the National Payments Corporation of India, these cards, also known as the National Common Mobility Card (NCMC), are based on open loop specifications. They can be used as debit cards at ATMs, as well as for seamless payments on the metro and rapid mass transport systems.

b. Public Financial Management System: It was rolled out as an end-to-end solution for processing of payments, tracking, monitoring, accounting, reconciliation and reporting of Central Government schemes. It also enables payments to be credited directly into a beneficiary’s bank account.

c. Committee on Deepening of Digital Payments: This committee has been constituted by the RBI to review the existing status of digitisation, analyse best practices, suggest safety and security measures, provide a roadmap for increasing customer confidence, and suggest a medium-term strategy for deepening of digital payments.

d. Strategy for New India @75 by NITI Aayog: The strategy details the current situation, constraints and way forward on financial inclusion, digital connectivity, smart cities and modernising of city governance for urban transformation

Use cases and benefits

Some of the use cases of digital payments implementation in smart cities are as follows:

- Building a mobile app/portal

- One City One Card

- Integration of payment gateways

- Direct Benefit Transfers (DBT)

- Value-added services (VAS)

- Transit service

- Availability of citizen services

Building a mobile app/portal

They enable the government to provide services such as payment of tax, informative services, transit and retail payments, and GPS-based services.

One City One Card

One smart card with a reloadable facility can be used for retail, e-commerce and transit payments, based on interoperable NCMC standards.

Integration of payment gateways

Payment gateways are being integrated and online payment instruments like cards, Internet banking and new age instruments like UPI, Bharat QR, mobile wallets and Bharat Bill Payment System (BBPS) are being enabled.

Direct Benefit Transfers (DBT)

Beneficiaries under various government schemes receive the amount directly in bank accounts linked with their Aadhaar number.Cards launched under schemes such as the ASMITA scheme, in collaboration with a private sector bank, are driving better health facilities for women by making subsidised sanitary napkins available to schoolgirls and rural women. Further, schemes to directly transfer fertiliser subsidies to farmers are being examined at by many state governments.By tightly coupling technology and payment innovation, DBT is being looked at as a tool to re-engineer the business process at the national level and to help in the betterment of society and citizen convenience.

Value-added services (VAS)

Value-added services like doorstep collections and DBT will further boost adoption of digital payments.

Transit service

Digitising of transit payments for bus, metros and other modes for commuters in cities, and offering payment options such as card, e-ticket and QR code-based tickets are being increasingly assessed.

Availability of citizen services

Digitisation of tax payments, booking payments, licences and certification, GPS attendance tracking, vehicle-related services, bus tracking and seat booking, grievance redressal, event information, polls, smart parking, citizen discussion forums, etc., is also being explored.

Government departments

• Increased operational efficiency

• Technological advancement and unified applications

• Automated reconciliation and settlement

• Time and cost efficiency

• Enabling IT infrastructure to process real-time payments and collections

• Reduced revenue leakages

Citizens

• Ease of access to services through online and doorstep facility

• Seamless experience across payments at various touchpoints in different departments

• Transparency across payments through digital record and account statements

• Security of transactions

• Awareness of services and new offerings

• Cost effectiveness

• Incentives and cashbacks

Banks

• Float income from smart city funds

• Revenue from card issuance fees

• Transaction charges on recurring basis

• Visibility and branding of bank

• Cross-selling of Cash Management Services and other banking products to departments and citizens

• New customer acquisition

Our point of view on future technology enablement

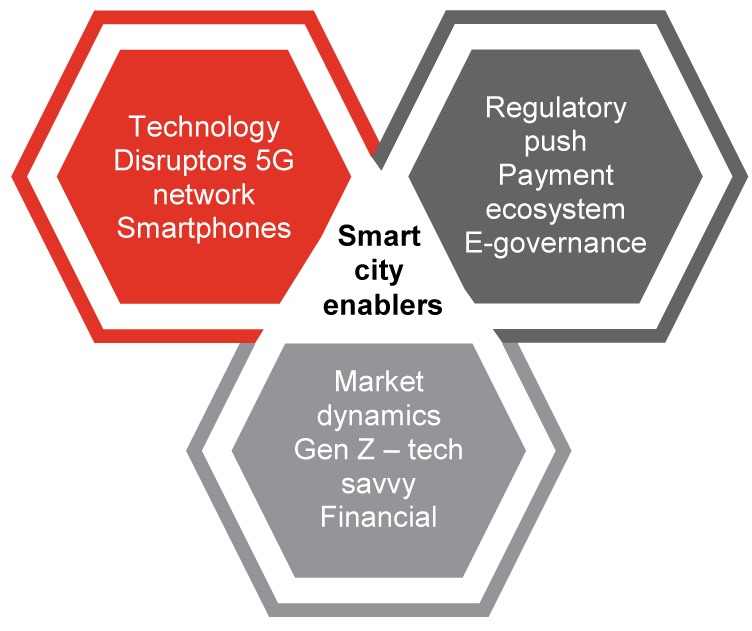

Digital payments have been a crucial development in the smart city story so far and are expected to receive a further boost going forward. There will be a paradigm shift from offline/cash/paper transactions to digital modes across multiple use cases. This will be facilitated by three major categories of enablers.

India is not just adopting digital payment technology but also developing new age payment methods. Government and private players are formulating a coopetition strategy (competing and collaborating) by adopting global best practices in the areas of smart city initiatives.

Smart city payment technology updates

One-Nation-One-Card: Here’s what you need to know about India’s public transport smart card

Business Insider

A RuPay smart card that aims to link all modes of public transport in the country. People will be able to book tickets, use it for metro in any city and pay for parking and withdraw cash.

Yes Bank Partners U.T. Administration of Diu to Launch Bharat QR

Yes Bank press release

Digitization project aims to benefit over 30,000 residents and 200+ retailers of Diu to buy daily essentials while also giving tourists convenience of cashless experience during their travel in DIU.

Ludhiana MC awarded for fastest growth in e-payments

Times of India

The municipal corporation (MC) has received an award for the fastest growing smart city (with population over 10 lakh) in digital payments. Ujjain, Amravati, NDMC, Bhopal, Pune, Bhubaneswar, Ahmedabad Pimpri, Chinchwad, Solapur and Port Blair have also been awarded.

Emirates Islamic teams up with emaratech for online government payments

Finextra

Emirates Islamic has partnered with Emaratech to enable individuals and businesses to make electronic payments for a range of government services in UAE via the noqodi payment gateway.

PM launches integrated command, control centres in five northeast cities

Business Standard

Prime Minister Narendra Modi launched integrated command and control centres, which use technology to integrate services like police, transport and water, for five cities in the northeast.

PNI Sensor’s PlacePod Smart Parking Solution Now Available in India

Business Wire

The city of Amritsar, India uses PlacePod sensors in curb-side parking spaces to minimize illegal parking, reduce traffic congestion, and maintain open lanes for emergency vehicles to pass.