Decoding India’s credit card market

July 2022

Credit card industry in India

The credit card industry has grown tremendously in India. There are many developments happening in the space, with varied innovations and changes in technology. These new developments offer smooth onboarding journeys, differentiated card products, personalised offers and rewards, and better mobile apps, which have proved to be greatly beneficial to existing customers and attracted new customers as well. Credit card issuers are also making efforts to bring further innovation and awareness to this space. The same can be seen from the significant growth in India’s credit card market.

The credit card industry in India has witnessed a compound annual growth rate (CAGR) of 20%1 in the last five years. The number of credit cards crossed 78 million in July 2022.2 Moreover, in May 2022, the overall credit card spend reached its highest-ever number of INR 1.13 lakh crore.3 Despite the considerable overall increase in credit card spends, the growth trajectory dipped during FY 2020–21 due to the COVID-19 pandemic, when it increased marginally by only 9%. Also, there were a few interventions by the Reserve Bank of India (RBI) which barred some of the largest credit card issuers from issuing new cards in India.

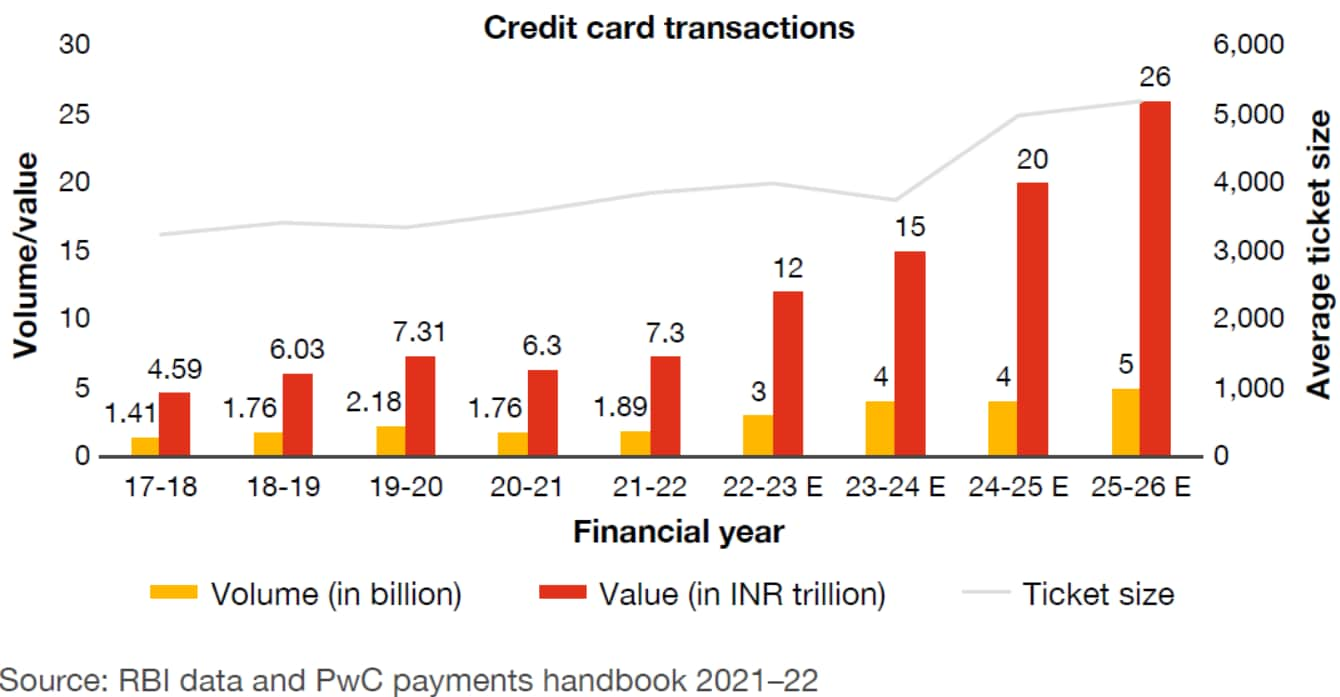

Source: RBI data and PwC payments handbook 2021–22

With the emergence of e-commerce, adoption of contactless payments and changes in the value proposition, the post-pandemic credit card space has undergone a considerable change and is evolving constantly. Credit card issuance increased by 15% during FY 2022.4 However, 80% of the credit card base is concentrated with the top-six issuers in the country.5 In the last three years, three banks have entered the credit card space as issuers. Further, owing to the ongoing and upcoming developments in the space, the credit card industry is expected to grow at almost thrice the speed in the next four years.

Along with credit card issuance, the transaction volume, value and average ticket size have also grown significantly. For FY 2021–22,6 the transaction spend has increased to INR 11.5 trillion – a 1.8 times growth from FY 2020–21, where the total spend for the year was INR 6.3 trillion.

Card-based transactions are expected to grow by 16%7 year-on-year for the next four years. Also, RBI Payments Vision 2025 has outlined that card acceptance infrastructure will increase to 250 lakh touchpoints,8 which will further boost transactions in India. The average ticket size has undergone a steady growth of 7.3% after recovering from the dip in FY 2019–20. This indicates the customers’ increased preference towards credit cards as a payment mode for high-value purchases.

Having said that, India is still largely an underpenetrated market, and only 3% of the population has a formal credit card.9 Traditionally, the Indian population has been operating in a conservative manner when it comes to using credit cards and is generally averse towards using these. However, major players in the payments ecosystem are now working towards changing this scenario by introducing various developments and spreading awareness about using credit cards in daily transactions. These developments and the consequent changing trend in customer behaviour have been discussed in detail in the upcoming sections.

Market evolution for credit cards

The last decade in the credit card industry has laid the foundation for constant evolution and growth of the same. With its steady focus on newer customer segments with differentiated product offerings, loyalty and experiences supported by enabling technology platforms and solutions, the industry is expected to grow exponentially in the upcoming years.

Focus on new customer segments

Traditionally, credit card products are focused on specific segments and groups such as people with high income, salaried professionals, population in tier I cities and customers with a good credit score.

Thus, there is an emerging need to penetrate newer segments that would widen the customer base for credit cards and encourage their adoption among masses.

Segments with low penetration

| Parameters | Low-penetration segments |

|---|---|

| Location | Tier II and III cities |

| Occupation | Self-employed professionals |

| Age | 18–25 years 55+ years |

| Income | Customers with income in the range of INR 2.5–5 lakh |

| Relationship | New to credit |

Tier II and III cities:

As per the RBI, 65%10 of the credit card penetration is present in tier I cities. Comparatively, the penetration in tier II and III cities has been significantly less. However, with the introduction of new business centres in tier II and III cities – such as Surat, Nashik and Kanpur – the increase in economic activities, entry of major brands across categories and emergence of manufacturing and service-based economy, there has been a considerable increase in the salaried customer base in these cities. Considering this shift, it is essential that product propositions are appealing and focused on the key demographic in these cities. To facilitate this, customer segmentation becomes one of the most critical activities for the issuing banks. Therefore, issuing banks must understand their target customers and make an effective customer acquisition strategy accordingly.

Self-employed professionals:

The self-employed professionals such as freelancers, doctors, chartered accountants and architects, remain one of the least-penetrated segments in the credit card industry. Today, a few FinTech players offer products catering to business-related credit-cumpayment needs of a self-employed professional. Entry of new players with differentiated offerings, coupled with value-added services, will help deepen the penetration of this segment.

Early jobbers:

Early jobbers, who typically fall within the age bracket of 18–25 years and are new to the employment market, generate a substantial demand for credit cards. However, the non-availability of credit history and low starting income have restricted the supply of credit cards. To curb this, some credit card issuers have started the issuance of cards with lower limits. It is expected that this will encourage the adoption of credit cards in this segment. Moreover, issuers may later offer upgraded and complex product propositions to the customers.

Rewards and loyalty programmes

Rewards and loyalty programmes play a critical role in the use and adoption of credit cards. These programmes act as differentiators for the issuers.

Earlier, rewards programmes involved the accumulation of reward points over a period for catalogue redemption in future. However, due to the increasing customer inclination towards instant gratification through cashbacks and discounts, rewards programmes today are undergoing a major shift.

There are mainly three types of reward programmes available for credit cards:

- merchant funded

- issuer funded

- hybrid reward programmes.

In addition to these existing programmes, curated reward programmes are being introduced by issuers in partnership with third-party players from different segments such as travel, entertainment and shopping. This will help issuers to provide differentiated offerings, create better relationships and build engagement with customers.

Credit card issuers are also engaging with standalone rewards and loyalty programme service providers in order to provide customers with a platform to redeem reward points. A well-designed portal for the same can help credit card issuers in improving the below-mentioned key areas.

Card activation

Brand value

Card spends

Customer acquisition

Customer engagement

In the last few years, it has been observed that the credit cards that provide a good rewards structure, loyalty benefits and various redemption options often sell well as compared to their counterparts. Issuers have now started to move away from the common practices of enticing customers with signup rewards and airport lounge access. Instead, they now focus on reward programmes and redemption flexibility. Post the pandemic, issuers have been quick in introducing and modifying their reward offerings. For example, the travel industry suffered considerably during the pandemic; thus, reward programmes were altered to focus on everyday expenses like groceries, streaming services and food delivery. The competitive nature of this space may eventually manoeuvre issuers towards flexible rewards and better loyalty benefits and therefore, deliver more value to the customers.

Hyper-personalisation for credit cards

Currently, the hyper-personalised experience (HPE) is one of the most talked-about topics in the banking space. Customers now prefer curated experiences and services for financial products. In India, several banks and FinTech entities have taken the digital-first approach and are using data analytics and artificial intelligence to generate personalised service offerings for customers. The credit card industry is no exception to this trend. Moreover, because the industry needs differentiation, there is no product which can fall into the ‘one-size-fits-all’ category.

Hyper-personalisation leverages data and analytics to identify customer needs and provide personalised offers or discounts on credit cards. It plays a critical role in defining customer journeys and rewards and offers management wherein customer behaviour is analysed for spend patterns. These spend patterns help card providers to target customers with dynamic reward programmes in order to enhance their experience and increase spending.

This is an important use case where customers choose the underlying value-added offerings on the card, such as cashbacks, rewards, travel, lifestyle and other offers. In future, it is expected that more such cards will be offered by different issuers.

Technology enablers for credit cards

Digital transformation is happening across industries and the credit card industry is no exception. Cognisant of the changing times and needs, the established players in the ecosystem are upgrading their offerings to more advanced platforms. These players are improving their existing technology stack and processes with the help of technology partners across various areas such as customer onboarding, underwriting and card processing – including virtual cards and instant issuance.

New-age service providers have designed solutions which are easy to integrate and enable faster go-to-market along with supporting launch of innovative products for credit cards. These solutions are hosted in the data centres of the solution providers and are made available to new and smaller issuers in the form of pay-per-use models. These home-grown service providers are assisting the issuers by delivering cloud-enabled CMS platforms which have modular capabilities and provide better user experience.

Legacy players in this field – who provided their solutions on licenced models, especially to major issuers – are transforming their business models and modifying them according to the emerging market needs. They have gradually moved to offer their solutions to the issuers as a pay-per-use model along with managed services.

Due to the pandemic, issuers rapidly enabled the digitisation of processes across the value chain, which covered services from onboarding to know your customer (KYC), settlements, repayments and customer services.

Moreover, issuers are closely working with various solution providers, such as IT companies and FinTech players, to create seamless and faster processes. These collaborations have resulted in providing different services for the issuers, as listed below.

Digital onboarding journeys

APIs integration stack

Fraud management modules

Underwriting modules

White-labelled mobile apps

Emergence of FinTech players in the market

FinTechs have considerably transformed the payments industry by providing ease of conducting transactions. As a result, customers have started to expect enhanced experiences and services from traditional banks.

In recent times, instant issuance of cards is becoming the norm. The availability of these cards in a virtual form on mobile applications allows customers to easily perform transactions on e-commerce websites. This helps in increasing the activation rate of the cards and initiates early engagement with the cardholders. Credit lines offered by cards through prepaid instruments have gained immense popularity among the millennial and Gen Z population across the country. Faster onboarding and instant availability of credit were the unique selling proposition for these players. These low-value credit lines emerged as a worthy payment instrument in the low-penetrated segments in the credit cards industry.

However, RBI guidelines have barred issuers from loading the prepaid payment instruments (PPIs) with credit lines. This has affected the business models of various FinTech players. Consequently, many players have stopped issuing new cards owing to the lack of regulatory clarity. Currently, FinTech players are exploring options such co-branded cards and allowing partner banks to issue add-on debit cards after opening a bank account.

Evolution in the credit card business models

In recent times, there have been many developments in the credit card business models where issuers have evolved their traditional, co-branded, and bank identification number (BIN)-sharing models.

Traditional credit card model

In this model, credit card issuers create standalone products without any partner having dedicated revenue sharing. However, the issuers may enter into arrangements with technology partners for availing their services. Thus, the ownership for platform development lies with the issuer, and the licence is provided by the technology partner. This partner may also customise and implement the platform and provide managed services of the same for the next 3–5 years. This business model pushes the issuers to have in-house capabilities – from acquisition to servicing. Moreover, it helps the issuers in their digital transformation to build strategies for digital acquisition, technology improvements, mobile applications and customer journeys.

This type of model may require a considerable amount of time and investment initially, but the returns are high as the revenue and profit earned by the business do not have to be shared with third parties.

Co-branded partnerships model

In the co-branded business model, the issuer partners with another brand. This partnership is based on the revenue sharing of interest subvention and fee incomes. A dedicated credit card product is built by the issuer with customised offers for the partner brand. The issuer bank must build their infrastructure like standalone credit cards model for different channels to provide digital onboarding, customer servicing and rewards. As the customer is managed directly by the bank, the co-branding partner is mostly responsible for sourcing and marketing to new customers.

Sourcing customers is easier in this model as the partner brand helps in customer acquisition and marketing for the co-branded credit cards. In addition, cross-selling of other products is also possible for the issuers, once the customer is onboarded. However, due to the recent RBI guidelines, any entity apart from the issuer bank cannot have access to transactional and customer data, thereby making cross-selling for partner brands difficult.

In the last two to three years, this business model has been adopted widely. By using this model, large banks have partnered with e-commerce players and witnessed an increase in credit card sales. The emergence of co-branded cards has attracted the attention of the RBI, who have introduced multiple guidelines to safeguard the customers’ interests. The new guidelines limit the co-branding partner to marketing and customer acquisition, while the transaction information and customer account details reside with the banks.

BIN-sharing business model

In this model, the credit card issuer shares the BIN with the partner, who then uses it to issue credit cards. These partnerships work on the sharing of interchange fees, or a fee-per-card model, where both entities earn whenever customers perform transactions. The partnered company is the customer-facing channel, while the main issuing bank works in the back end. The partner helps the bank to co-create the product, perform underwriting services and enable other critical factors required for the credit card business to function.

Players in this space have been leveraging technology to attract customers and issued a significant number of credit cards in India. This helps issuing banks to increase their issuance in minimum time for going to market, and enable a revenue stream without much effort.

The BIN-sharing model has gained prominence in the last two years.

However, the recent RBI guidelines on data sharing might impact this business model going forward, as partnership firms will need to reimagine and alter the model in order to stay relevant in the current market.

Impact of other payments products

The growth of digital payments has disrupted the credit card industry lately. The penetration of smartphones and affordable internet prices, along with almost all merchants having the required permissions in place, have enabled a rapid increase in the Unified Payments Interface (UPI) transactions in recent years. At the same time, many FinTech players are providing credit cards in collaboration with traditional banks and digital lending via buy now pay later (BNPL), equated monthly instalment (EMI) and other services. In the following sections, each of these products is discussed in detail, along with its impact on the credit card industry.

- UPI

- BNPL

UPI

Currently, only RuPay cards are allowed to be linked to the UPI apps. Now, the RBI has permitted the linking of credit cards to UPI. This can facilitate quick response (QR)-based payments at physical stores using credit. Moreover, it will simplify the payments processes for consumers because it will allow various payment methods from a single app.

The RBI has specified that the linkage should have a clear differentiation between person to merchant (P2M) and person to person (P2P) transactions, as the success of UPI as a payment rail will depend on the differentiated charges and service fees being applicable across the value chain. However, transactions may end up becoming expensive in the process as earlier, these did not require payment of additional fees to the card issuers.

For example, the merchant discount rate (MDR) that contributed to 1–2% of the overall amount, and interchange fees – which contributed to 1.81% of the overall amount transacted for point of sale (PoS) systems11 – were exempted earlier. For the specific use case of linking UPI with credit cards, there will be a need for an MDR that remunerates participants across the transaction value chain to maintain the value propositions offered by credit cards as a consumer credit-based financial product.

The guidelines may also impact chargebacks, frauds handling, customer compensation, turnaround time (TAT) for query resolutions, etc. Presently, more clarity on the same is awaited from the RBI.

BNPL

The BNPL sector in India has witnessed an exponential growth in the past few years. BNPL total transaction volume is expected to surge at a CAGR of 67% since inception and reach 2 billion by FY 2025–26.12 However, currently, the adoption of BNPL is limited by the fact that it has a credit limit ranging from a couple thousand to INR 1 lakh. In addition, it is not widely accepted across merchant websites and retail outlets as card payments.

Keeping this in mind, BNPL can be viewed as a service complementary to the credit cards. As more BNPL providers and products enter the growing market space, customer needs are being prioritised. Banks and traditional lenders can therefore look at BNPL as an opportunity rather than a contender.

The millennial and Gen-Z customers are currently looking for alternatives rather than paying interest on credit cards. This is forcing traditional lenders to be more competitive. As the digital world evolves at a faster pace, people expect financial services to provide various options to improve customer experiences.

BNPL offerings provide feasible credit-based payment options to the unbanked and underbanked customers. Issuers can leverage the advancements in technology to access and aggregate customer data in order to make better credit decisions for customer segments that fall out of the traditional credit metrics. Recent RBI guidelines restricting the business model have impacted the growth of this financial product. This has prompted the players to re-invent the offering and business model in order to remain compliant with the new guidelines. It is expected that BNPL players will re-invent their offerings to provide credit-card based BNPL – a model more prevalent in other countries. These offerings will be closer to pure play credit cards.

Further, KYC and collection of BNPL dues will remain as the two main focus areas for the issuers. It is expected that this will ensure compliance of the KYC terms by FinTech entities and implement changes for a better risk management infrastructure. Moreover, making use of an account aggregator framework will help in overcoming this problem. Tie-ups with financial institutions and using their networks for issuance and collection will further impart the much-needed stability to payments operations.

Key regulatory interventions

The RBI guidelines on the provision of credit and debit card-issuance and conduct issued on 21 April 2022 are expected to have several repercussions on the credit card as well as the money lending industry.

The key guidelines and their impact on the credit card industry are discussed below:

Non-banking financial companies (NBFCs) get a boost to enter the credit card market

The RBI has recently had a more accepting stance towards permitting NBFCs with a minimum net worth of INR 100 crore to start their credit business with prior approval.

This move will allow the entry of new players, which will increase the competition in the credit card space. With a prioritised focus on untapped customer segments and leveraging the existing relationships, a huge customer base will soon be available for credit card issuance.

Focus on customer centricity

The new guidelines address and instruct the banks to take necessary steps around the areas listed below:

- Publish key fact statements: Banks are expected to publish all the board-approved policies on their websites. In addition, all the key fact statements are to be shared with the customers. While initially this may result in the increase in operational load – as banks have to inform the customers through multiple channels – it will result in a well-informed pool of customers and ultimately reduce the number of customer queries. To facilitate this, banks can create a dedicated portal for all the policy documents available, which can then be accessed via their dedicated websites and mobile apps.

- Focus on activation campaigns: After applying for a credit card, if the card is not activated within 30 days, the issuer has to close the card without any charges. To avoid shrinkage of their portfolios, issuers may have to invest resources for activation campaigns.

- Bifurcate and share all charges: Issuers are required to bifurcate all the charges, interest, discounts, etc., applicable to a customer. This will provide clarity to customers in terms of the structure of the applicable charges for each product used. In the longer term, this will reduce fees and charges-related disputes, the direct impact of which would be apparent on various issuer operations.

- Provision for one-time change in the billing cycle as per preference: Allowing customers to opt for alternative billing cycle once, as per their preference, will help to align their billing cycle with their cash inflow cycle. Issuers, in turn, will be impacted in terms of managing their cash flows, as most of the repayments may be made closer to the salary payout days. This can further impact the revolver base and marginally reduce revolver interest and associated fees and charges.

Entry of new players

In the last couple of years, the credit card market has seen an influx of new players introducing new offerings that were welcomed by the customers. As traditional players have not been able to match these expectations, they have introduced new offerings in the credit card market.

Why should NBFCs join the credit card space?

We have seen how the market is booming for the credit card industry. As mentioned already, the guidelines shared by the RBI allow NBFCs to enter and issue credit cards to their customers.

How can NBFCs become successful in the market?

- Cater to the untapped market: In recent years, NBFCs have been trying to reach an untapped section of the market – specifically, those living in tier II and III cities. Retail and micro, small and medium enterprises (MSMEs) have been key growth areas for NBFCs. NBFCs can leverage this customer base for the initial round of business as this segment has remained underpenetrated so far.

- Generate revenue from various streams: Credit cards will provide an additional revenue-generating opportunity for the NBFCs entering in the space. Interest income from revolvers and affordability programmes such as EMI conversions and loan on cards will substantially contribute to the overall revenue. Interchange earned by issuers on the card spends is another major revenue contributor, followed by fees and charges.

- Boost customer engagement: By adding credit card services in addition to their other offerings, NBFCs can engage with their customers on a regular and continued basis. This is a stark contrast to retail and consumer durable loans, where customer engagement is limited to the duration of the loan.

Way forward

The Indian credit card market is at the right juncture to expand the industry to the next level. The guidelines by the RBI are also facilitating this expected exponential growth in the coming years. This growth will be led by different market players, who will all need to set individual rules to expand their credit card businesses. With the RBI promoting as well as structuring the space, a levelled playing field can be created, which will challenge the players to be more innovative in their product and service offerings.

All the new developments in the credit card industry are expected to cater to the untapped customer segments by offering new and innovative products via various channels and modes for online, offline and transit payments. Providing dedicated mobile applications for credit cards, that facilitate end-to-end customer services, is a pressing priority as the general mobile banking applications have limited features and customers have to largely rely on websites for fulfilling their payment needs.

Overall, a credit card is a great product that attracts millennials and Gen-Z alike, and cross sells other products and services. In future, we may also see an increase in the number of collaborations to improve the service offerings in this space. Additionally, with the evolving models and changes in the credit card industry, an interesting time lies ahead for the credit industry.