UPI preferred over digital wallets - PwC India

December 2019

Introduction

Over the past few years, digital payments have witnessed tremendous growth in India. This growth has been largely driven by digital wallets and Unified Payments Interface (UPI). Speed and ease of access and attractive cashbacks are the reasons behind the widespread adoption of digital wallets by consumers.

Digital wallets saw tremendous growth until 2017, while UPI has seen exponential growth in transaction volumes since that year.

Regulatory push, interoperability, virtual payment address (VPA), direct and instant transfer to bank accounts, etc., are the factors which have led to the unprecedented success of UPI.

Recent digital payment trends in India suggest that the UPI platform has been outperforming e-wallets rapidly, both in terms of value and volume of transactions. Demonetisation proved to be an inflection point for digital payments. It also gave a big push to the adoption of e-wallets as a preferred mode of payment.

During the same time, smartphone-based faster payments modes like UPI (without the need for an additional store of value) have picked up pace. In this newsletter, we will attempt to analyse the reasons behind the wallet industry’s declining popularity and growth compared to emerging payment instruments like UPI, and also assess what the future holds for payment instruments.

Growth stagnation for digital payment instruments

Digital wallets or e-wallets were at the core of the digital payment journey in the Indian economy till 2017. As per the Reserve Bank of India (RBI), there are 43 companies in the prepaid instrument market.1

Demonetisation created a cash crunch and thus provided a boost to digital wallets. But for the past one year, the growth has been stunted. As per the RBI’s bulletins,2 the volume of PPI transactions was INR 177 billion in September 2018. It grew to INR 186 billion in March 2019 but fell to INR 178 billion in September 2019. UPI transactions have gained traction and this has had an impact on the growth of digital wallets.

There are fundamental differences between the features of digital wallets and UPI-powered payment instruments. The convenience of not having to manage an additional store of value and lower merchant discount rate (MDR) for merchants have proved to be beneficial for UPI payments. Additional regulatory requirements for know your customer (KYC) details on e-wallets have hampered the growth of PPIs.

However, the RBI has introduced guidelines for new types of semi-closed PPIs. These wallets can have an outstanding balance of INR 10,000, and require the user’s mobile number to be verified by a one-time password (OTP) to comply with KYC norms.

Preferences of customers are also changing as they don’t want to have an additional store of value. Instead, they can leverage UPI to make payments directly from their bank accounts.

Emerging payment instruments - UPI becoming more popular

UPI provides a lot of convenience to customers, as well as merchants. Encouragement to use UPI by the National Payments Corporation of India (NPCI) and the Government of India (GoI), creation of a virtual payment address (VPA), marketing and promotion activities by FinTech players, increased participation by non-banks and interoperability have resulted in strong growth of UPI in the last two years.

As per NPCI, the market share of UPI has increased from less than 1% in 2017 to 13% in September 2019, whereas PPI transactions accounted for to 1-2% of the market share in the last 2-3 years.

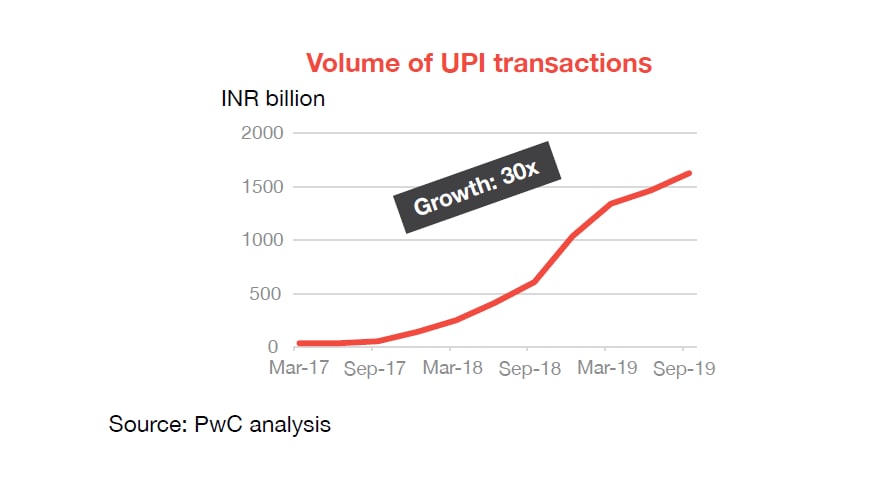

UPI has seen an exponential growth since its inception in April 2016. The entry of FinTech companies and private players in the UPI market has further accelerated UPI’s growth. In September 2017, the volume of UPI-based transactions was INR 53 billion, which grew 30 times to INR 1,614 billion by September 2019.

The Indian payments industry is expected to grow fivefold by 2023 to USD 1 trillion.4 But with fast-changing market dynamics in the payments industry, digital wallets will continuously need to build new value propositions, augment their services and bring in payment adjacencies such as lending, loyalty and new businesses, to compete with faster payments.

Challenges to adoption and growth of PPIs

Challenges faced by digital wallets

While there has been an overall growth in the use of digital payment systems in India, people are shifting towards bank-to-bank payment methods such as UPI, over other instruments such as e-wallets. The key reasons that are influencing customers to move away from mobile wallets have been analysed below.

In digital wallets, users need to create a separate account and add money to it before beginning transactions. This adds to operational inefficiency for payments.

UPI allows frictionless transactions by directly debiting money from the user’s bank account.

Digital wallets usually take T+1 day to settle payments in merchant accounts.5 This leads to cash mismanagement problems and has an impact on merchants’ credit cycles. In contrast, UPI instantly credits money to the beneficiary’s account. Settlements can be made in multiple batches throughout the day.

Compared to UPI, digital wallets charge merchants a higher MDR. The typical rate charged for wallet transactions is >1% of the total + GST, whereas for UPI transactions, the rate is 0.3% of the total + GST.6 This encourages merchants to accept UPI payments instead of payments from e-wallets.

Digital wallet companies spent a lot to promote cashback incentives, as part of their customer acquisition strategies. Once the freebies were discontinued, customers moved to cheaper payment alternatives such as UPI.

In digital wallets, both the sender and the receiver must be on the same wallet platform to make a transaction possible. UPI has overcome this feature and allows transactions on different platforms with different service providers.

The RBI’s mandate on physical verification to complete KYC norms of digital wallet users and double authorisation adds to the woes of digital wallet users.

Way forward for digital wallets

There is no doubt that e-wallets have been losing ground to UPI rapidly over the last two years. However, all is not lost for the e-wallet industry and they need to figure out unique business offerings that can help them find their own space in the digital payments industry.

Some of the new growth opportunities which could be lucrative for e-wallets are as follows:

Regulatory policy shaping the payments industry

Policies regarding KYC norms, interoperability, data localisation and transaction pricing will determine the future of the payments industry to a large extent.

There was a lot of uncertainty regarding KYC norms for PPI wallets. It started with minimal KYC, but eventually, the RBI directed that PPI wallets need to comply with full KYC norms, which increased operational costs among wallet players.

In December 2019,8 the RBI introduced a semi-closed PPI. The minimum KYC requirements for operating these wallets are the user’s mobile number verified by an OTP and a self-declaration. This allows users to have an outstanding balance of INR 10,000 at any point of time. But these PPIs can only be loaded by a bank account and used for purchase of goods and services and not for funds transfer.

Digital wallet providers need to actively work with regulators and policymakers to design policies for digital payments.

Future landscape of digital wallets

The digital wallet industry is going through a stagnation phase. Strong, innovative measures/offerings need to be taken soon to sustain the wallets business. Some of the steps digital wallet players can take are:

Consolidation

Industry stagnation calls for consolidation, where market leaders will look to acquire smaller players and expand their customer base both organically and inorganically.

They must also rationalise pricing to set an industry standard for others to follow. This will eventually result in enhanced profitablity.

Penetration

Tier 2 and 3 cities are the new future markets for digital wallet players. Wallets should focus on harvesting growth from these areas. Bringing unbanked customers into the digital payments space will be another key business driver for the growth of digital wallets.

Diversification

The industry players will also look for new business opportunities such as the B2B payments market and lending space.

They will also look to collaborate with other payment instuments such as UPI to bring out the synergies among payment channels.

Sell-off/exit

Lastly, a few players will try to acquire a large customer base by following a competitive pricing strategy. These players will either merge or sell off their business operations and existing customer base to large players.

With input from Parag Mukherjee, Aarushi Jain and Kshitij Mathur.

Sources

- Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India

- RBI Bulletin

- RETAIL PAYMENTS STATISTICS Nov-2019

- Payment Drivers 2018

- Merchant Support

- Start Accepting Payments for FREE!

- MSME

- Introduction of a new type of semi-closed Prepaid Payment Instrument (PPI) - PPIs upto ₹ 10,000/- with loading only from bank account

Payments technology updates

Google wants US Fed to replicate India’s UPI model

Business Standard

The time has come to examine exactly how The US Federal Reserve, or the Fed, should replicate India’s Unified Payments Interface (UPI) model for its proposed interbank real-time gross settlement (RTGS) service, Google has recommended.

RBI to introduce new prepaid payment instrument for digital transactions up to Rs 10,000

Economic Times

The Reserve Bank of India’s (RBI) proposal to introduce a prepaid payment instrument (PPI) for transactions up to Rs 10,000 on goods and services will give good competition to Google Pay, Paytm, PhonePe etc.

Paytm payments bank eyes small finance model

Times of India

Paytm wants to convert its payments bank into a small finance bank as that will allow it to lend to its customer and build a more profitable growth model.

Paytm now only app offering NEFT, IMPS, UPI, wallet and card payments

Livemint

With the Reserve Bank of India (RBI) making online NEFT transfers 24/7 on all days including weekends and holidays from Monday, India’s digital payment leader Paytm has become the only payments app offering three ways to pay 24x7 seamlessly, within the same “Money Transfer” flow via UPI, IMPS and now NEFT mode.